By Pam Martens and Russ Martens: November 28, 2023 ~

FRED is a huge online database at the St. Louis Fed that enables anybody to chart the monetary and financial information kept in its repositories. We utilize the information routinely to bring our readers a crystal-clear picture of the progressively hazardous foundations of the U.S. monetary system.

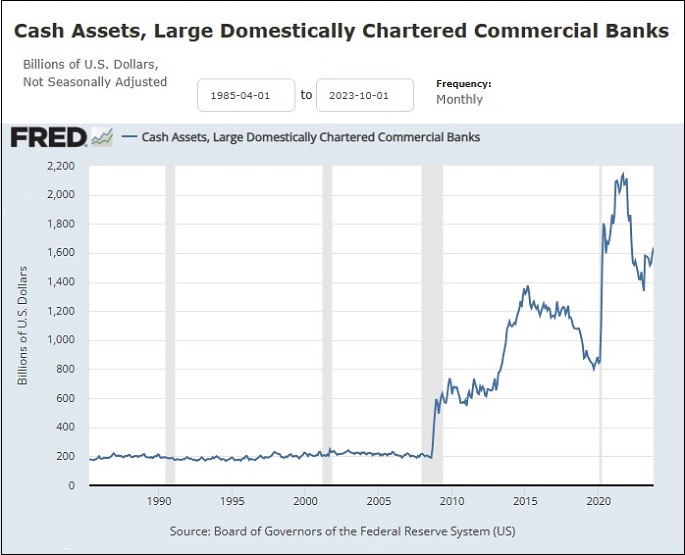

Let’s begin with the very first chart above. This chart illustrates the money possessions held by the 25 biggest U.S. industrial banks. The Fed specifies the term “money possessions” as “vault money, money products in procedure of collection, balances due from depository organizations, and balances due from Federal Reserve Banks.” Notification that from April 1, 1985 to right before the monetary crash of 2008, money levels at the most significant banks were as consistent as a soft breeze on a spring day. However from that point on through today, there have actually been freakish spikes and plunges in money levels. Soft-breeze banking has actually become disorderly typhoon banking, with the Fed pumping in trillions of dollars in emergency situation money and the mega banks careening from one crisis to the next.

How did this occur? A quick walk through U.S. banking history remains in order.

Following the Wall Street crash in 1929, more than 9,000 banks in the United States stopped working over the next 4 years. In simply the one year of 1933, more than 4,000 banks closed their doors completely as an outcome of insolvency.

The 1930s banking crisis capped on March 6, 1933, simply one day after President Franklin D. Roosevelt was inaugurated. Following a month-long work on the banks, Roosevelt stated an across the country banking vacation that closed all banks in the United States. On March 9, 1933 Congress passed the Emergency situation Banking Act which enabled regulators to examine each bank before it was allowed to resume. Countless banks were considered insolvent and completely closed. There was no federal deposit insurance coverage at that time and it is approximated by the Federal Deposit Insurance Coverage Corporation (FDIC) that depositors lost $1.3 billion to stopped working banks because age. That would be around $25.5 billion in today’s dollars.

To bring back the general public’s self-confidence and motivate Americans to position their cost savings in checking account, Roosevelt signed into law on June 16 the Banking Act of 1933, more widely called the Glass-Steagall Act after its authors Senator Carter Glass, a Democrat from Virginia, and Home Associate Henry Steagall, a Democrat from Alabama. The legislation developed federal deposit insurance coverage for checking account for the very first time in the U.S. while prohibiting banks that took part in hypothesizing in stocks or financing them to own federally-insured banks.

This separation of banking was welcomed with broad public approval at the time. Years of Senate Banking Committee hearings following the ’29 crash had actually notified the Congress of that age, along with the general public, that Wall Street’s gambling establishment banks betting with depositors’ cash in wild stock speculations had actually triggered the stock exchange crash and occurring worked on the banks.

The Glass-Steagall Act secured the U.S. banking system for 66 years till its repeal throughout the Costs Clinton presidency in 1999. The incentive for its repeal was the statement in 1998 that Sandy Weill wished to combine his trading companies, Salomon Brothers and Smith Barney (under the Travelers Group umbrella), with Citicorp, moms and dad of the federally-insured Citibank industrial bank. (The editorial board of the New York City Times was a huge cheerleader for letting Weill get his method and for rescinding the Glass-Steagall Act)

Weill had a particular intention for this merger, which developed the Frankenbank, Citigroup– and it wasn’t to advance the country’s interests. Weill informed his merger partner, John Reed of Citibank, that his inspiration for the offer was: “We might be so abundant,” according to Reed in an interview with Costs Moyers

The repeal of the Glass-Steagall Act in 1999 indicated that the casino-style financial investment banks and trading homes throughout Wall Street might now own federally-insured industrial banks and utilize their numerous billions of dollars in insured deposits to hypothesize in stocks and derivatives. Every significant Wall Street trading home either purchased a federally-insured bank or developed one.

What Weill indicated by “We might be so abundant” was this: If the trading bets won huge, the bank CEOs ended up being obscenely abundant on stock-option-based efficiency pay. When the bets lost huge, the federal government would be required to do a bailout instead of enable a giant, adjoined, federally-insured bank to stop working. (You can check out Weill’s Count Dracula stock option/get-rich-quick strategy here)

Simply 9 years after the repeal of Glass-Steagall, Wall Street blew itself up once again and the federal government needed to action in with a huge bailout for the deposit-taking banks that had actually combined with Wall Street’s financial investment banks and brokerage companies. In addition to the federal government bailout, the Federal Reserve, which was expected to be monitoring these mega bank holding business, changed into the secret sugar daddy of the mega banks. Without one vote by the legal branch of federal government, the Fed covertly funneled $ 29 trillion in cumulative loans to bail out the gambling establishment banks, including their trading operations in London.

The Federal Reserve has actually been showing this Stockholm Syndrome with the violent banks it “controls” since. (See our archive of short articles on the Fed’s continuous bank bailouts that started on September 17, 2019, prior to the pandemic, here)

Both Weill and Reed did, undoubtedly, end up being obscenely abundant. (Weill left as a billionaire). Weill’s kids, Citigroup, on the other hand, got the biggest taxpayer bailout in U.S. history in 2008, taking in $45 billion in equity from the U.S. Treasury; a federal government warranty on $300 billion on Citigroup’s suspicious possessions; the Federal Deposit Insurance Coverage Corporation (FDIC) ensured $5.75 billion of its senior unsecured financial obligation and $26 billion of its industrial paper and interbank deposits; and the Federal Reserve covertly funneled $2.5 trillion cumulatively in low-interest loans to systems of Citigroup from December 2007 to a minimum of July 2010 according to a federal government audit of the Fed’s emergency situation bailout programs that was launched in 2011.

The extraordinary nature of the Fed’s bailouts of these gambling establishment banks holding trillions of dollars of insured deposits did not end up being totally understood till 2011 when a media court fight with the Fed won the release of part of the details and a federal government audit of the Fed launched more information. Nor was the main report of the corruption on Wall Street and regulative failures that had actually caused the crisis launched by the Monetary Crisis Query Commission till 2011.

By that time it was far too late. Congress had actually enacted the toothless Dodd-Frank monetary “reform” legislation on July 21, 2010. Rather of bring back the desperately-needed Glass-Steagall Act, the expense played around the edges of reform, with Wall Street’s legions of lobbyists positive that Wall Street might steamroll right through any speed bumps– which it carried out in brief order

So what we have today is a banking system controlled by a handful of mega banks that are “monitored” by the Fed. However rather of really monitoring the banks and avoiding them from producing panic and bank runs, the Fed is too shy to really handle the banks’ legions of attorneys and chooses to just develop never ever ending bailout programs when the banks undoubtedly get themselves into difficulty.

To highlight that truth, listed below is a chart revealing what caused the repo crisis that started on September 17, 2019– months before there was even one revealed case of COVID-19 throughout the world. (The COVID-19 pandemic, which set off another substantial round of the Fed’s emergency situation bailout programs, was stated by the World Health Company on March 11, 2020.)

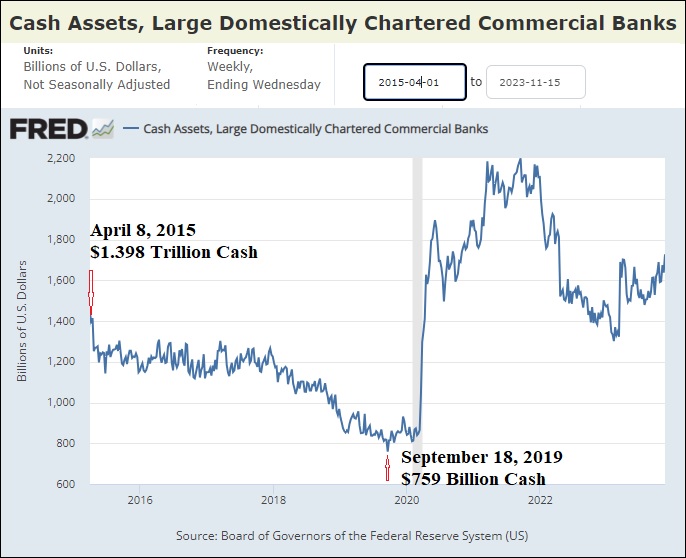

On April 8, 2015, money possessions stood at $1.398 trillion at the 25 biggest U.S. banks. By September 18, 2019, money possessions had actually plunged to $759 billion– a decrease of 45.7 percent while Fed bank inspectors were obviously snoozing.

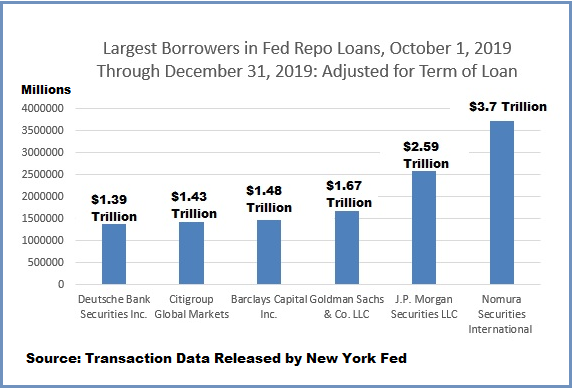

This next chart demonstrates how the Fed reacted to this money crisis in the fall of 2019, making trillions of dollars in revolving repo loans to U.S. and foreign banks.

When the names of the banks that got these trillions of dollars in low-cost loans from the Fed were lastly exposed 2 years later on, there was a total mainstream media news blackout on this seriously crucial details about the U.S. banking system’s inept guidance by the Fed. (Read our report: There’s a News Blackout on the Fed’s Identifying of the Banks that Got Its Emergency Situation Repo Loans; Some Reporters Seem Under Gag Orders)

Any system that is this naturally corrupt will ultimately collapse under the weight of its own corruption. The 2008 monetary collapse was the worst recession in the U.S. given that the Great Anxiety of the 1930s. It took 6 years for tasks to recuperate; more than 10 million Americans fell under hardship; and more than 6 million households lost their homes to foreclosure.

This previous spring the U.S. got another loud caution siren that the U.S. banking system is not being properly monitored. The 2nd, 3rd and 4th biggest banking failures in U.S. history happened in the period of 7 weeks.

How is it possible that Congress and the Senate Banking Committee can’t see that the Federal Reserve has more than capably shown that it is an inept and caught regulator of mega banks and need to be entirely severed from any function in their guidance.