patpitchaya

JPMorgan Equity Premium Earnings ETF ( NYSEARCA: JEPI) is developed mostly for income-focused financiers as it pays a regular monthly dividend. Based upon its reasonably appealing 8.3% payment, it’s anticipated to be a core holding of earnings financiers seeking to concentrate on creating a sustainable regular monthly dividend.

Nevertheless, it is essential to think about that JEPI isn’t developed to duplicate the S&P 500 ( SPX) ( SPY). I think it is essential to consider this as JEPI is developed to use a less unstable technique over a “ complete market cycle” (3 to 5 years) compared to the SPX. With its more protective portfolio choice, JEPI is anticipated to underperform the S&P 500 in a booming market. As an outcome, I examined that JEPI isn’t the very best automobile for overall return financiers seeking to surpass the SPX regularly. I last upgraded JEPI financiers in mid-September 2023, highlighting its uptrend healing thesis. Although JEPI has actually underperformed the S&P 500 ever since, the thesis has actually still turned out, as the marketplace went on a rampaging run. As an outcome, I think it’s apt for me to offer an upgrade on JEPI, to assist financiers reassess whether the entry levels are still prompt to include direct exposure, and whether they ought to prepare for a pullback before purchasing more.

Watchful financiers ought to understand that JEPI fund supervisors suggested in its prospectus that its income-driven, lower volatility method might “underperform compared to the S&P 500, especially in bullish markets.” Financiers ought to understand that JEPI performs its covered call method by “ targeting 30-Delta OTM calls.” As an outcome, it intends to “stabilize catching some index upside while making choice premiums.” Nevertheless, even with this technique, it’s still susceptible to considerable underperformance in bullish markets, as seen over the previous 3 months.

Appropriately, the S&P 500 published a 3M overall return of 18.6%. On the other hand, JEPI published a 3M overall return of 10.1%. As an outcome, the fund recorded about 54% of SPX’s overall return over the very same duration. Zooming out over the previous year, JEPI published an overall return of 10.3% compared to SPX’s 22.3% over the very same duration. Regardless of the relative underperformance, it appears like JEPI has actually disappointed what the fund supervisors have actually meant to do, which is to “provide a substantial part of the returns connected with the S&P 500 Index however with lowered volatility.”

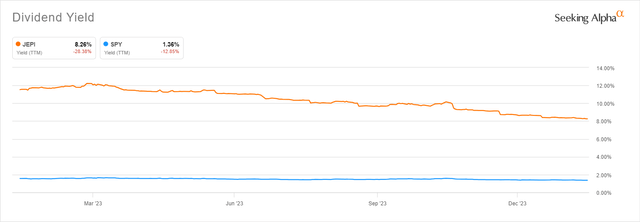

JEPI Vs. SPY TTM dividend yield (1Y) ( Looking For Alpha)

Still, we might see that JEPI has actually still provided a much greater dividend yield than SPX. For that reason, it still satisfies among JEPI’s worth proposals, recognized as a “essential differentiator, using routine capital to financiers.”

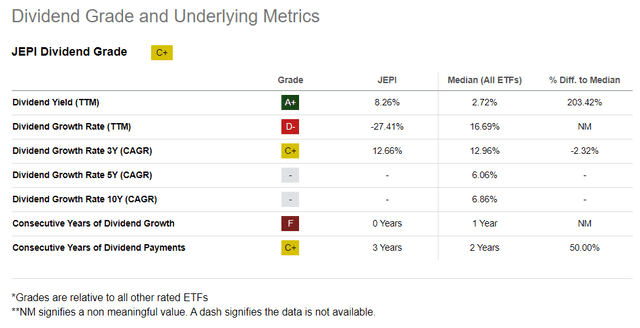

JEPI Dividend Grade metrics ( Looking For Alpha)

As seen above, JEPI is appointed a reasonably neutral “C+” dividend grade by Looking for Alpha Quant. Its “A+” yield grade is thought about best-in-class, although the development rates in its dividends have actually not transcended. As an outcome, earnings financiers searching for a more constant and market-leading dividend development chance may require to consider its less attractive consistency in their evaluation.

Furthermore, JEPI is developed with a lower portfolio concentration than the SPX. Appropriately, the leading 10 constituents in JEPI represented simply 15.5% of its overall net properties. On the other hand, the S&P 500’s leading 10 holdings represented almost 32% of its overall allowance. For that reason, financiers searching for a more varied portfolio ought to discover JEPI better.

There’s little doubt that the Splendid 7 have considerably affected the S&P 500’s efficiency over the previous year. The ongoing rise might likewise result in over-optimism threats as many are no longer underestimated. According to Morningstar’s assessment analysis, just Google ( GOOGL) ( GOOG) is still listed below its reasonable assessment. With the tech sector accounting for about 31% of the S&P 500’s direct exposure, financiers trying to go after alpha by pursuing its existing upward momentum might be struck by an unexpected pullback. As an outcome, I have self-confidence that JEPI’s more protective construct might assist even overall return financiers alleviate these threats by reallocating some direct exposure from the S&P 500.

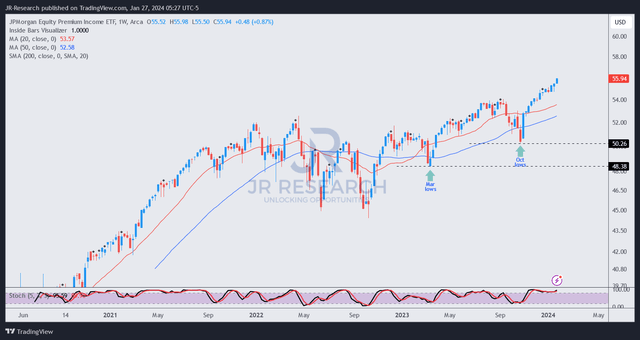

JEPI cost chart (weekly, changed for dividends) ( TradingView)

As seen above, JEPI has actually restored its uptrend predisposition given that October 2023 when changed for dividends. As an outcome, I examined that JEPI’s method is working, regardless of its relative underperformance to the S&P 500.

With the S&P 500 continuing its rally after the current debt consolidation, I do not anticipate the relative underperformance to reverse in the near term. Nevertheless, JEPI might take advantage of a subsequent pullback and possibly greater indicated volatility, which has actually combined at its June 2023 lows.

In addition, JEPI ought to still get robust assistance from earnings financiers seeking to take advantage of its reasonably appealing yields. As an outcome, I see less factors to turn more careful on JEPI, despite the fact that it’s not unsusceptible to possible market volatility causing a pullback.

In view of this, financiers can think about the zone in between the $50 to $52 levels if they prepare for a pullback in the broad market. While JEPI’s covered call method can possibly alleviate drawback threats, they do not offer complete defense. As an outcome, steeper pullback in the broad market will likely still effect JEPI’s upward predisposition, paying for financiers a more appealing chance to purchase weak point.

Ranking: Maintain Purchase.

Crucial note: Financiers are advised to do their due diligence and not count on the info offered as monetary guidance. Please constantly use independent thinking and note that the score is not meant to time a particular entry/exit at the point of composing unless otherwise defined.

I Wished To Speak With You

Have positive commentary to enhance our thesis? Identified an important space in our view? Saw something crucial that we didn’t? Concur or disagree? Remark listed below with the objective of assisting everybody in the neighborhood to discover much better!