Presenting my brand-new retail sales charts of three-month moving averages to settle the huge month-to-month spikes and drops that mess up the patterns.

By Wolf Richter for WOLF STREET

OK, I have actually had it with the synthetic and worthless drama of the month-to-month ups and downs of seasonally changed retail sales that go through huge up-or-down modifications the list below month. Sellers report their sales quarterly, and GDP is reported quarterly in the United States, therefore I’m going to change my charts on retail sales to a three-month-moving average, which removes a great deal of the sound that obscures the patterns. And the previous 6 months have actually been especially loud with substantial ups and huge downs.

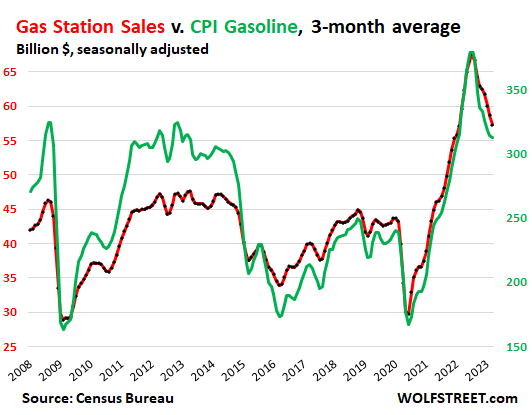

Dropping costs effect retail sales Likewise note that the CPI for numerous classifications of items that these merchants offer has actually dropped, with fuel costs plunging, food costs dipping, and numerous items costs falling, as inflation has actually moved to services, and merchants do not offer services; they offer items. Dropping costs suggest dropping sales, even when the merchant offers the exact same quantity of items. Even more listed below you will see a chart of sales by filling station overlaid with a chart of the CPI for fuel, and they clearly run in near-lockstep due to the fact that customers purchase about the exact same quantity of fuel in gallons, however when the costs alter so drastically, profits (in dollars) alter with the costs.

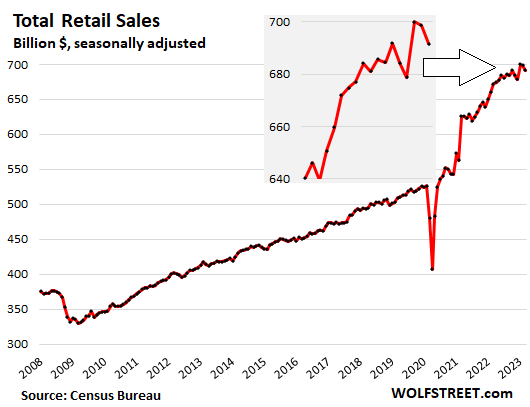

So this is my timeless chart. Overall retail sales, seasonally changed, fell 1.0% in March from February, after a dip in February, a big 3.1% spike in January, decreases in December and November, and a dive in October.

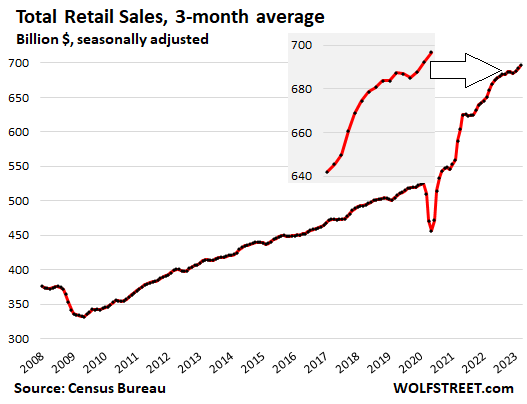

And this is my brand-new chart of overall retail sales as a three-month moving average The March three-month moving average = the average of January, February and March, so representing Q1.

Q1 retail sales were up by 1.7% from Q4 and by 5.4% from the exact same duration a year ago!

Tip: Do not use total CPI to retail sales due to the fact that inflation has actually moved to services, and merchants offer items, and numerous items costs have actually dropped or plunged, such as by 17% for fuel! ( My in-depth conversation about inflation)

The insert reveals the current information of the pattern: the downturn late in 2015 and a pickup up until now this year:

Retail sales by classification, 3-month moving average, seasonally changed.

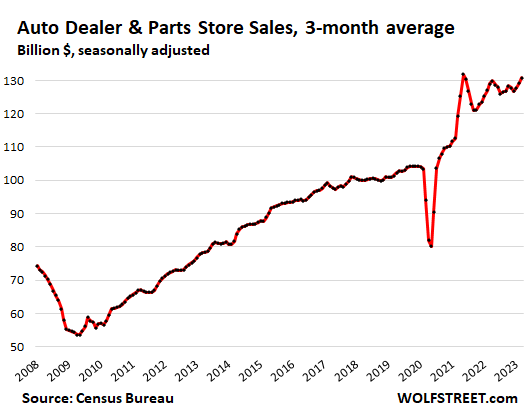

New and Utilized Lorry and Components Dealerships ( 19% of overall retail sales):

- Sales: $131 billion

- From previous month: +1.2%

- Year-over-year: +1.5%

- CPI utilized automobiles: -0.9% for the month, -11.2% year-over-year

- CPI brand-new automobiles: +0.4% for the month, +6.1% year-over-year.

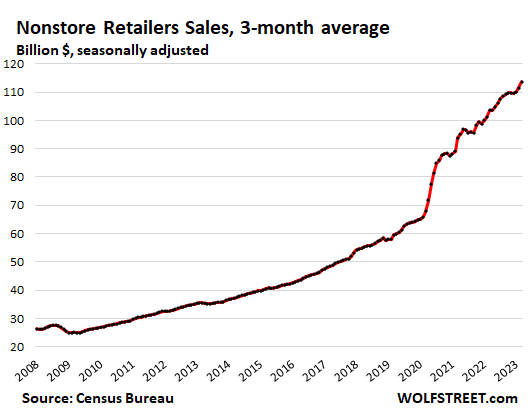

Ecommerce and other “nonstore merchants” ( 16% of overall retail sales), ecommerce merchants, ecommerce operations of brick-and-mortar merchants, and stalls and markets:

- Sales: $114 billion

- From previous month: +2.0%

- Year-over-year: +9.8%

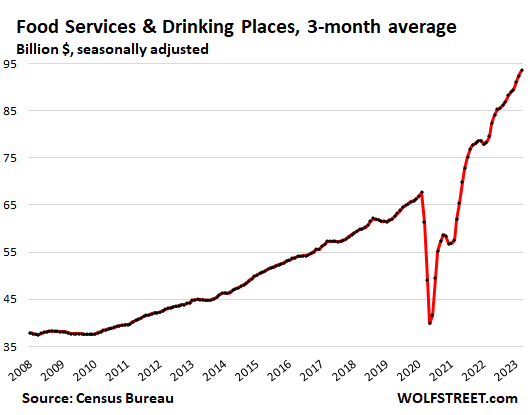

Food services and drinking locations ( 13% of overall retail), consists of dining establishments, snack bars, bars, and so on

- Sales: $93 billion

- From previous month: +1.2%

- Year-over-year: +17.5%

- CPI for “food far from house”: +0.6% for the month, +8.8% year over year:

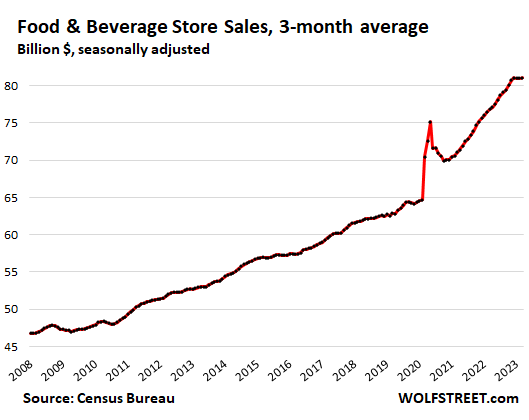

Food and Drink Stores ( 12% of overall retail):

- Sales: $81 billion

- From previous month: +0.1%

- Year-over-year: +5.5%

- CPI for “food in your home”: -0.3% month-to-month, +8.4% year over year:

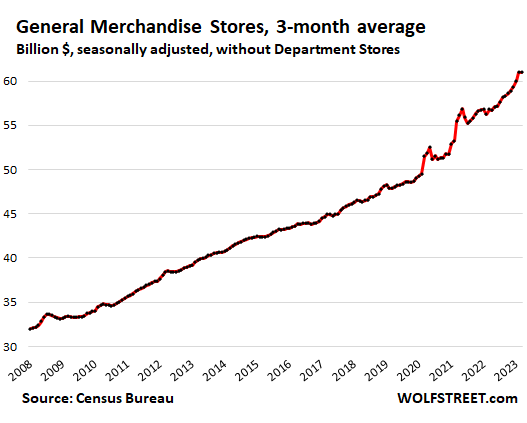

General product shops, without outlet store (9% of overall retail):

- Sales: $61 billion

- From previous month: -0.1%

- Year-over-year: +7.4%

Gasoline station ( 8% of overall retail):

- Sales: $57 billion

- From previous month: -2.4%

- Year-over-year: -4.0%

- CPI for fuel: -4.6% for the month, -17.4% year over year:

This chart reveals the relationship in between the CPI for fuel (green, best axis) and sales in billions of dollars at filling station, consisting of the other product filling station offer (red, left axis):

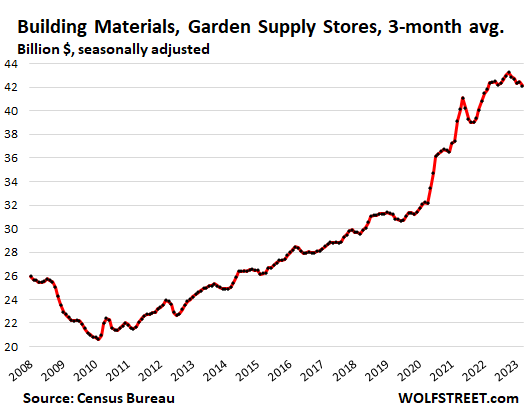

Structure products, garden supply and devices shops ( 6% of overall retail):

- Sales: $42 billion

- From previous month: -0.7%

- Year-over-year: -0.6%

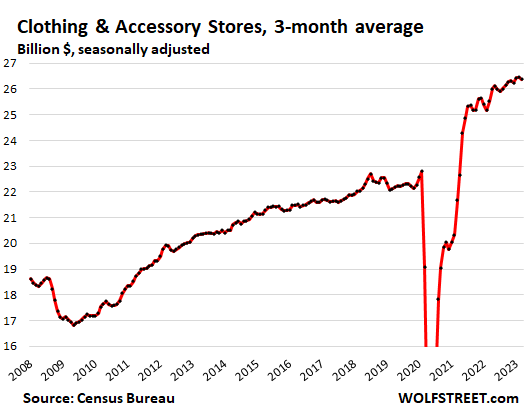

Clothes and accessory shops ( 4% of overall retail):

- Sales: $26 billion

- From previous month: -0.3%

- Year-over-year: +3.3%

- CPI clothing: +0.3% for the month, +3.3% year-over-year.

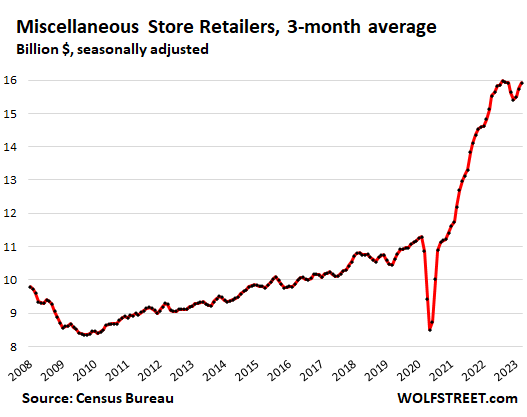

Various shop merchants, consists of marijuana shops ( 2.3% of overall retail): Specialized shops, from art-supply shops to wine-making supply shops. Marijuana shops are the development chauffeur in this classification.

- Sales: $16 billion, seasonally changed

- Month over month: +1.1%.

- Year-over-year: +5.2%

- CPI Marijuana does not yet exist. However per Marijuana Benchmarks U.S. Area Index, typical costs have actually plunged 18% year-over-year.

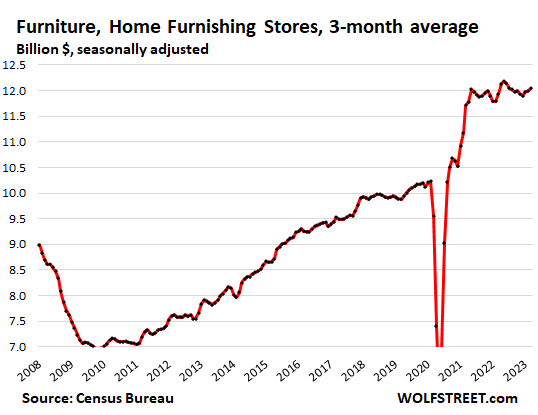

Furnishings and house providing shops ( 1.7% of overall retail):

- Sales: $12 billion, seasonally changed

- From previous month: +0.4%

- Year-over-year: +0.9%

- CPI Family home furnishings: +0.8% for the month, +5.8% year-over-year.

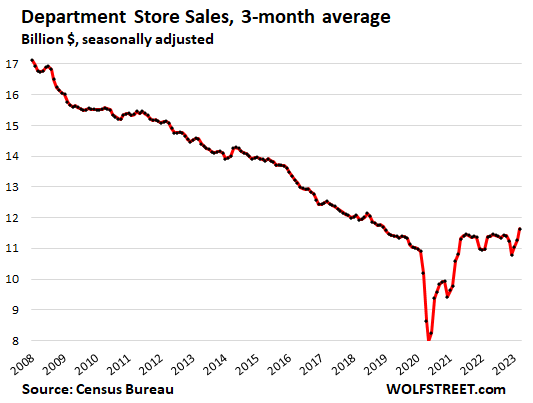

Outlet store ( now down to 1.7% of overall retail, as customers progressively purchased this things online, consisting of at the ecommerce websites of the couple of making it through outlet store chains):

- Sales: $11.6 billion

- From previous month: +3.2%

- Year-over-year: +2.4%

- From peak in 2001: -40% in spite of 21 years of inflation.

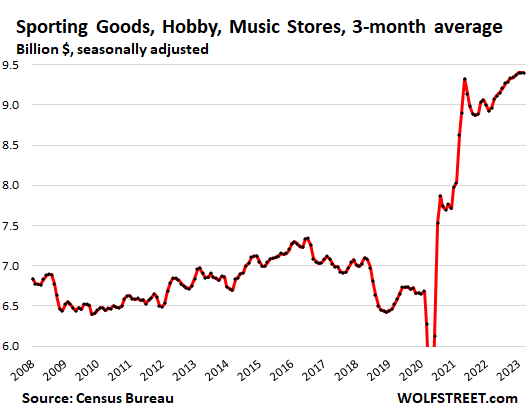

Sporting items, pastime, book and music shops ( 1.3% of overall retail);

- Sales: $9.4 billion

- Month over month: 0%

- Year-over-year: +4.8%.

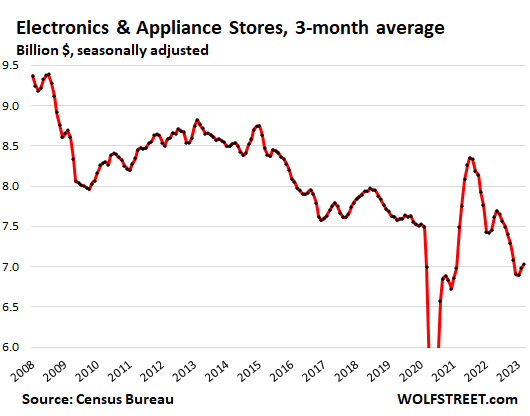

Electronic devices and home appliance shops: Specialized electronic devices and home appliance shops (Finest Buy, Apple shops, and so on), not consisting of electronic devices and home appliance sales online and at other merchants.

- Sales: $7.0 billion, seasonally changed

- Month over month: +0.7%

- Year over year: -5.7%

- CPI customer electronic devices: -0.4% for the month, -11.5% year over year.

- CPI devices: +0.7% for the month, +1.1% year over year.

Enjoy reading WOLF STREET and wish to support it? You can contribute. I value it exceptionally. Click the beer and iced-tea mug to learn how:

Would you like to be alerted through e-mail when WOLF STREET releases a brand-new short article? Register here

![]()