DNY59

Energies stocks came under substantial pressure for the majority of 2023, as the Fed rates of interest walkings knocked much-needed sense into over-optimistic financiers. Nevertheless, the damaging in energies stocks has actually likewise developed chances for financiers in late 2023 as the energies sector ( XLU) bottomed out. Appropriately, XLU bottomed out in early October 2023, well before Fed Chair Jerome Powell suggested the Fed’s expectations of 3 rate cuts in 2024 at his mid-December interview. To put it simply, astute energies financiers have actually prepared 2 months ahead of a long-lasting bottom in the rate-sensitive sector, thinking that the worst hammering in energies stocks is most likely over.

Cohen & & Steers Facilities Fund ( UTF) is a CEF mainly focused on facilities business in its capital allotment. It has a goal of “ overall return with a focus on earnings.” For that reason, the CEF’s targeted financiers are most likely earnings financiers aiming to take advantage of the nonreligious styles in facilities investing. Furthermore, the fund utilizes utilize ( reliable utilize: 30.1%) with the intent of “ increasing earnings readily available for investors.” UTF highlights its sensible usage of utilize to “possibly increase dividend yield for investors.” Appropriately, 85% of its funding is based upon repaired rates with a typical regard to 3 years. Nevertheless, with 15% of its funding based upon variable rates, the marketplace most likely required to show execution threats on its financial investment technique, offered the Fed’s unmatched rate walkings.

Offered the Fed’s interaction of rate cuts in 2024, I think it provided credence to the bottoming procedure in UTF in early October 2023, in line with XLU’s bottom. That’s right; the marketplace had actually prepared for the Fed pivot well ahead of Powell’s pressor, advising financiers why they should look forward, not backwards, when examining the most appealing entry levels for a financial investment thesis.

By the time you read this short article from me, UTF has actually currently recuperated almost 26% (consisting of dividend modifications) from its October lows through its current December highs. It’s well above UTF’s 5Y and 10Y overall return CAGR of 8.8% and 8.7%, respectively. For that reason, risk/reward matters, even for a leveraged CEF like UTF. Based upon Morningstar’s moat category, UTF’s portfolio primarily includes business with a minimum of a narrow moat. Appropriately, more than 58% of its portfolio is credited to large- and narrow-moat business. For that reason, I obtained that UTF is still a strong income-generating financial investment at the best levels to provide its overall return facility. With a TTM circulation yield of 8.65% versus its 10 average of 7.7%, I think the medium-term healing thesis in UTF stays legitimate for income-focused financiers aiming to outshine on an overall return basis.

Why? I think the primary worry about UTF’s thesis isn’t asserted on the quality of the business in its portfolio, as I suggested previously. The marketplace de-rated UTF in sync with the hammering in energies stocks, as UTF has more than 50% direct exposure in the sector since Q3. Furthermore, making use of utilize is a double-edged sword that might cause more losses than prepared for, especially when UTF requires to re-finance its variable and set rate utilize. As an outcome, it might lead to UTF being less able to safeguard its existing circulation payment if its leveraged financial investment technique shows to be less effective than anticipated. These vital elements benefit even more evaluation for financiers thinking about utilizing UTF to get leveraged direct exposure to facilities stocks.

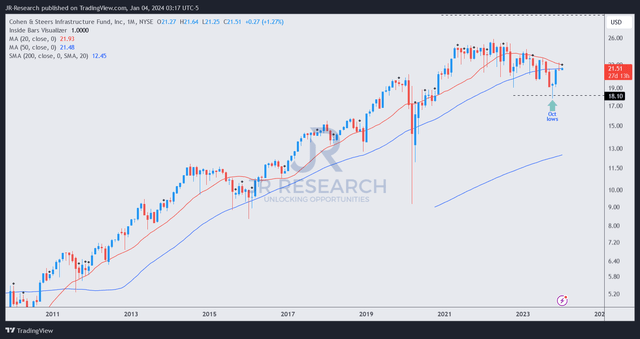

UTF rate chart (month-to-month) (TradingView)

Based upon my evaluation that UTF bottomed out in October 2023, as seen above, I have self-confidence that it need to restore composure and resume its long-lasting uptrend extension.

It ought to be clear to rate action financiers that UTF’s long-lasting uptrend stays unbeaten. Its October low was an astute bear trap ( incorrect drawback breakdown) that showed dip purchasers have actually returned convincingly, protecting those lows resolutely.

While I do not anticipate UTF to restore its all-time high anytime quickly, the risk/reward stays beneficial, supported by its appealing yields. Nevertheless, financiers should beware about being too aggressive. UTF’s rise from its October lows might be primed for profit-taking by financiers who purchased its dips, causing increased near-term volatility. As an outcome, a more regulated cadence of purchasing in stages is motivated, permitting financiers to purchase steeper near-term pullbacks, partaking in UTF’s prospective long-lasting healing thesis.

Score: Start Purchase.

Crucial note: Financiers are advised to do their due diligence and not depend on the info supplied as monetary suggestions. Please constantly use independent thinking and note that the score is not meant to time a particular entry/exit at the point of composing unless otherwise defined.

I Wished To Speak With You

Have positive commentary to enhance our thesis? Identified an important space in our view? Saw something crucial that we didn’t? Concur or disagree? Remark listed below with the objective of assisting everybody in the neighborhood to find out much better!