- Homebuyers came out of the woodwork as home loan rates published the most significant regular monthly decrease because 2008.

- Sellers likewise came off the sidelines, however not with as much force; brand-new listings increased 0.1% to the greatest level because September 2022.

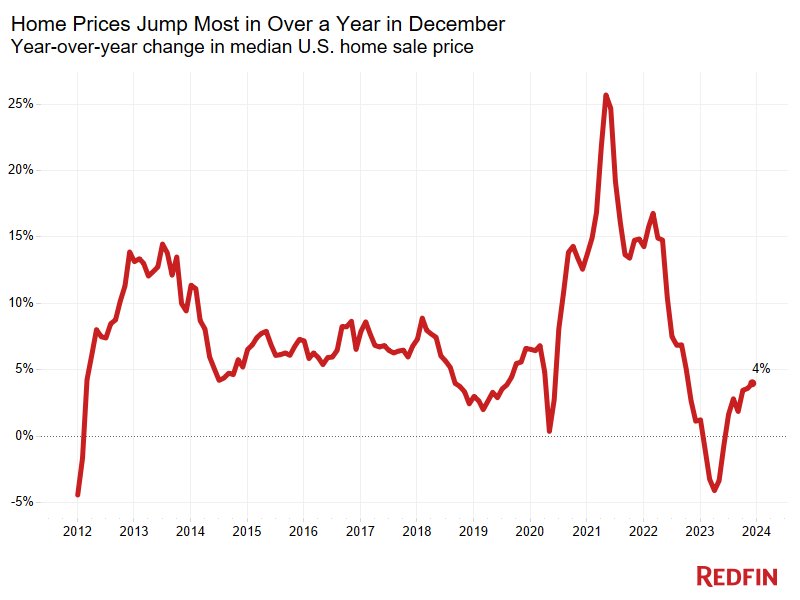

- Rates leapt 4%, the most in over a year, as purchasers completed for a still-limited swimming pool of homes.

- Redfin representatives state bidding wars in some locations are ending up being more regular as individuals who were searching when rates were greater buckle down about purchasing. However January is off to a slower-than-expected start in the middle of freezing weather condition.

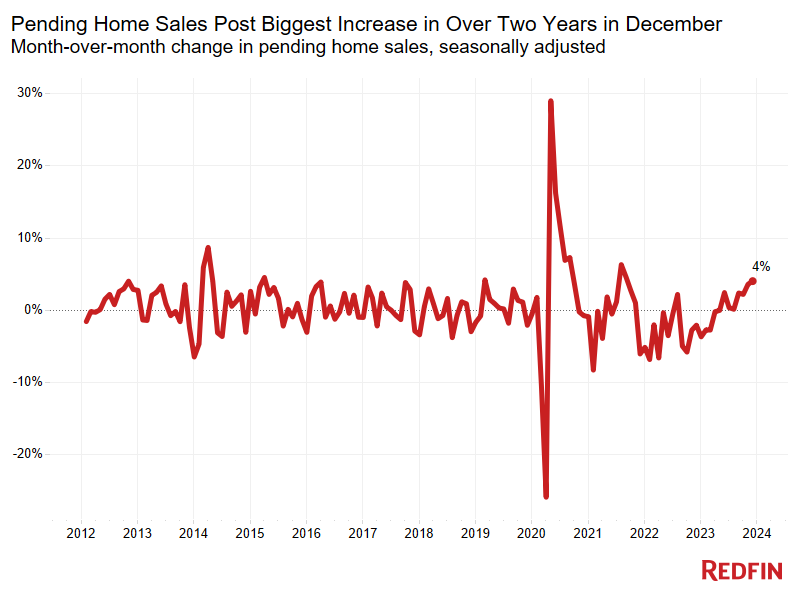

Pending home sales increased 4.1% month over month in December on a seasonally changed basis– the most significant boost because September 2021– to the greatest level in more than a year. They climbed up 5.9% from a year previously, the most significant yearly gain because June 2021.

Pending sales leapt since a high drop in home loan rates tempted purchasers to the marketplace. The typical 30-year-fixed home loan rate was up to 6.82% in December from 7.44% in November, the most significant regular monthly decrease because 2008. Purchasers who were delicately looking when rates were above 7% are now buckling down, Redfin representatives state.

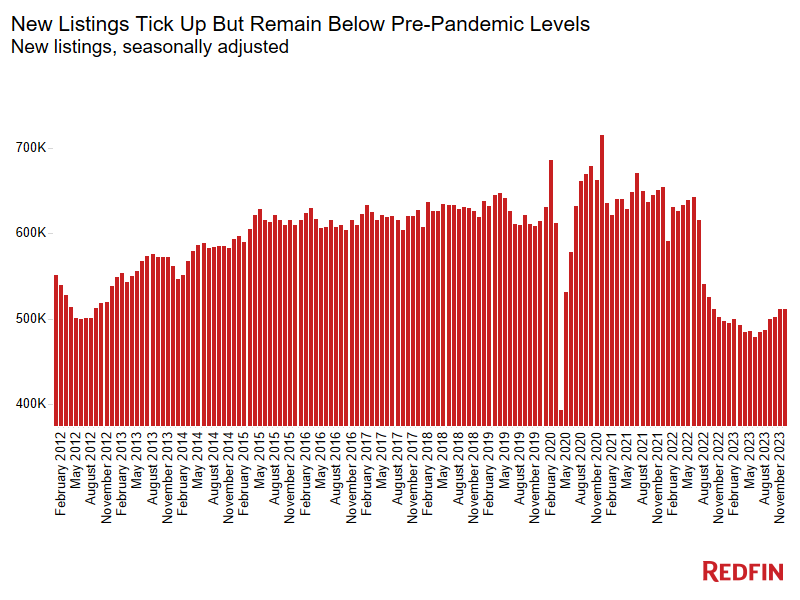

The dip in home loan rates has actually likewise brought sellers off of the sidelines, though they have not returned with as much strength as purchasers, likely since a bulk of them do not wish to quit the ultra low home loan rate they scored throughout the pandemic. New listings increased 0.1% month over month to the greatest seasonally adjusted level because September 2022, and were up 2.7% year over year– the biggest boost because July 2021.

While real estate supply has actually ticked up, it stays listed below pre-pandemic levels. Active listings, or the overall variety of homes for sale, increased 3.1% month over month on a seasonally changed basis however fell 5.1% from a year previously.

” We’re absolutely seeing an uptick in activity from both purchasers and sellers,” stated Abby Alwan, a Redfin Premier property representative in Austin, TX “ I have 2 listings in the suburban areas that 6 months earlier would’ve rested on the marketplace. However suddenly, purchasers are coming out of the woodwork thanks to lower rates. More folks are seeking to have discussions about what they require to do to go into the marketplace now that they have actually seen enhancement in the market.”

It deserves keeping in mind that while need leapt in December, January is off to a slower-than-expected start, most likely due to serious winter season weather condition. Redin economic experts anticipate the marketplace to get as spring methods, so long as home loan rates do not soar.

Home Rates Post Largest Boost in Over a Year

The typical U.S. home price climbed up 4% year over year to $403,714 in December, the most significant yearly boost because October 2022, and fell 1.1% month over month. Please note that home cost information is not seasonally changed, and it is not uncommon for costs to slow from a month previously in December.

The current uptick in property buyer need is most likely adding to the increase in real estate costs, however the main motorist of cost boosts is America’s relentless lack of homes for sale, which is sustaining competitors in some locations.

” Bidding wars are taking place once again, however they’re far more sensible than they were throughout the pandemic homebuying craze,” Alwan stated. “Homes are getting in between one and 5 completing quotes, and rather of using a couple of hundred thousand dollars over the asking cost, competitive purchasers are using 3% to 5% over.”

December 2023 Emphasizes: United States

| December 2023 | Month-Over-Month Modification | Year-Over-Year Modification | |

|---|---|---|---|

| Average price | $ 403,714 | -1.1% | 4.0% |

| Pending sales, seasonally changed | 425,466 | 4.1% | 5.9% |

| Residences offered, seasonally changed | 407,255 | -0.5% | -4.0% |

| Brand-new listings, seasonally changed | 511,136 | 0.1% | 2.7% |

| All homes for sale, seasonally changed (active listings) | 1,569,438 | 3.1% | -5.1% |

| Months of supply | 2.6 | -0.3 | 0 |

| Average days on market | 43 | 6 | -2 |

| Share of for-sale homes with a rate drop | 14.2% | -5 ppts | 0.5 ppts |

| Share of homes offered above last sticker price | 25.5% | -3.3 ppts | 2.5 ppts |

| Typical sale-to-final-list-price ratio | 98.6% | -0.4 ppts | 0.5 ppts |

| Pending sales that fell out of agreement, as % of general pending sales | 16.2% | -0.1 ppts | 0.7 ppts |

| 6.82% | -0.63 ppts | 0.45 ppts |

Note: Data goes through modification

Metro-Level Emphasizes: December 2023

Information in the bullets listed below originated from a list of the 91 U.S. city locations with populations of a minimum of 750,000. Select cities might be left out from time to time to make sure information precision. A complete metro-level information table can be discovered in the “download” tab of the control panel in the regular monthly area of the Redfin Data Center Describe our metrics meaning page for descriptions of metrics utilized in this report. Metro-level information is not seasonally changed.

- Pending sales: In New Orleans, pending sales increased 40.3% year over year, more than any other city Redfin examined. Next came McAllen, TX (31.8%) and Dallas (25.7%). Pending sales fell most in Honolulu (-27.3%), Knoxville, TN (-24.2%) and Greensboro, NC (-22.8%).

- Closed sales: Closed sales increased in simply 6 cities, with the most significant boosts in North Port, FL (7.1% YoY), Las Vegas (4.6%) and Salt Lake City (4.4%). Closed sales fell fastest in Tacoma, WA (-23%), Boston (-19.4%) and Frederick, MD (-18.6%).

- Rates: Average list price increased most from a year previously in Anaheim, CA (17.6%), Camden, NJ (16.1%) and Rochester, NY (16%). They fell in 10 cities, with the most significant decreases in New Orleans (-5.4%), Charlotte, NC (-2.6%) and Austin (-2.4%).

- New listings: New listings increased most from a year previously in Salt Lake City (22.3%), Memphis, TN (18.4%) and McAllen (16.6%). They fell most in San Francisco (-30.8%), Atlanta (-17.6%) and Indianapolis (-15.4%).

- Total supply: Active listings increased fastest in Cape Coral, FL (53.7% YoY), North Port (40.7%) and New Orleans (26%). They reduced fastest in Las Vegas (-31%), New Brunswick, NJ (-25.4%) and Anaheim (-24.6%).

- Competitors: In Rochester, 65.3% of homes offered above their last sticker price, the greatest share amongst the cities Redfin examined. Next came Newark, NJ (61.3%) and Buffalo, NY (61.2%). The shares were most affordable in West Palm Beach, FL (8.6%), Cape Coral (9.4%) and Austin (9.4%).

- Speed: In Rochester, 61% of homes that went under agreement did so within 2 weeks– the greatest share amongst the cities Redfin examined. Next came Grand Rapids, MI (48.5%) and Cincinnati (46.6%). The most affordable shares remained in Honolulu (2.4%), Knoxville (6%) and Lake County, IL (8.8%).

Home-Purchase Cancellations

Information listed below originated from a list of the 50 most populated city locations.

| City Location | December 2023: Pending Sales That Fell Out of Agreement, as % of Total Pending Sales | November 2023: Pending Sales That Fell Out of Agreement, as % of Total Pending Sales | December 2022: Pending Sales That Fell Out of Agreement, as % of Total Pending Sales |

| Anaheim, CA | 12.7% | 15.5% | 15.9% |

| Atlanta, GA | 23.6% | 24.6% | 25.5% |

| Austin, TX | 13.3% | 14.8% | 16.5% |

| Baltimore, MD | 14.1% | 14.0% | 14.5% |

| Boston, MA | 10.2% | 11.1% | 11.5% |

| Charlotte, NC | 12.7% | 13.5% | 13.6% |

| Chicago, IL | 18.3% | 17.5% | 17.2% |

| Cincinnati, OH | 14.1% | 14.6% | 14.2% |

| Cleveland, OH | 19.2% | 22.6% | 20.5% |

| Columbus, OH | 16.4% | 16.6% | 16.9% |

| Dallas, TX | 16.5% | 18.9% | 20.3% |

| Denver, CO | 16.7% | 18.4% | 19.3% |

| Detroit, MI | 18.7% | 16.9% | 17.2% |

| Fort Lauderdale, FL | 22.2% | 21.7% | 20.1% |

| Fort Worth, TX | 17.8% | 18.7% | 20.4% |

| Houston, TX | 18.7% | 18.7% | 19.4% |

| Indianapolis, IN | 18.3% | 17.7% | 17.3% |

| Jacksonville, FL | 21.6% | 23.7% | 25.7% |

| Kansas City, MO | 15.9% | 16.0% | 14.4% |

| Las Vegas, NV | 19.8% | 21.3% | 17.7% |

| Los Angeles, CA | 15.5% | 16.6% | 14.3% |

| Miami, FL | 19.8% | 20.1% | 17.4% |

| Milwaukee, WI | 10.5% | 11.2% | 11.9% |

| Minneapolis, MN | 11.5% | 11.1% | 9.6% |

| Montgomery County, PA | 9.9% | 8.7% | 10.9% |

| Nashville, TN | 14.9% | 16.6% | 14.5% |

| Nassau County, NY | 5.5% | 5.6% | 5.2% |

| Brand-new Brunswick, NJ | 10.8% | 12.0% | 13.0% |

| New York City, NY | 8.9% | 9.0% | 8.2% |

| Newark, NJ | 10.7% | 10.4% | 10.3% |

| Oakland, CA | 10.7% | 10.1% | 11.5% |

| Orlando, FL | 22.4% | 21.3% | 20.4% |

| Philadelphia, PA | 11.7% | 11.8% | 12.9% |

| Phoenix, AZ | 17.8% | 19.0% | 18.8% |

| Pittsburgh, PA | 17.1% | 16.8% | 16.2% |

| Portland, OR | 13.8% | 15.2% | 14.7% |

| Providence, RI | 12.5% | 13.0% | 12.7% |

| Riverside, CA | 17.4% | 17.8% | 18.6% |

| Sacramento, CA | 14.9% | 16.0% | 16.7% |

| San Antonio, TX | 20.4% | 19.4% | 12.1% |

| San Diego, CA | 12.6% | 15.9% | 13.1% |

| San Francisco, CA | 6.5% | 5.6% | 4.1% |

| San Jose, CA | 6.9% | 6.4% | 7.8% |

| Seattle, WA | 10.1% | 11.0% | 11.9% |

| St. Louis, MO | 17.2% | 15.5% | 16.7% |

| Tampa, FL | 20.6% | 21.0% | 21.6% |

| Virginia Beach, VA | 15.6% | 16.1% | 14.3% |

| Warren, MI | 11.9% | 12.6% | 12.7% |

| Washington, DC | 14.3% | 12.6% | 14.9% |

| West Palm Beach, FL | 17.0% | 17.3% | 17.6% |

| National– U.S.A. | 16.2% | 16.3% | 15.5% |