The Washington Post/The Washington Post by means of Getty Images

J&J Treat and Foods ( NASDAQ: JJSF) runs in treats and drinks, a fully grown market that displays restricted development capacity, primarily driven by cost boosts associated with inflation. However, the business can broaden its company in the future and attain a greater development rate than the market by leveraging its ingenious abilities and pursuing mergers and acquisitions, profiting from its strong balance sheet. As typically takes place when there is capacity for future development the marketplace capitalization is too abundant and I would choose to see a significant decline in stock cost before thinking about purchasing shares.

I will rapidly make a stock cost and company summary, then I will talk about the business’s monetary information concentrating on the Q1 2024 revenues, take a look at possible development drivers, and lastly conclude with an assessment.

Stock summary

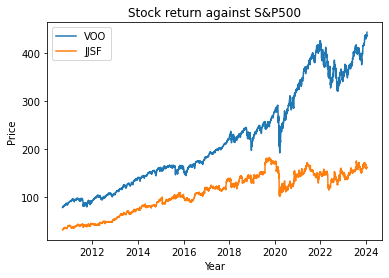

JJSF had a great efficiency in between 1996 and 2020. Nevertheless, after the COVID-19 pandemic, the stock cost has actually primarily stayed stagnant, whereas the S&P 500 had a return of around 110%.

Stock return versus S&P 500 (Image produced by the author through Python library yfinance)

When a stock drags the primary indexes, there are typically 2 various descriptions: either the business has significant issues that are impacting its efficiency or the stock exchange is losing out on an important buy chance.

Company summary

J&J Treat Foods makes and offers junk food and disperses frozen drinks mainly to food service and retail grocery store clients. It primarily runs in the United States, Canada, and Mexico. The primary items produced and dispersed by the business are:

- Frozen drinks marketed through the brand names: Icee, Slush Puppie, and Parrot Ice;

- Soft pretzels offered through the brand names: Super Pretzel, Super Pretzel Bavarian, New York City Pretzel, and Brauhaus;

- Frozen novelties offered through the brand names: Luigi’s, Dippin’ Dots, Dogsters, Icee, Philly Swirl, and Minute Housemaid;

- Churros marketed through the brand names: California Churros and ¡ Hola!

- Bakeshop items offered through the brand names: Readi-Bake, Mary B’s, Daddy Ray’s, Readi-Bake, Nation Home, Mary B’s, Daddy Ray’s, and Hill & & Valley;

- Other junk food such as funnel cakes are marketed as The Funnel Cake Factory and other portable items.

These renowned brand names are offered throughout several areas: shopping centers, fast-foods, dining establishments, arenas, amusement park, theater, and grocery stores.

Although the business runs in the food sector, a market that I typically view as non-cyclical, the sale of treats is discretionary and can quickly be prevented by an individual or a whole home. For instance, a household may still wish to go to the movie theater throughout a crisis however might be deciding to pass up treats. The business itself in its newest 10-K thinks about as a threat the worsening of the entire economy. For all these factors I categorize J&J junk food as a cyclical corporation.

Q1 2024 outcomes

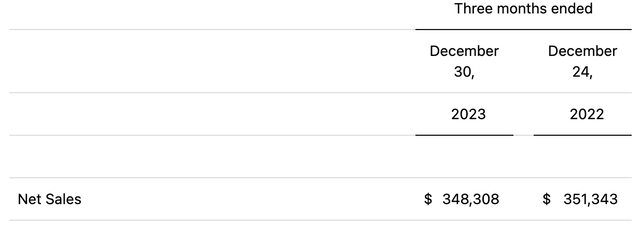

After 3 successive years of double-digit top-line development, the business is presently dealing with a downturn in sales General sales reduced by around 1% on a year-over-year basis mainly due to a decrease in customer usage in food service section. The business is continuing to have excellent lead to frozen drinks which grew around 8.5%.

Net sales result (Business’s Q1 2024 news release)

The most worrying element is that the decline in earnings does not line up with a considerable boost in marketing expenses. I am not versus marketing expenditures, I think that they produce momentum and improve brand name awareness. Nevertheless, I would anticipate to see a favorable relationship in between marketing expenditures and earnings development, and the present absence of positioning raises some concerns.

Business expenses in Q1 2024 (Business’s Q1 2024 news release)

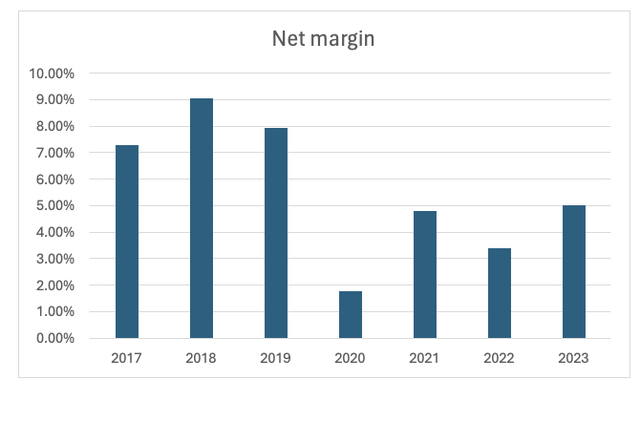

In spite of the softness in earnings outcomes, the business had the ability to improve its success margins. Margins was among my main focus for this revenues call offered the business’s usually low margins, I would have liked to see an upward pattern. These outcomes show the favorable effect of the business’s technique to grow higher-margin core items, in addition to ongoing enhancements in total performance.

The business reported a boost of 20.6% in adjusted operating earnings, a 19.4% boost in changed EBITDA, and a 9.78% boost in GAAP earnings. I am positive that the management group, through active methods and an easing of inflationary pressure, will have the ability to continue growing the bottom line and bring back net margins at 2018-2019 levels in the coming years.

Net margin advancement (Image produced by the author utilizing Python library yfinance)

Favorable viewpoints

The United States junk food market is valued at around $ 114 billion The market is anticipated to grow at a CAGR of around 3.79% into 2029 primarily driven by a boost in items’ cost and a little increase in sales volumes.

Thankfully, J&J Treat and Foods has a lot of possibilities to grow at a greater rate than the typical market. The business is presently dealing with channel growth by protecting handle brand-new merchants or boosting existing collaborations. For instance, in the last quarter, Super Pretzel got schedule at Wallgreens. The business can profit from the cinema momentum leveraging its ICEE brand name.

Furthermore, there is development capacity through item development. For instance, throughout the Q4 2023 revenues call the CEO highlighted the intro of 2 brand-new tastes for ICEE items: cherry and blue raspberry. I like the management group’s concentrate on development, the business continuously presents brand-new tastes or item options to line up with customers’ tastes.

The business boasts a robust balance sheet with an overall debt-to-free capital of 2.68 and a debt-to-equity equivalent to simply 0.13. In my view, the business is well-positioned for future possible acquisitions. Throughout the Q4 2023 revenues call, the CEO revealed optimism about future M&A operations:

Transitioning to M&A. We continue to be extremely disciplined in our method. We are examining chances that match our brand name portfolio and company design which deal appealing investor returns. Economically, we have the resources and the balance sheet to purchase development when chances line up.

Thinking about all these chances, I think that it is most likely to see the business continue growing its sales on a double-digit base while likewise increasing success in the next years.

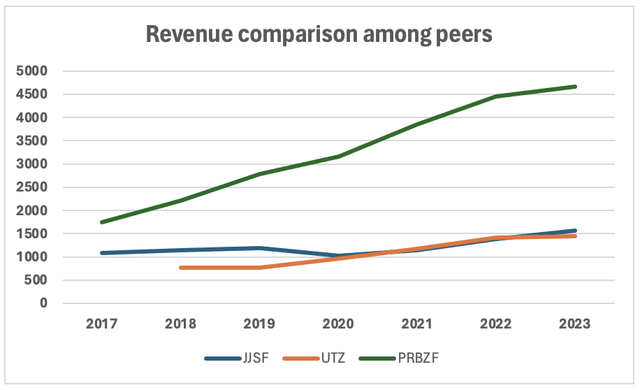

Upon evaluating the monetary information and previous efficiency together with 2 primary rivals, Utz Brand Name ( UTZ) and Premium Brands Holdings Corporation ( OTCPK: PRBZF), it appears how earnings development recently has actually underperformed compared to the business’s peers. Given that 2017 earnings grew at a compound yearly development rate of 5.32% whereas the other 2 rivals have actually attained development rates surpassing 10%. Nevertheless, thinking about the analysis performed in the previous passage about possible future growth, I am positive that the management group can reverse this pattern and begin growing more than its peers.

Income pattern and peers contrast (Image produced by the author through Python library yfinance)

Threats and possible problems

The snacking market is vibrant and really competitive and it’s ending up being significantly tough to stick out and acquire a substantial market share. While I think that a little competitors can be advantageous for a business, in this case, the intense landscape needs substantial financial investments in capital investment, R&D, and marketing to draw in brand-new clients and maintain existing ones, decreasing the business’s margins. Furthermore, the market has plenty of huge business such as PepsiCo ( PEP), The Coca-Cola Business ( KO), or perhaps Nestlé ( OTCPK: NSRGY) that can quickly go beyond small business like J&J Treat and Foods.

The business’s operation and monetary outcomes are likewise impacted by seasonality, especially with iced brand names like ICEE that have greater need throughout summertime. Since of seasonal variations, there can be no guarantee that the outcomes of any specific quarter will be a sign of outcomes for the complete year or future years.

Appraisal

Given that the business has a steady complimentary capital and is likewise dedicated to dividend payments, I chose to assess it through both the dividend discount rate design and the affordable capital design and compare the outcomes.

Let’s start with the dividend discount rate design.

The business is dedicated to dividend boosts to reward investors and I anticipate this pattern to continue likewise in the future. Thinking about the basic efficiency of the business and the FCF payment ratio at 69%, the dividend is sustainable. At the minute in which I am composing the short article, the present yield is at 1.8%, I anticipate the business to gradually line up with the market typical yield of 3%

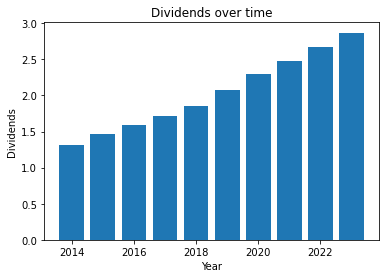

Dividends with time (Image produced by the author through Python library yfinance)

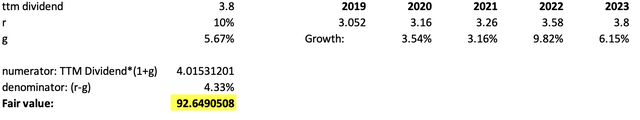

On the best side of the sheet are reported the annual dividends for the last 5 years and their particular development. On the left side are calculated the anticipated dividends for the 2024, 3.80$ per share, thinking about a 10% yearly return for the financial investment (r) and the typical dividend development for the last 5 years (g) which amounts to 5.67%. Using the formula reported in the image I got a worth of 92.65$ per share, considerably lower than the present cost of 156$.

DDM appraisal (Author’s estimation on Excel)

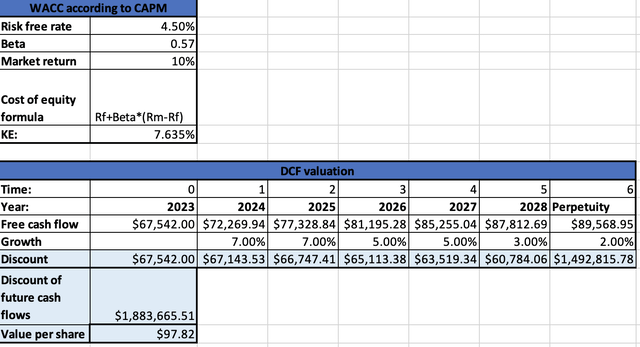

Passing to the DCF, thinking about all future development drivers in the previous paragraphs, and considering the extremely competitive market, I get a reasonable worth of $1.88 billion or $97.82 per share. These outcomes are acquired by forecasting earnings development of 10% as much as 2026, following my financial investment thesis, which will decrease for the staying years. I presumed a continuous development of 2% and a boost in net margins up to the 2018 level (9%). I lastly got the complimentary capital by thinking about capital investment equivalent to 4% of incomes, and the very same portion likewise for devaluation and amortization. I lastly calculated the expense of equity following the popular capital possession prices design formula reported in the image listed below and I utilized it as a discount rate element.

DCF appraisal (Author’s estimation on Excel)

The outcomes acquired with the 2 designs are comparable and they are shrieking “offer”. The business is likewise misestimated when considering its forward P/E ratio of around 28 while the sector mean is around 19. Although the business has favorable viewpoints it appears that they are currently priced in and I would keep away till it reaches a lower market capitalization.

Conclusions

J&J Treat Foods is a great business offering excellent items in a competitive market. Although it can increase its incomes on a double-digit base through various growth chances, in the previous couple of years it was unable to stay up to date with the very same rate set by its peers and its revenue margins are really low. The future excellent viewpoints appear to be currently thought about in the present stock cost and I wish to see a 40-50% stock cost decline before thinking about purchasing the stock.