2023 hasn’t been the greatest year for copper. Although it started strong, the base metal has actually been affected by supply and need concerns, and costs look set to end the year reasonably flat.

Copper has a favorable long-lasting outlook thanks to its location in the green energy shift, where it contributes in connection, electrical lorry (EV) production and even wind power generation. However a weak healing in leading customer China has actually moistened the red metal’s near-term future, leaving financiers expecting much better basics in the brand-new year.

Continue reading to discover how copper carried out in 2023, from costs to provide and require.

How did copper carry out in 2023?

Copper cost in Q1

Copper ended 2022 with a small cost decrease, however opened the year in a strong position. Being available in at US$ 8,307.01 per metric lot (MT) on January 3, copper rapidly reached its annual high of US$ 9,406.01 on January 26. The metal saw some moderate volatility throughout the quarter, however stayed mostly rangebound, remaining above the US$ 8,500 mark.

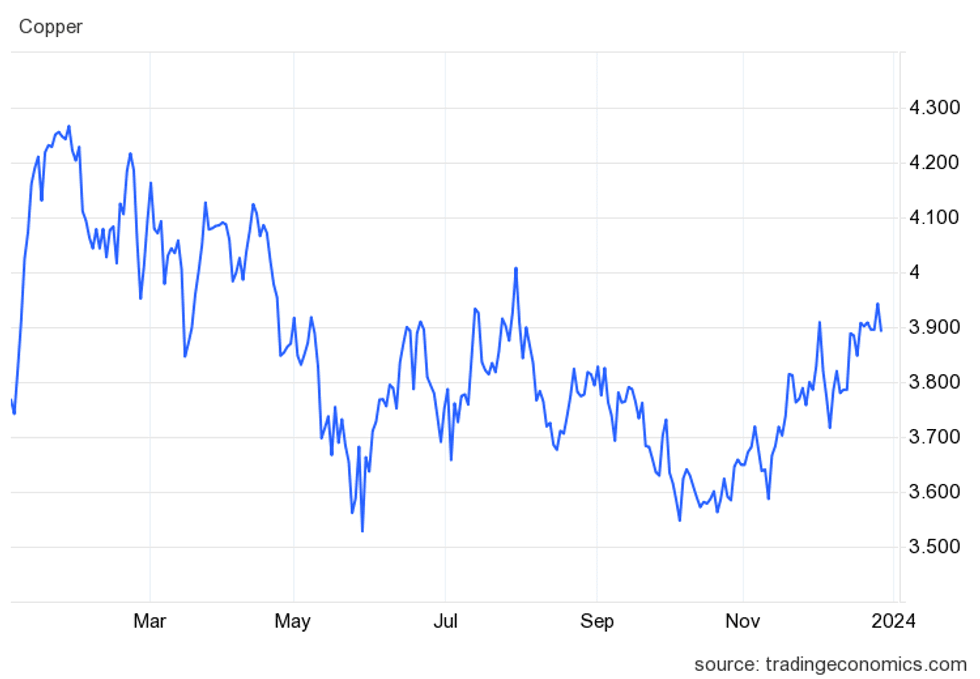

Copper cost from January 3, 2023, to December 28, 2023.

Chart by means of Trading Economics

Copper cost in Q2

The peak for copper in the 2nd quarter began April 13, when it reached US$ 9,091.85; nevertheless, the red metal saw a sheer decrease after that point, reaching its annual low of US$ 7,778.56 on Might 29. This downturn began the back of lower need for copper from the Chinese realty sector.

After getting through the very first half of June following a retreat in the United States dollar, copper closed Q2 at US$ 8,270.63.

Copper cost in Q3

The start of Q3 saw copper change together with volatility in the dollar, and the metal reached its quarterly high of US$ 8,836.12 on July 31. Copper began to decrease after that point as the dollar acquired strength, however saw a small rebound in the middle of August as fund supervisors went long on copper Eventually, brief positions triumphed, and copper took a decline at the end of the month as China continued to experience realty sector concerns

The 3rd quarter likewise brought some closure to a scenario in Peru, the world’s second biggest copper-producing country. Q1 was marked by a series of fatal mining demonstrations in the nation– they started in late 2022 and continued through March, causing a 25 percent year-on-year drop in mining exports from the nation in January.

While the demonstrations slowed in the 2nd quarter, they flared as soon as again in mid-July and into August, this time collaborated by mining employees and unions who required the resignation of President Dina Boluarte. Nevertheless, the most current round of demonstrations was mostly restricted to the country’s capital of Lima, restricting impacts on the mining sector.

After months of discontent, Peruvian Prime Minister Alberto Otarola vowed at the end of September to punish the mayhem and instability Market experts have actually kept in mind that the nation stays weak in its efficiency in suppressing the demonstrations, and there is unpredictability around federal government stability along with market policies and bureaucracy

Regardless of these concerns, copper production in Peru increased by around 19 percent throughout the very first 3 quarters of the year compared to the exact same duration in 2022. In an e-mail to the Investing News Network, Federico Gay, senior mining expert at Refinitiv, kept in mind that these production boosts were mostly due to brand-new mining operations coming online or reaching capability in Peru in 2023, consisting of Anglo American’s (LSE: AAL, OTCQX: AAUKF) Quellaveco.

This increased production will assist Peru maintain its position as a significant copper manufacturer for the time being. “We approximate Peru will stay the 2nd biggest manufacturer for the next number of years,” Gay discussed, “however the Democratic Republic of Congo, presently the 3rd biggest manufacturer, is threatening to take Peru’s location in the future.”

The cost of copper continued to move into completion of the quarter, reaching US$ 8,226.54 on September 29.

Copper cost in Q4

The 4th quarter saw copper costs start to rebound as Chinese stockpiles dropped to 13 month lows and stocks held by the London Metal Exchange decreased followimg a boost in mid-July.

Copper saw additional gains as significant miner Very first Quantum Minerals (TSX: FM, OTC Pink: FQVLF) dealt with issues at its Panama-based Cobre Panama mine, which represents 1 percent of world copper supply.

On October 20, the Panamanian federal government approved a twenty years mining license for the Cobre Panama mining concession, with the alternative for a twenty years extension. In return, the business consented to pay the federal government US$ 375 million annually. Nevertheless, news of the offer triggered prevalent demonstrations by an approximated 250,000 individuals who were worried about the mine’s influence on the environment and supply of water; they effectively shut operations at the mine down for weeks.

Eventually, Panama’s Supreme Court discovered the offer to be unconstitutional, and on November 28 Laurentino Cortizo, the nation’s president, purchased the mine closed. First Quantum is presently checking out legal alternatives for its operations in Panama, however arbitration concerning Cobre Panama is most likely to be lengthy.

Copper costs reached a quarterly high of US$ 8,617.86 on December 1.

What other aspects affected copper supply and need in 2023?

Taking a look at copper supply and need in 2023, the International Copper Study Hall (ICSG) supplies initial information in a December news release It reveals that international copper mine production increased by about 1 percent year-on-year over the very first 10 months of 2023; on the other hand, improved copper production increased by about 5.5 percent.

With world evident refined copper use up by around 4 percent year-on-year from January to October, the ICSG keeps in mind that the improved copper market remained in an evident deficit of about 51,000 MT throughout that time.

As pointed out, costs for copper are affected by supply, along with need from different markets. The biggest source of need is the Chinese real estate market, which requires copper for a range of structures. While need from this classification has actually plunged, copper’s growing applications in the energy shift are offering assistance.

A main factor to this need has actually been utility-scale power-generating operations like wind farms, which need in between 3.5 and 9.6 MT of copper per megawatt of power generation, and photovoltaic plants, which can include more than 5 MT of copper per megawatt. Need from the automobile market has actually likewise been increasing– with more countries phasing out gas engines, EVs are positioning extra pressure on copper supply.

That stated, it deserves keeping in mind that EV makers are searching for options to the red metal. Specialists think need from the sector might not be as high as was formerly anticipated if brand-new developments lower the quantity required per EV.

Financier takeaway.

In October, the ICSG was expecting a copper surplus of 467,000 MT in 2024 as brand-new mines and smelters come online, however this price quote came before the closure of First Quantum’s Cobre Panama eliminated more than 300,000 MT of supply.

Considering that the mine was taken offline, companies like BMO Capital markets and Goldman Sachs (NYSE: GS) have upgraded their projections The previous is now requiring a little refined copper deficit in 2024, while the latter anticipates supply to disappoint need by more than 500,000 MT. Jefferies Financial Group (NYSE: JEF) likewise anticipates a big copper deficit next year.

” Interruptions have actually substantially increased, and a market deficit is now significantly most likely,” BNN Bloomberg prices estimate Jefferies as stating. “We might be at the foothills of the next copper cycle.”

Do not forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct financial investment interest in any business pointed out in this post.

Editorial Disclosure: The Investing News Network does not ensure the precision or thoroughness of the details reported in the interviews it performs. The viewpoints revealed in these interviews do not show the viewpoints of the Investing News Network and do not make up financial investment suggestions. All readers are motivated to perform their own due diligence.

From Your Website Articles

Associated Articles Around the Web