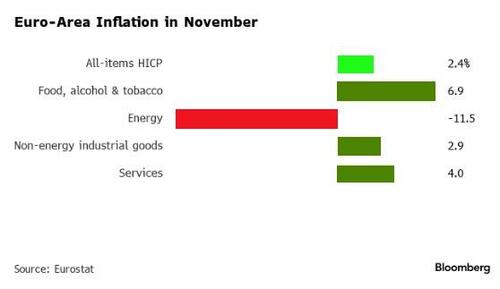

Following cooler than anticipated CPI from Germany and Spain the other day, the aggregate euro-zone inflation cooled more than anticipated today with heading CPI toppling from +2.9% in October to +2.4% in November. Core CPI – that leaves out unpredictable elements consisting of fuel and food – likewise moderated for a 4th month, to 3.6%.

Source: Bloomberg

The decrease in inflation was controlled by Energy deflation …

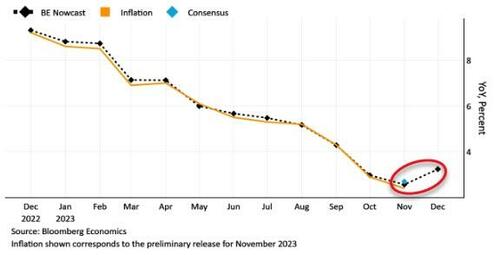

And inflation is slowing throughout all of Europe …

Nevertheless, inflation is most likely to tick greater before going back to target due to analytical impacts and the wind-down of procedures released in 2015 by federal governments to balance out skyrocketing energy rates.

President Christine Lagarde has actually alerted rate gains might speed up “a little” in the coming months and Bloomberg Economics’ Nowcast for December indicate a reading of 3.2%.

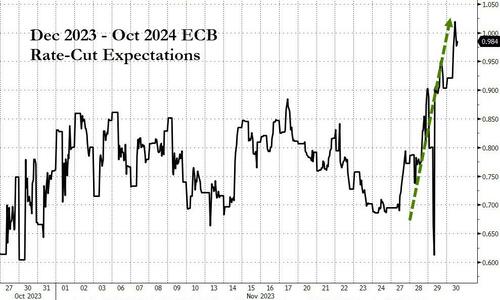

And this has actually raised expectations for ECB rate-cuts next year, advancing expectations for the very first cut from Might to April …

Source: Bloomberg

Furthermore, markets are banking on 4 quarter-point decreases in 2024 – up from 3 recently – and are designating a 70% opportunity of a 5th, which would bring the deposit rate back to 2.75% from a record 4% presently.

ECB authorities are determined, nevertheless, that financial policy needs to stay tight to guarantee inflation makes it all the method back to 2%.

By Zerohedge.com

.