It has actually been 3 years considering that the U.S. stock exchange struck its COVID-19 bottom as the international economy unexpectedly closed down at the start of the pandemic in early 2020.

The S&P 500

SPX,.

has actually increased almost 76% from its closing low of 2237.40 reached on March 23, 2020, while the Dow Jones Industrial Average.

DJIA,.

is up 72.3% from its low of 18591.93 hit on the very same day and the Nasdaq Composite.

COMPENSATION,.

has actually advanced over 70%, according to Dow Jones Market Data.

Infections brought on by COVID-19 started to spread out in early 2020, and panic activated by the financial unpredictability resulted in a drop in the stock exchange that began in late February. On Feb. 24, the Dow commercial average dropped more than 1,000 points, its third-worst day-to-day point drop in history.

The selloff sped up in mid-March, with the Dow getting in bear-market area on March 10, down more than 20% from the record close embeded in the previous month. On the other hand, the large-cap index S&P 500 dropped almost 34% in about a month, eliminating 3 years’ worth of gains for the marketplace, according to Dow Jones Market Data.

Nevertheless, a huge quantity of assistance from the Federal Reserve, consisting of an emergency situation interest-rate cut, in addition to the fast advancement of COVID-19 vaccines, restricted an additional slump in stocks. The S&P 500 increased to an all-time high in August and reached numerous more all-time highs in the following months, according to Dow Jones Market Data.

In 2021, 3 significant indexes all liquidated the year with robust gains as financiers rejected a series of market-moving occasions that might have crashed stocks. The strong efficiency can be found in a year specified by, to name a few things, the January 6 attack on the U.S. Capitol, supply-chain disturbances, high inflation, labor-market lacks and the omicron and delta COVID versions.

However as the calendar turned to 2022, U.S. stocks began to topple after the Federal Reserve and reserve banks around the world started raising rates of interest strongly to combat rising inflation, stiring worries of a worldwide economic crisis.

Russia’s intrusion of Ukraine in February 2022 and China’s zero-COVID policies, in location till the nation unexpectedly ditched the rigid procedures in December 2022, likewise added to market volatility. The 3 stock indexes all suffered their worst year considering that 2008.

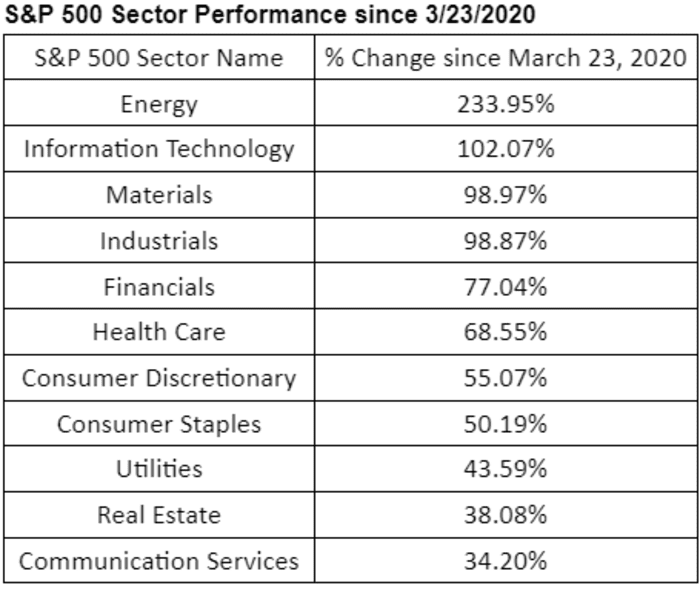

Amongst 11 S&P 500 sectors, energy.

SP500.10,.

has actually been the best-performing sector over the previous 3 years. The sector was enhanced by a spike in crude-oil and natural-gas rates in the after-effects of Russia’s intrusion of Ukraine.

DOW JONES MARKET DATA.

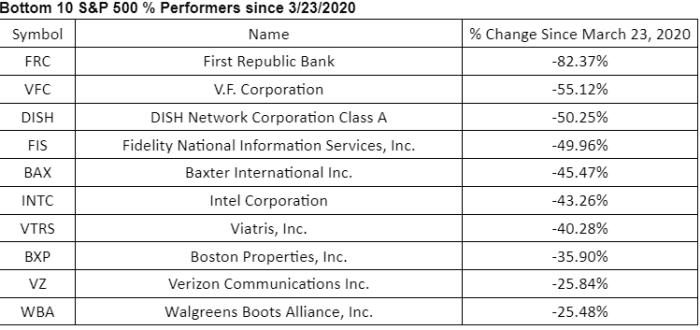

Amongst private stocks, First Republic Bank has actually been the worst entertainer in the S&P 500 considering that March 2020, with the banks coming under tension following the collapse of 2 U.S. local banks.

DOW JONES MARKET DATA.

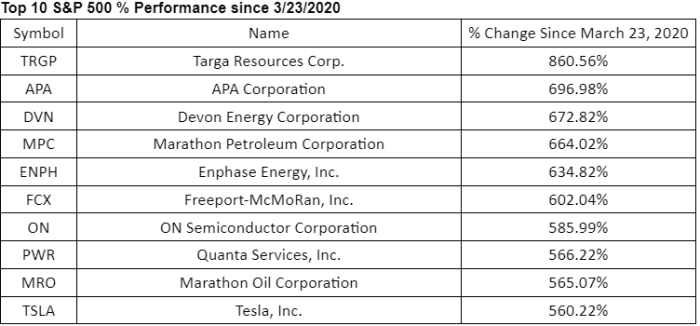

DOW JONES MARKET DATA.

Likewise see: The Fed pivot is near, and yield curve inversion has most likely peaked. That’s typically problem for stocks, this Fidelity strategist states.

U.S. stocks rallied on Thursday after closing dramatically lower in the previous session. The Federal Reserve raised rates of interest by another 25 basis points on Wednesday while keeping in mind that policy makers weren’t booking rate cuts this year, in spite of current tension in the banking market. Stocks likewise responded after Treasury Secretary Janet Yellen stated she wasn’t thinking about actions to ensure all bank deposits.

The S&P 500 acquired 0.3%, while the Dow advanced 0.2% and the Nasdaq Composite was up 1%.

.