Over the previous couple of years, unusual earth metals have actually normally seen high need and rates.

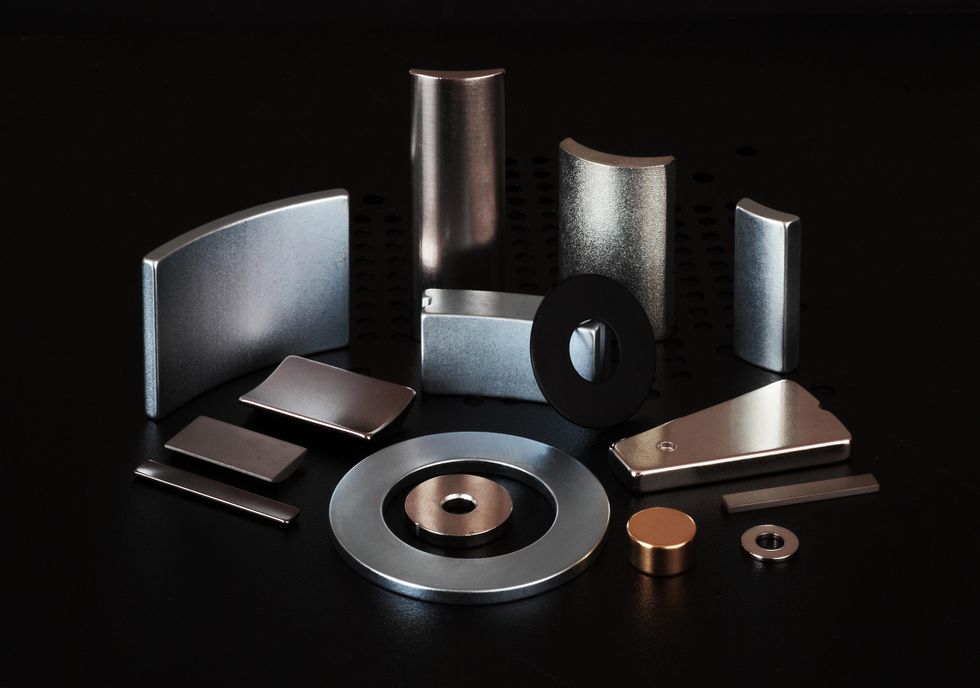

Uncommon earth aspects (REEs) are crucial metals for modern applications, consisting of irreversible magnets, which have prevalent capacity, particularly in the innovation and electrical automobile sectors.

Nations around the globe will continue attempting to protect unusual earths from sources beyond China– which is excellent news for unusual earths business in Australia. In the long-lasting, according to the International Energy Firm (IEA), unusual earths might see a need boost of as much as 7 times by 2040.

For financiers thinking about getting a foot in the market, listed below is a list of the biggest ASX-listed unusual earths stocks by market cap. Information for this stocks list was gathered utilizing TradingView’s stock screener on November 24, 2023.

1. Lynas Rare Earths (ASX: LYC)

Market cap: AU$ 6.26 billion; existing share rate: AU$ 6.62

Lynas Rare Earths is the biggest unusual earths designer in Australia, in addition to the only substantial unusual earth products manufacturer worldwide beyond significant powerhouse China. Concentrated on incorporated shipment, Lynas is a miner and provider of top-quality unusual earths. According to the business, its Mount Weld property in Western Australia is among the highest-grade unusual earths mines worldwide.

Throughout the 2023 , the business reported record production for neodymium and praseodymium (NdPr) at 6,142 tonnes. Its overall unusual earth oxide production reached 16,780 tonnes throughout the exact same duration.

Market cap: AU$ 2.97 billion; existing share rate: AU$ 6.90

Iluka Resources has years of experience in the mining market, mainly in the production of zircon and top-quality titanium-dioxide-derived rutile and artificial rutile. Nevertheless, recently, it has actually established an uncommon earths portfolio.

At its Eneabba operation in Western Australia, Iluka has a tactical monazite-rich mineral stockpile that it prepares to extract and procedure. The business is presently dealing with a expediency research study for a totally incorporated unusual earths refinery at Eneabba, which would produce apart unusual earth oxides from its own feedstock and possibly from 3rd party feedstock also. Building and construction will begin when earthworks have actually been finished, with very first production at the refinery anticipated in 2025.

Iluka’s Wimmera task in Victoria, Australia, likewise has the prospective to be a long-lasting provider of zircon and unusual earths. Following an initial expediency research study performed at its Wimmera task, the business’s board authorized AU$ 30 million in financing for a conclusive expediency research study. Iluka anticipates to finish the research study by the end of 2025.

3. Arafura Rare Earths (ASX: ARU)

Market cap: AU$ 401.53 million; existing share rate: AU$ 0.19

Arafura Resources (ASX: ARU) is advancing its Nolans NdPr task in Australia’s Northern Area, and it is presently in the middle of building. Arafura has prepare for its Nolans task to be a vertically incorporated NdPr operation with processing centers on website. According to the business’s site, the Nolans task will provide around 4 percent of the worldwide NdPr oxide need when total.

In April, the business signed an offtake arrangement with Siemens Gamesa Renewable resource that begins in 2026. This arrangement ensures a 5 year agreement under which Arafura will provide Siemens Gamesa with NdPr from its Nolans task. The supply offer will begin at 200 tonnes for the very first year, before increasing gradually as the task reaches nameplate production. According to its quarterly report for Q3 2023, early building work at the Nolans task is total, leading the way for major building, which it anticipates to begin in March 2024.

4. Northern Minerals (ASX: NTU).

Market cap: AU$ 177.32 million; existing share rate: AU$ 0.03

Northern Minerals (ASX: NTU) is an uncommon earths business based in Australia concentrated on establishing its Browns Variety dysprosium-terbium task in Western Australia and bringing the task’s Wolverine deposit to production.

Northern Minerals is establishing Browns Variety through a 3 phase system, and the task has actually currently been producing heavy unusual earth carbonate because 2018. The business is presently dealing with a conclusive expediency research study for a commercial-scale mining operation and beneficiation plant at Browns Variety that will respectively draw out and process ore from the Wolverine deposit.

In November, the business got assays from its drilling program finished in March 2023. Northern Minerals has actually started directional drilling to update its Wolverine resource from presumed to suggested resource, with partial financing from the Federal Federal government’s Crucial Minerals Advancement Program.

5. Hastings Innovation Metals (ASX: HAS).

Market cap: AU$ 99.61 million; existing share rate: AU$ 0.76

Hastings Innovation Metals is an Australian expedition and advancement business whose objective is to end up being a leading unusual earths provider, particularly for NdPr for the irreversible magnets sector. Hastings is presently concentrated on its 2 unusual earths jobs in Western Australia: the Yangibana task and the Brockman task. The Yangibana task is seeking to produce a combined unusual earth carbonate to be processed off website.

In a statement from early Might, Hastings completed a binding term sheet with GR Engineering, which is set to create and build the Yangibana beneficiation plant to make sure effective, on-time shipment of the very first concentrate by Q1 2025. The Yangibana task is prepared for to produce around 3,400 tonnes per year of NdPr over a 17-year mine life-span.

Frequently asked questions for ASX unusual earths stocks.

What are unusual earths?

Uncommon earths are a classification of aspects that share lots of chemical homes. In reality, all however 2– yttrium and scandium– are likewise called lanthanides. These aspects are typically discovered in the exact same deposits and are needed for varied technological applications such as unusual earth magnets.

In overall there are 17 unusual earth aspects, and they are divided into light and heavy unusual earths, with each section being organized together on the table of elements. On the light side, there are cerium, lanthanum, praseodymium, neodymium, promethium, europium, gadolinium and samarium, and on the heavy side there are dysprosium, yttrium, terbium, holmium, erbium, thulium, ytterbium, yttrium and lutetium.

Which nations have the most unusual earths?

In regards to both unusual earths reserves and unusual earths production, China is the frontrunner by a long shot, with 44 million tonnes of reserves and 210,000 tonnes of production in 2022. Nevertheless, Vietnam, Brazil and Russia all likewise have reserves above 20 million tonnes. With concerns to production, the United States remains in 2nd location at 43,000 tonnes due to the Mountain Pass mine in California, and Australia remains in 3rd location with 18,000 tonnes.

What makes unusual earths unusual?

Uncommon earths are in fact fairly plentiful in the Earth’s crust, contrary to what their name recommends. Nevertheless, they’re rather dispersed rather of being discovered focused in particular locations, which indicates finding financial deposits to mine is hard.

As China manages much of worldwide unusual earths production, lots of nations have actually considered them vital minerals and are focusing on supply chain security.

Short Article by Matthew Flood; Frequently Asked Questions by Lauren Kelly.

This is an upgraded variation of a short article initially released by the Investing News Network in 2018.

Do not forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Matthew Flood, hold no direct financial investment interest in any business discussed in this short article.

Securities Disclosure: I, Lauren Kelly, hold no direct financial investment interest in any business discussed in this short article.