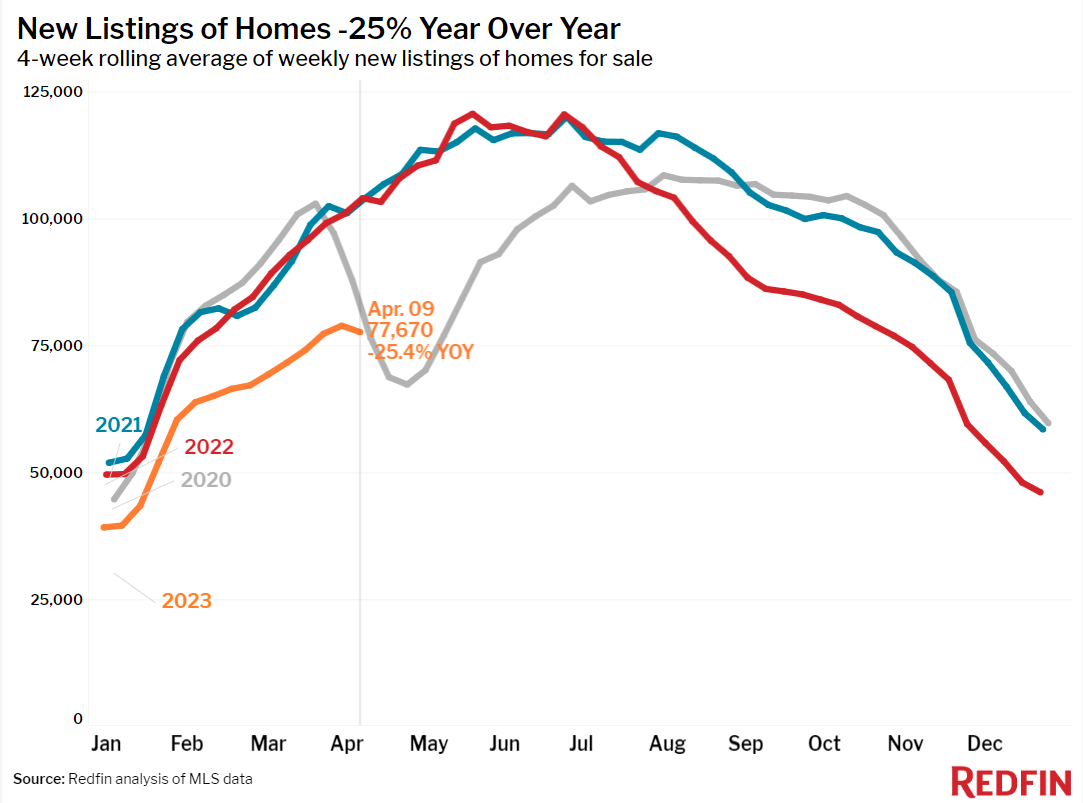

New listings of houses on the market are down 25% from a 12 months in the past, marking the 8th directly month of double-digit declines. Thatâs making it tough for consumers to search out houses however giving some dealers a aggressive edge.

New listings of U.S. houses on the market dropped 25% from a 12 months previous all through the 4 weeks finishing April 9, proceeding an eight-month streak of double-digit declines. Thatâs the most important drop because the get started of the pandemic, however there used to be a vacation weekend impact:Â Easter fell per week previous this 12 months than final 12 months, so itâs most likely that final weekendâs vacation made the new-listings decline greater than it will had been if Easter fell all through final 12 monthsâs comparability length.

Persons are reluctant to promote as a result of they donât wish to surrender their low loan fee, itâs exhausting to search out every other domestic to shop for and plenty of American citizens just lately moved. Even supposing charges are down from their November height, this weekâs moderate is 6.27%; 85% of house owners have a fee some distance beneath 6%. The brilliant aspect for householders who’re checklist now could be that fascinating, well-priced houses are being snapped up in bidding wars in markets the place call for outpaces provide.Â

New listings fell from a 12 months previous in all 50 of essentially the most populous U.S. metros, with the most important declines in California. They dropped maximum in Sacramento and Oakland (-47% YoY apiece), San Francisco (-43.2%), San Jose (-42.9%) and San Diego (-41.4%). The shortage of houses hitting the marketplace, together with increased loan charges, is conserving again gross sales. Pending domestic gross sales dropped greater than 30% in every of the ones metros, greater than the nineteen% national decline.Â

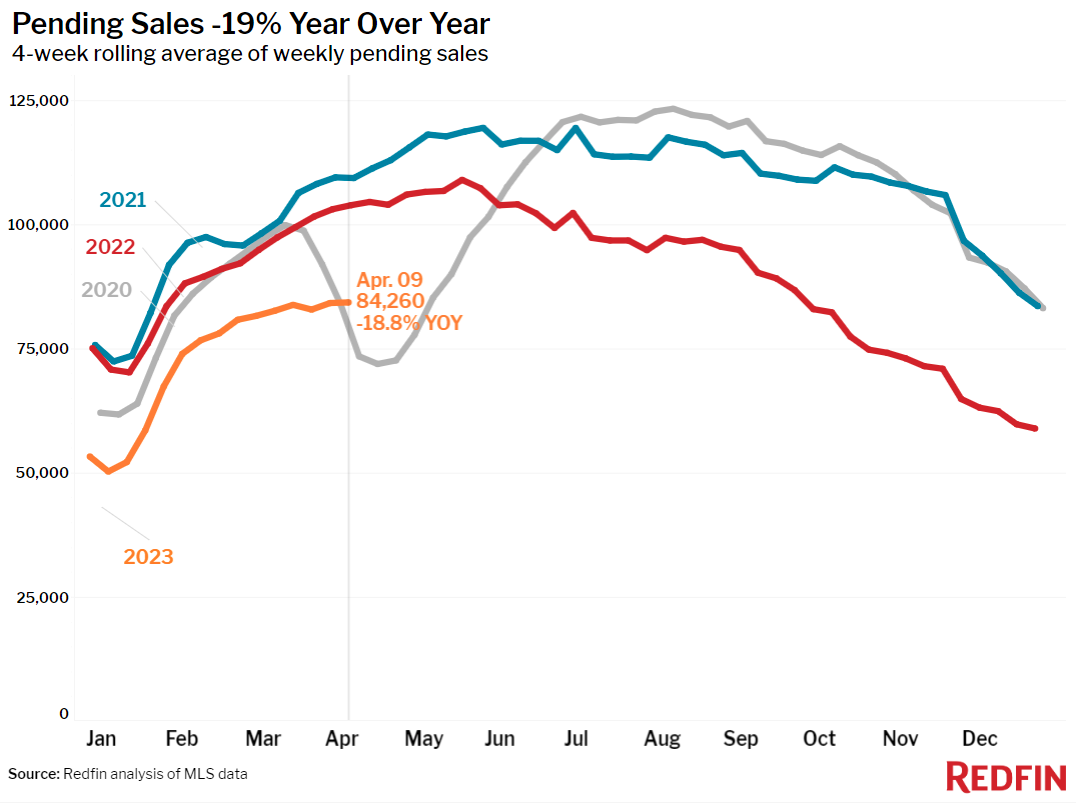

Whilst pending gross sales are down, early-stage homebuying call for is ticking up, with mortgage-purchase programs up 8% from per week previous, seasonally adjusted.Â

Angela Langone, a Redfin agent in San Jose, mentioned there arenât sufficient listings to move round, with more than one provides on many houses. Each new listings and pending gross sales are down greater than 40% from a 12 months in the past in San Jose.Â

âMany consumers right here arenât held again through top loan charges; itâs the loss of stock thatâs truly getting of their means,â Langone mentioned. âI’ve a number of shoppers who’re fascinated about purchasing a house they usuallyâre actively taking a look, however they are able toât to find anything else presently they usuallyâre looking forward to extra houses to trickle onto the marketplace.â

Consumers have extra choices in different portions of the rustic. In Nashville, TN, as an example, new listings and pending gross sales have been each down about 14% from a 12 months previousâhowever the ones are probably the most smallest drops within the nation.Â

âStock isnât a significant issue right here since the higher Nashville space is so sprawling, and there are a large number of newly constructed houses available on the market within the suburbs,â mentioned Nashville Redfin agent Jennifer Bowers. âDevelopers went large within the outskirts of the town over the previous couple of years and now theyâre providing incentives to draw consumers, to the purpose the place particular person dealers are having a troublesome time competing. For consumers keen to stray from the town middle, there are many houses on the market.â

Two new items of monetary knowledge function tea leaves we will learn to look ahead to how loan charges will pattern over the following few months: Itâs not going theyâll skyrocket, nevertheless itâs additionally not going theyâll come down sufficient to encourage locked-in householders to promote. The March consumer-price index and jobs file confirmed that inflation persisted to chill and salary enlargement ticked down from the month ahead of, however inflation continues to be upper than the Fedâs goal.

âThe Fed has made some growth cooling inflation with fee hikes however thereâs nonetheless paintings to be completed,â mentioned Redfin Leader Economist Daryl Fairweather. âEven though the Fed chooses to not hike charges subsequent month, which might most likely carry down loan charges, the restricted provide of houses on the market would stay a big impediment for would-be consumers. Charges dipping beneath 6% would most definitely pique the pastime of extra consumers, however sufficient householders have charges within the 3% or 4% vary that weâre not going to look a large uptick in new listings.â

House Costs Falling in Extra Than Part of the U.S.

The median U.S. home-sale charge fell 2.3% 12 months over 12 months to kind of $364,000, the most important decline in additional than a decade. Â

Costs fell considerably greater than that during some metros, however rose in others. House-sale costs dropped in additional than part (29) of the 50 maximum populous U.S. metros, with the most important drop in Austin, TX (-13.9% YoY). Subsequent come 4 West Coast metros: Oakland (-11.4%), San Francisco (-10.9%), Seattle (-10.9%) and Sacramento (-10.6%). Thatâs the most important annual decline since no less than 2015 for Seattle.Â

At the different finish of the spectrum, sale costs larger maximum in Citadel Lauderdale, FL, the place they rose 11.6% 12 months over 12 months. Subsequent come Milwaukee (9.5%), Miami (8.5%), Cincinnati (7.3%) and Windfall, RI (7.2%).

Main signs of homebuying process:

- For the week finishing April 13, moderate 30-year fastened loan charges dropped to 6.27%, the 5th directly week of declines, even though it best ticked down somewhat from the week ahead of. The day by day moderate used to be 6.42% on April 12.

- Loan-purchase programs all through the week finishing April 7 larger 8% from per week previous, seasonally adjusted. Acquire programs have been down 31% from a 12 months previous.Â

- The seasonally adjusted Redfin Homebuyer Call for Indexâa measure of request for domestic excursions and different homebuying services and products from Redfin brokersâdropped somewhat from the 10-month top hit a week previous all through the week finishing April 9. It used to be up 6% from a month previous, however down 21% from a 12 months previous.Â

- Google searches for âhouses on the marketâ have been up about 40% from the trough they hit in November all through the week finishing April 8, however down about 18% from a 12 months previous.

- Traveling process as of April 8 used to be up about 13% from the beginning of the 12 months, in comparison with a 26% building up on the identical time final 12 months, consistent with domestic excursion era corporate ShowingTime.Â

Key housing marketplace takeaways for 400+ U.S. metro spaces:

Except differently famous, the knowledge on this file covers the four-week length finishing April 9. Redfinâs weekly housing marketplace knowledge is going again thru 2015.

Information in line with houses indexed and/or offered all through the length:

- The median domestic sale charge used to be $364,366, down 2.3% from a 12 months previous, the most important decline in additional than a decade and the 7th week in a row of costs declining once a year after greater than a decade of will increase. The latter is consistent with Redfinâs per 30 days dataset, which fits again thru 2012.

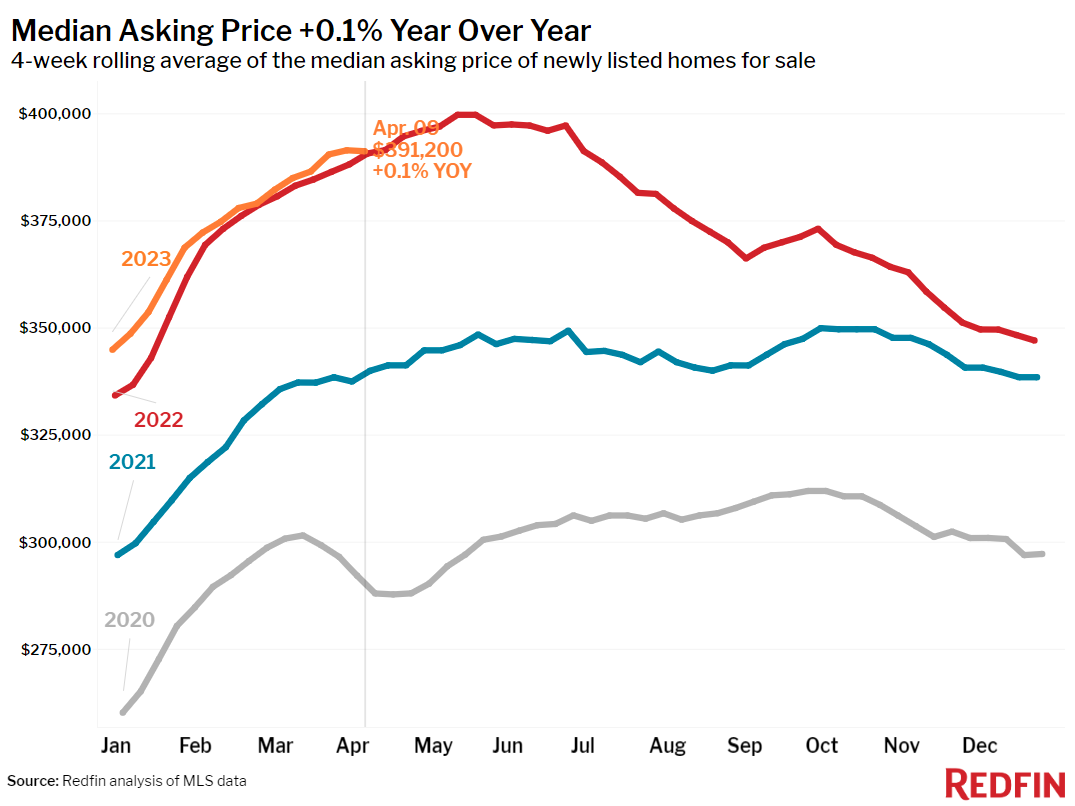

- The median asking charge of newly indexed houses used to be $391,200, necessarily flat (up 0.1%) 12 months over 12 months. Thatâs the smallest building up since Might 2020.Â

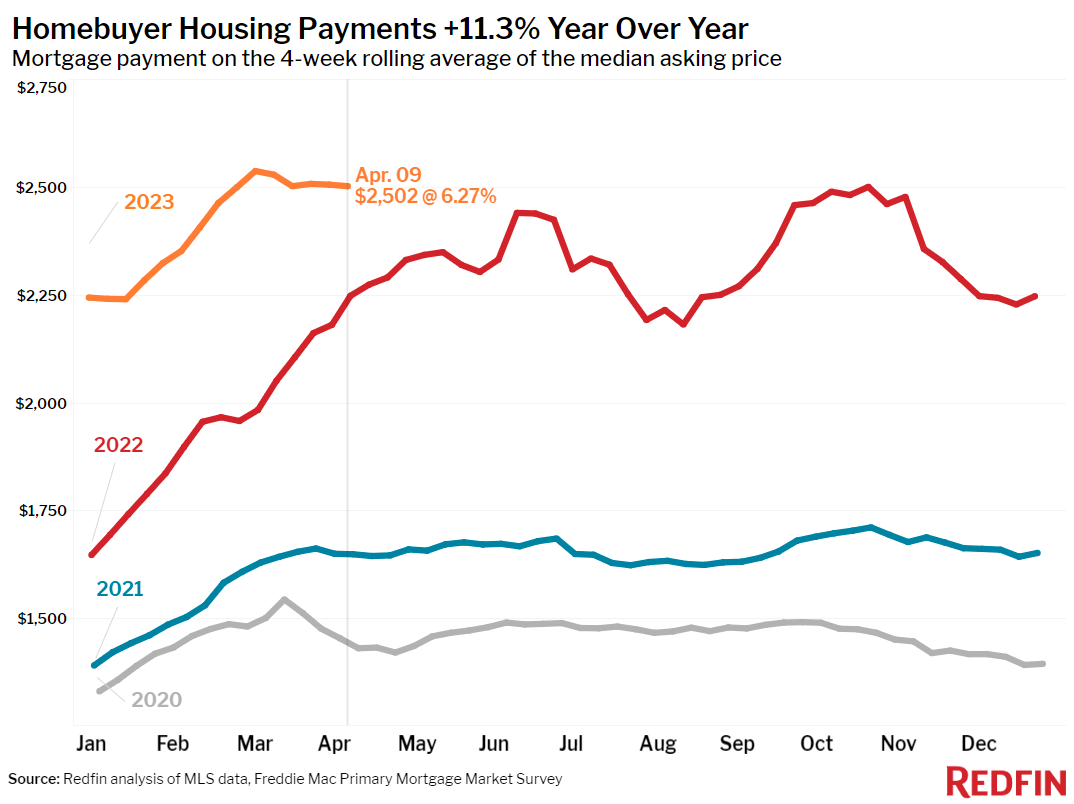

- The per 30 days loan cost at the median-asking-price domestic used to be $2,502 at a 6.27% loan fee, the present weekly moderate. Per 30 days loan bills are down somewhat from the height they reached final month, however up 11% ($255) from a 12 months in the past.

- Pending domestic gross sales have been down 18.8% 12 months over 12 months, the most important decline in additional than two months.

- Pending domestic gross sales fell in all 50 of essentially the most populous U.S. metros. They declined maximum in Las Vegas (-45.7% YoY), adopted through 4 West Coast metros: San Jose, CA (-42.9%), Seattle (-42.4%), Portland, OR (-41.9%) and Oakland, CA (-41.1%).Â

- New listings of houses on the market fell 25.4% 12 months over 12 months, the most important decline since Might 2020. If now not for Easter falling on April 9, the decline most likely would had been consistent with the prior four-week lengthâs 22% drop.

- New listings declined in all 50 of essentially the most populous U.S. metros. They declined least in Texas: Citadel Value (-7.6% YoY) noticed the smallest drop, adopted through Austin (-11.1%), Dallas (-11.6%), Nashville (-13.5%) and Houston (-13.9%).

- Lively listings (the choice of houses indexed on the market at any level all through the length) have been up 10.4% from a 12 months previous, the smallest building up in additional than 5 months. The whole choice of houses on the market posted an unseasonal early-spring decline.Â

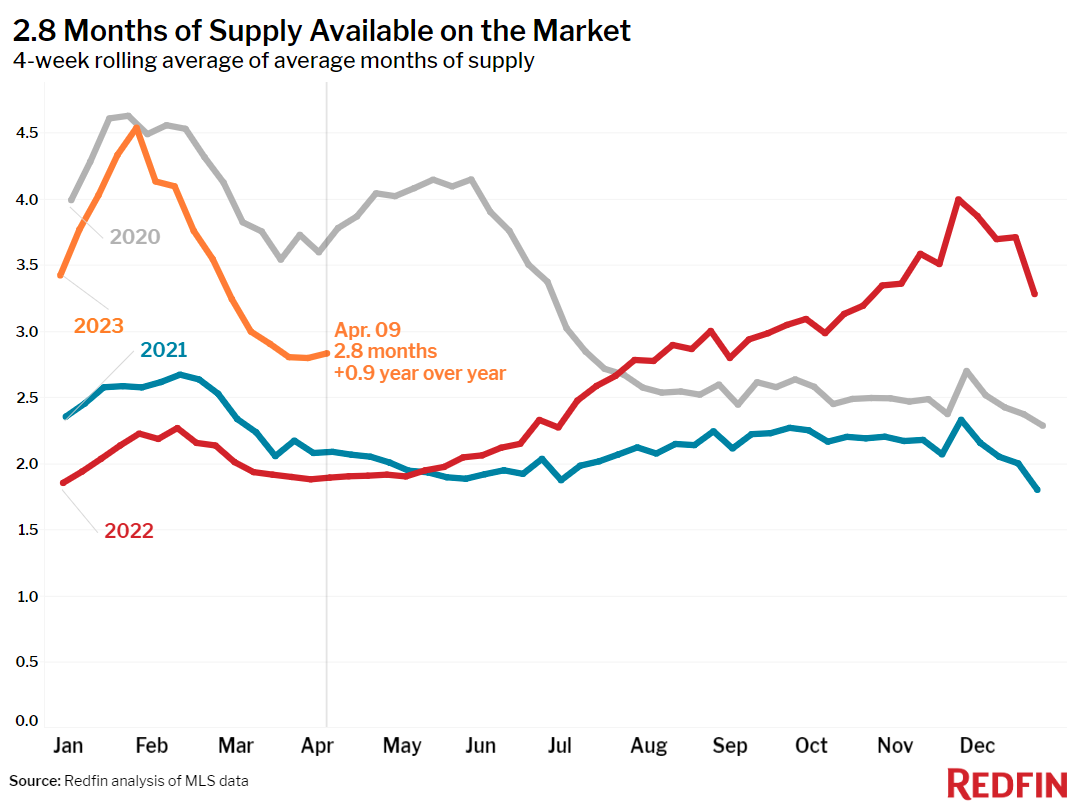

- Months of provideâa measure of the steadiness between provide and insist, calculated through the choice of months it will take for the present stock to promote on the present gross sales tempoâused to be 2.8 months, down from 3.2 months a month previous and up from 1.9 months a 12 months previous. 4 to 5 months of provide is thought of as balanced, with a decrease quantity indicating supplierâs marketplace prerequisites. Â

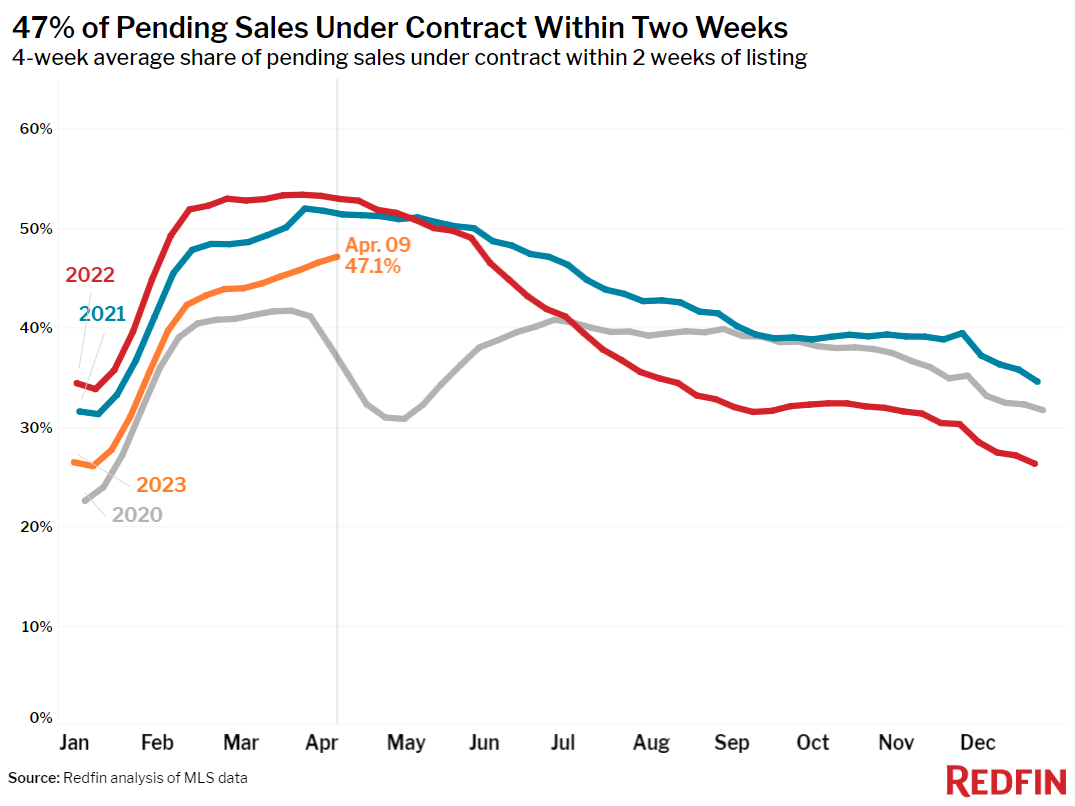

- 47% of houses that went below contract had an approved be offering throughout the first two weeks available on the market, the perfect stage since June, however down from 53% a 12 months previous.Â

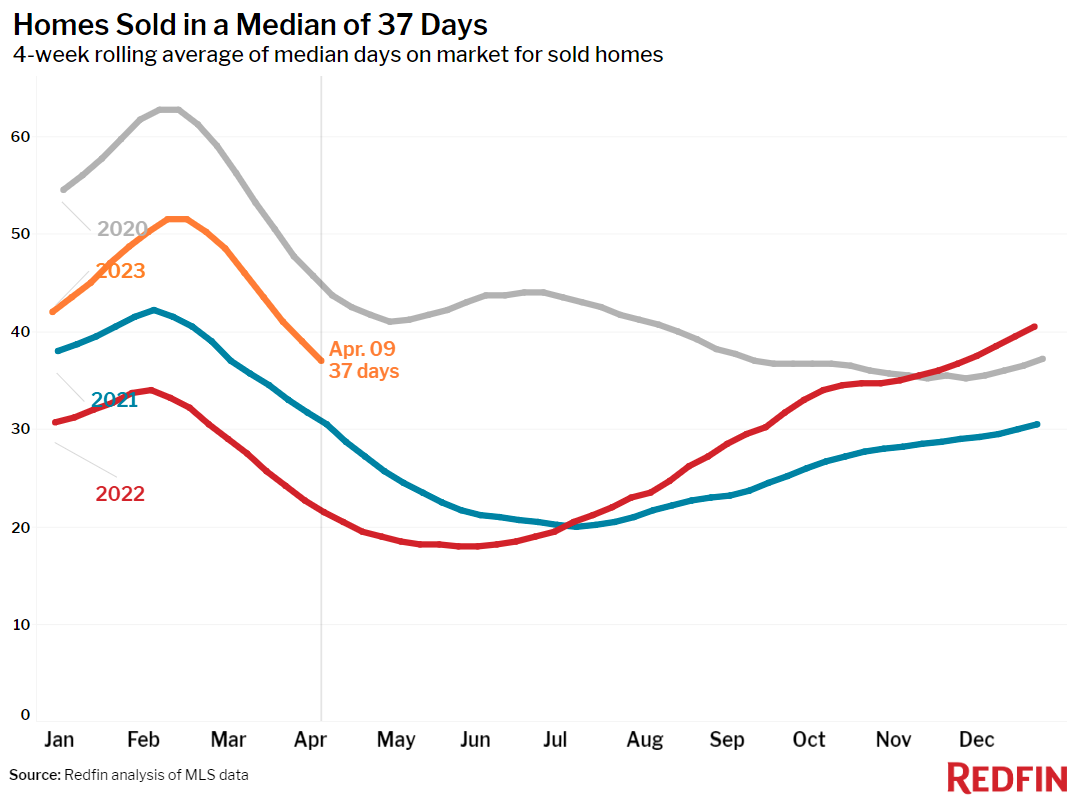

- Properties that offered have been available on the market for a mean of 37 days, the shortest span since November. Thatâs up from 22 days a 12 months previous and the report low of 18 days set in Might.

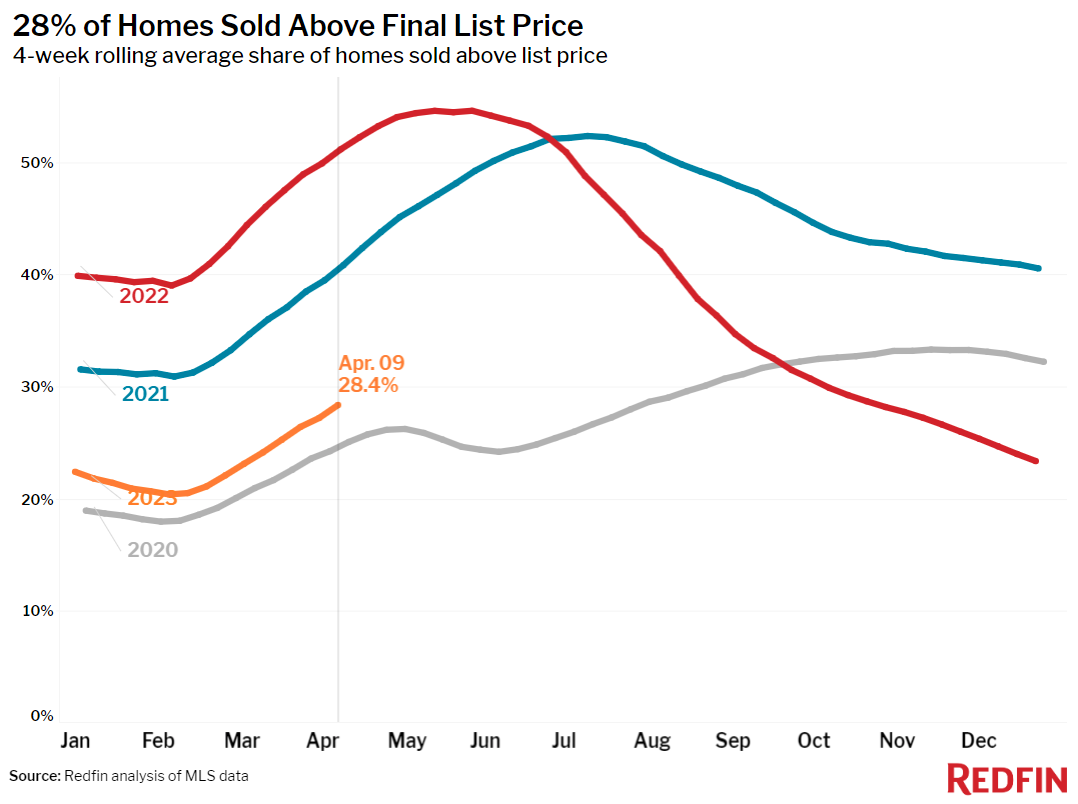

- 28% of houses offered above their ultimate record charge, the perfect percentage in additional than 3 months however down from 51% a 12 months previous.

- On moderate, 4.9% of houses on the market every week had a worth drop, up from 2.3% a 12 months previous.Â

- The typical sale-to-list charge ratio, which measures how shut houses are promoting to their ultimate asking costs, used to be 98.9%, the perfect stage in just about six months however down from 102.1% a 12 months previous.Â

Consult with our metrics definition web page for explanations of all of the metrics used on this file.

Â

Â