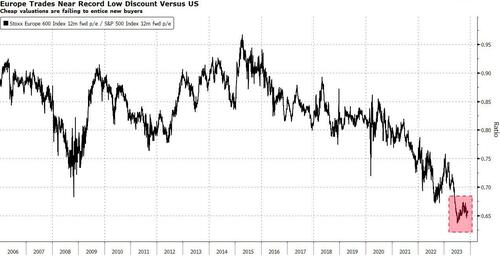

Even a near-record discount rate for European stocks relative to the United States isn’t showing enough to lure financiers stressed over a slowing economy and weakening revenues.

After beginning the year well ahead of the S&P 500, the Stoxx Europe 600 lost ground from Might onward as the buzz around expert system fired up innovation stocks throughout the Atlantic Fret about a local economic crisis have actually likewise sustained an exodus from European stock funds, and the index is back to underperforming United States stocks in dollar terms for the complete year.

That’s an aggravating turn of occasions for equity bulls who were banking on a 35% discount rate in Europe’s price-to-earnings ratio– practically the most affordable on record– to revive financier interest Wall Street strategists state the space isn’t closing whenever quickly.

Forecasters from Bank of America to Deutsche Bank anticipate the S&P 500 to strike a record high in 2024. The outlook for European criteria is a lot more shy, with profits anticipated to increase simply 6.7% versus an 11% gain in the United States, according to information assembled by Bloomberg Intelligence.

” We anticipate European stocks to underperform the United States,” states Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “We are currently in a worldwide production decline and it’s truly weighing on cyclical exporter markets like Europe.” While she concurs European stocks are fairly inexpensive, “regrettably worth tends to underperform in an economic crisis,” she states.

Veitmane is not alone. A multi-asset portfolio group at Societe Generale states European stocks are most likely to reveal no gains at all next year amidst a financial downturn. They see the area’s stocks possibly plunging almost 10% early in the year– a starkly bearish position compared to the United States, where they anticipate the S&P 500 to flirt with its all-time peak.

The gloom has actually likewise been shown in the financier exodus from the area this year. European stock funds had outflows for 37 straight weeks, according to a Bank of America note pointing out EPFR Worldwide. Even Goldman Sachs’s Sharon Bell, who anticipates the Stoxx 600 to increase next year, states the primary purchasers will originate from within Europe through business buybacks.

Not that the discount rate does not matter. Part of Bell’s optimism comes from Europe’s “sensible assessments.” And while JPMorgan’s Mislav Matejka is remaining underweight on the euro zone versus the United States in the meantime, his group state they might possibly alter that call through the very first half of 2024 “offered the progressively appealing assessments.” Oliver Collin, co-head of European equities at Invesco, states that “European equities are among the couple of equity markets to still be magnificently priced relative to bonds.”

However that’s inadequate for bears like BofA’s Sebastian Raedler, who anticipates the Stoxx 600 to move 15% midway through the year. “We see scope for a significant wear and tear in development momentum ahead on the back of a compromising credit cycle,” he states.

By Farah Elbahrawy and Sagarika Jaisinghani, Bloomberg markets live press reporters and strategists

.