Jakub Porzycki|Nurphoto|Getty Images

The very best wish for preventing a collapse of ailing loan provider Very First Republic depends upon how convincing one group of lenders can be with another group of lenders.

Advisors to First Republic will try to encourage the huge U.S. banks who have actually currently propped it up into doing another favor, CNBC has actually discovered.

The pitch will go something like this, according to lenders with understanding of the circumstance: Purchase bonds from First Republic at above-market rates for an overall loss of a couple of billion dollars– or deal with approximately $30 billion in FDIC charges when First Republic stops working.

It’s the current twist in a weekslong legend triggered by the unexpected collapse of Silicon Valley Bank last month. Days after the federal government took SVB and Signature, mid-sized banks struck by serious deposit runs, the nation’s most significant banks united to inject $30 billion in deposits into First Republic. That service showed short lived after the depth of the business’s issues ended up being understood.

If the First Republic consultants handle to encourage huge banks to acquire bonds for more than they deserve– to take the hit of financial investment losses for the good of the banking system, along with their own well-being– then they are positive that other celebrations will step up to assist the bank recapitalize itself.

The consultants have actually currently lined up possible buyers of brand-new First Republic stock because situation, according to the sources.

Important days

These financial investment lenders are now looking for to produce a sense of seriousness. CNBC’s David Faber, who initially reported on the current rescue strategy Tuesday, stated that the coming days are important for First Republic.

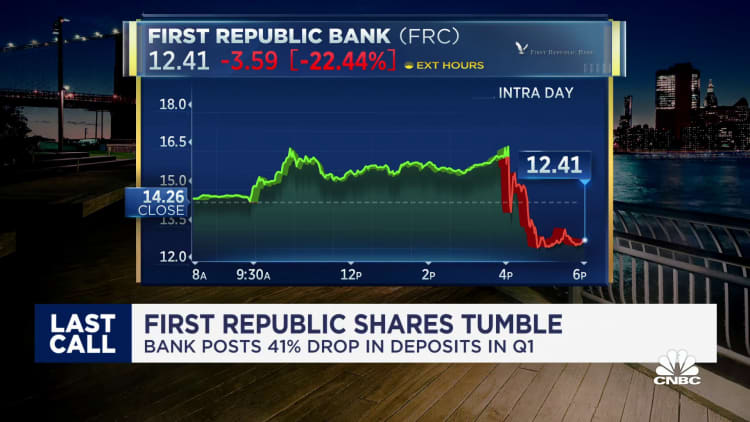

The bank’s stock has actually remained in freefall because divulging Monday that its deposits fell an incredible 40.8% just recently, leaving it with $104.5 billion in deposits, consisting of the infusion from huge banks. Experts covering the business released cynical reports after CEO Michael Roffler chose not to take any concerns after a short 12-minute teleconference.

” Now that the revenues are out, when you have actually got a window to act, it’s time to do it,” stated among the lenders, who requested for privacy to speak openly. “You never ever understand what will occur if you wait, and you do not wish to be handling an emergency circumstance.”

Incorrect starts

For several years, First Republic was the envy of peers as its concentrate on abundant Americans assisted turbocharge development and permitted it to poach skill. However that design broke down in the after-effects of the SVB failure as its rich clients rapidly pulled uninsured deposits.

Lazard and JPMorgan Chase were employed last month to encourage First Republic, according to media reports

The essential benefit of the consultants’ strategy, they state, is that it enables First Republic to unload some, however not all of its undersea bonds. In a federal government receivership, the entire portfolio should get discounted simultaneously, leading to what Morgan Stanley experts approximated to be a $ 27 billion hit.

One issue, nevertheless, is that the consultants are counting on the U.S. federal government to summon bank CEOs together to check out possible services.

There have actually been incorrect starts currently: One top-four U.S. bank stated that the federal government informed them to be prepared to act upon the First Republic circumstance this previous weekend, however absolutely nothing occurred.

Huge bank doubts

While the specific shape of any offer is a matter for settlement and might consist of an unique function automobile or direct purchases, a number of possibilities resolve the bank’s ailing balance sheet.

First Republic packed up on low-yielding properties consisting of Treasuries, community bonds and home loans, making what was basically a bet that rate of interest would not increase. When they did, the bank discovered itself with 10s of billions of dollars in losses. The bank is weighing the sale of $50 billion to $100 billion in financial obligation, Bloomberg reported Tuesday.

By dramatically decreasing the size of its balance sheet, the bank’s capital ratios will unexpectedly be far healthier, leading the way for it to raise more funds and continue as an independent business.

Other possible, however less-likely relocations consist of transforming the huge bank’s deposits into equity, and even discovering a purchaser. However a suitor hasn’t emerged in the previous month, and isn’t most likely considered that any buyer would likewise own the losses on First Republic’s balance sheet.

That has actually led sources near the huge banks to think that the most likely situation for First Republic is federal government receivership, which is how SVB and Signature were dealt with.

Those near the banks were reluctant to back a strategy in which they would need to acknowledge losses for paying too much for bonds. They likewise revealed suspect of government-brokered offers after a few of the pacts from the 2008 monetary crisis wound up being more expensive than anticipated.

Open vs closed

However the failures of SVB and Signature– the 2 most significant because the 2008 monetary crisis– cost the FDIC Deposit Insurance coverage Fund numerous billions of dollars, which is spent for by member banks. They likewise benefited the purchasers who had the ability to cherry-pick the very best properties while the FDIC keeps undersea bonds, the First Republic consultants kept in mind.

Advisors described the private-market services as the “open bank” choice, while federal government receivership is the “closed-banked” situation.

However there is a 3rd possibility: the bank grinds on as is, gradually losing yet more worth in the middle of possible quarterly losses, skill flight and unceasing doubts.

” Time, by the method, is not the bank’s buddy,” expert Don Bilson composed Tuesday. “If anything, last night’s preventing upgrade will make it even harder for First Republic to keep what it has.”