When it pertains to funding your villa, not all loans are developed equivalent– so select carefully.

All set to purchase that ski cabin or lake home? Leasing it out while you’re not utilizing it is a fantastic method to make it occur– however not so quick. Lending institution guidelines might not enable it, so here’s what you require to understand.

Various loans have various guidelines

The initial step to funding your villa is comprehending what home mortgages are readily available and their guidelines about leasing:

- Main house loans These loans are the most beneficial, and you’ll get the most affordable possible home loan rates. These loans need you to move into the house within 60 days of closing and reside in it for a minimum of one year. After that, you’re totally free to rent the house.

- Second-home loans These loans have the very same rates as main houses, so your rate will be the most affordable it can be, however deposits should be bigger– most lending institutions need 20 percent down. You receive the loan utilizing your complete main house real estate expense plus your complete 2nd house expense. You can utilize the house for friends and family, however lending institutions will not let you lease the house.

- Non-owner occupied loans Likewise called rental home loans, these loans use rates.25 percent to.375 percent greater than primary-residence or second-home rates, and deposit requirements generally begin at 30 percent. Your lending institution will let you understand if you can utilize the rental earnings to certify. These loans enable you to lease the house and utilize it when it’s not leased.

Second-home loans featured constraints

The very best aspect of a second-home home loan is that the rates are the very same as a main house home loan. The worst thing is that you can’t lease the house.

This is a typically neglected arrangement of second-home loans, however it’s the most essential, since if you ever lease your holiday trip, you’ll breach the loan’s terms.

When you get a loan, there’s a file called the note, which define the loan’s quantity, rate, payments and repaired versus adjustable durations. Depending upon what state you reside in, you’ll likewise have either a home loan or a deed of rely on addition to your note, which define extra loan requirements. ( See which states utilize home mortgages versus deeds of trust.)

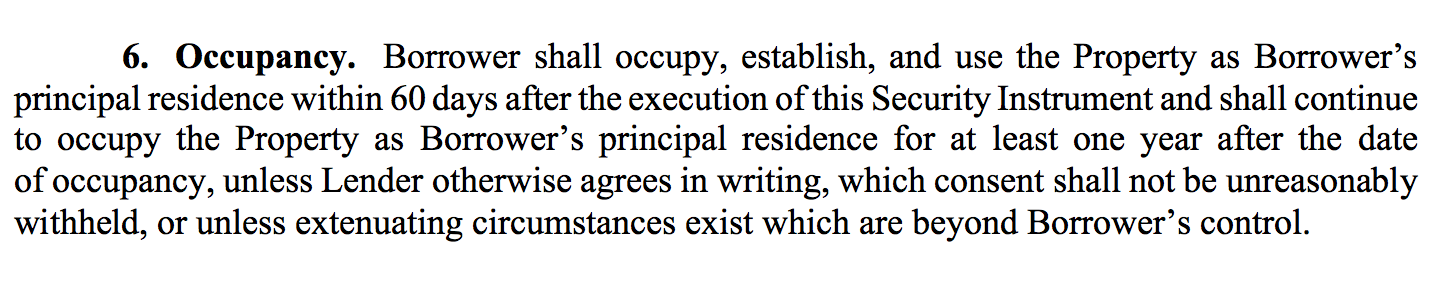

Initially glimpse, a second-home home loan or deed of trust looks like it has the very same requirements as a main house. Arrangement 6 states you should relocate within 60 days and live there for a minimum of one year– then you’re totally free to lease it out. Here’s a sample:

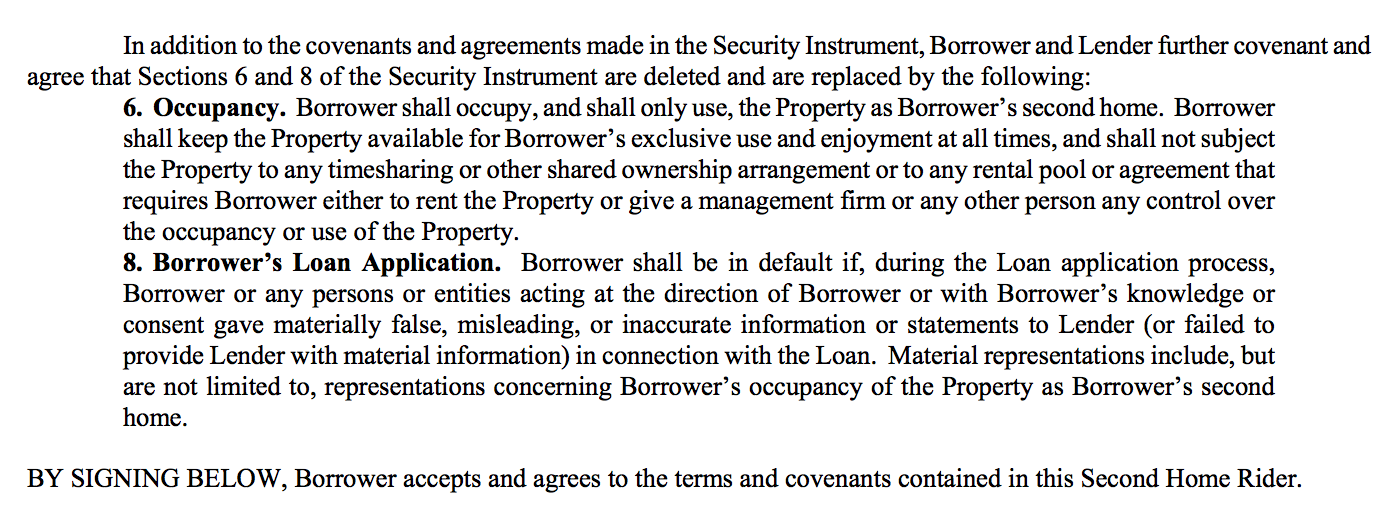

Nevertheless, there’s an addendum– called a rider– in home mortgages and deeds of trust that changes this friendly requirement with a brand-new, a lot more rigorous requirement stating that you can’t rent the house. Here’s a sample:

Nevertheless, there’s an addendum– called a rider– in home mortgages and deeds of trust that changes this friendly requirement with a brand-new, a lot more rigorous requirement stating that you can’t rent the house. Here’s a sample:

This language, though covert deep in the loan files you’ll sign prior to closing, makes 2 crucial points:

- You can’t lease the house.

- If you looked for a second-home loan and lease it out, your whole loan balance might be called due and payable by your lending institution.

So, if you prepare to pay for a villa by leasing it out, you can’t fund it with a second-home loan. However you’ll require to examine non-owner-occupied loan alternatives with your lending institution to satisfy the goal of utilizing and leasing a house that’s not your main house.

As kept in mind above, this indicates you’ll require to put down a bigger deposit, and your rate will be a little greater. However it’s a little cost to spend for the versatility of making earnings from a house that you likewise utilize for your own pleasure.

Leading picture from Shutterstock.

Associated:

Note: The views and viewpoints revealed in this post are those of the author and do not always show the viewpoint or position of Zillow.

Initially released October 4, 2016.