In 2015, a significant style in the worldwide gold market was the record gold purchasing by reserve banks throughout the world, with the World Gold Council and its information collectors (Metals Focus) computing that reserve banks had actually cumulatively bought a net 1136 tonnes of financial gold throughout 2022.

At the beginning of 2023, this led the World Gold Council to forecast that:

” Looking ahead, we see little factor to question that reserve banks will stay favorable towards gold and continue to be net buyers in 2023.”

This undoubtedly has actually shown to be the case, for after Q1 2023 waned, the World Gold Council approximated that in the very first quarter of 2023, the world’s reserve banks had actually once again been net purchasers of gold to the tune of a combined 228 tonnes This is the greatest very first quarter of reserve bank gold purchasing on record.

And the reserve bank leading the pack in this gold build-up has actually been none aside from BullionStar’s neighbour, the Monetary Authority of Singapore (MAS), whose head office are actually a brief 2 kms walk from BullionStar’s store and display room in Singapore’s main downtown

For in the area of 3 months in between January and March 2023, Singapore’s reserve bank has actually silently purchased an unbelievable 68.7 tonnes of gold, making Singapore the world’s leading sovereign gold purchaser for the very first quarter of 2023, even ahead of China.

While the very first tranche of Singapore’s gold purchases in January 2023 was covered in a BullionStar short article from early March entitled “ Singapore’s reserve bank MAS increases gold reserves to almost 200 tonnes“, this, as it ends up, was just the start, for the Monetary Authority of Singapore kept returning, including more gold to its reserves in both February and March 2023.

The Information

In usually discreet style, Singapore’s reserve bank (MAS), does not reveal its gold purchasing through news release or any other technique of promotion. MAS simply updates the information on its site in a regular monthly report called ‘ International Reserves and Foreign Currency Liquidity‘, which is released on the last day of the month and covers the previous month.

Up till completion of December 2022, MAS had actually been reporting overall gold reserves of 153.8 tonnes (4.94 million ozs). At the end of February, it emerged from the report that in January 2023, MAS had actually included a massive 44.6 tonnes of gold to its main reserves, consequently increasing Singapore’s gold holdings from 153.8 tonnes to 198.4 tonnes in simply one month.

When the ‘International Reserves and Foreign Currency Liquidity’ came out at the end of March, it once again revealed that MAS had actually included another 6.79 tonnes of gold in February– consequently improving Singapore’s gold holdings to over 205 tonnes.

Singapore’s reserve bank, MAS, purchased another 6.79 tonnes of gold throughout February, and now holds 205.17 tonnes of gold https://t.co/TbXgsjTesz pic.twitter.com/BUbqD4aQrj

— BullionStar (@BullionStar) April 5, 2023

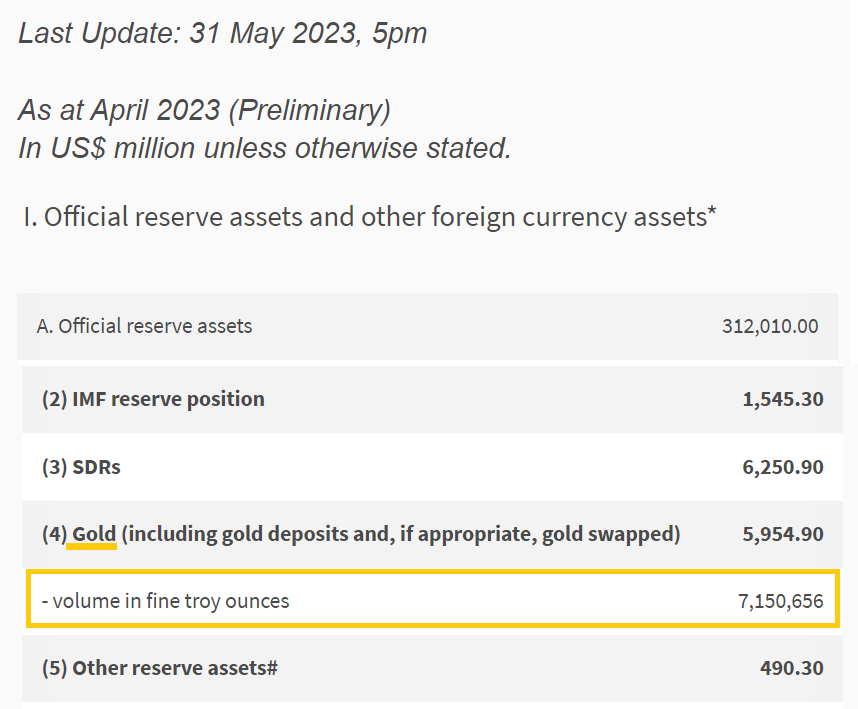

Then when the MAS International Reserves report was released once again at the end of April, it revealed yet another boost of 17.24 tonnes of gold, bringing Singapore’s gold holdings to a massive 222.4 tonnes (7.15 million ozs)

BREAKING– Singapore’s reserve bank (MAS) purchased another 17.24 tonnes of throughout March, bringing its overall gold reserve holdings to 222.4 tonnes. MAS has actually now purchased 68.6 tonnes of gold throughout Q1 2023 https://t.co/TbXgsjTesz

— BullionStar (@BullionStar) April 29, 2023

Singapore’s Gold Reserves– Up 35% in 3 Months

Hence throughout 3 months from January to March inclusive, MAS has actually purchased a shocking 68.7 tonnes of gold, improving its gold reserves by a massive 44.6%. In regards to recognized reserve bank gold purchasers, this gold build-up by MAS is the biggest gold purchase by any reserve bank on the planet throughout the very first quarter of 2023.

Taking a look at the most recent MAS ‘ International Reserves and Foreign Currency Liquidity report released on 31 Might and concealing to the end of April 2023, this reveals that MAS did not purchase any gold throughout April, as the overall gold holding is still noted as being 7,150,656 troy ounces, similar to the end of March.

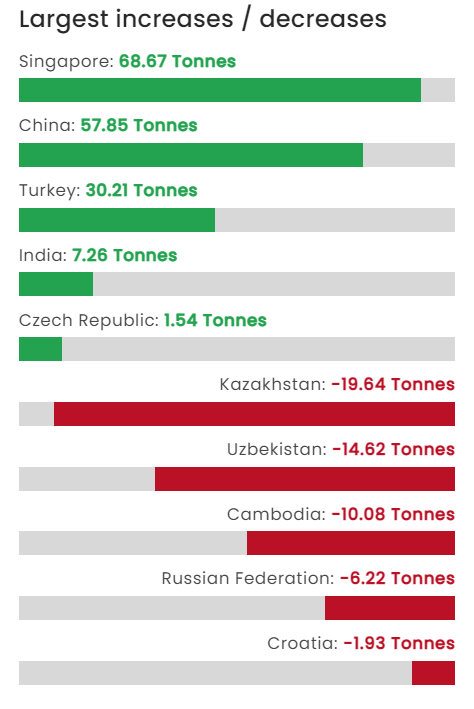

So the 3 month gold purchasing spree by Singapore’s reserve bank has actually pertained to an end– in the meantime a minimum of. Nevertheless, its a world record for Q1 2023. It even goes beyond the revealed gold purchases by China for Q1 2023, which pertained to a collected 57.85 tonnes, and that makes China the 2nd biggest reserve bank gold purchaser in Q1 2023. In 3rd location is Turkey, which included 30.2 tonnes of gold in Q1. In 4th location is India with a ‘simple’ 7.2 tonnes purchased in Q1.

In a comparable vein to 2022 where a bulk of reserve bank gold purchasing was explained by the World Gold Council as ‘unreported purchasing’ (due to the fact that the purchases were not openly revealed by the purchasers however are obviously understood by Metals Focus to have actually taken place), the Q1 2023 gold purchasing information from the World Gold Council declares that reserve banks made ‘net purchases’ of a cumulative 228 tonnes of gold, nevertheless the World Gold Council information on ‘reported’ reserve bank gold purchasers and sellers in Q1 2023 amounts to 125 tonnes.

This leaves a web 103 tonnes of gold purchasing by reserve banks in Q1 that we do not understand who the purchasers are as they wish to stay confidential. This nevertheless, still leaves Singapore as the biggest ‘understood’ reserve bank gold purchaser of the very first quarter of 2023.

Singapore’s gold purchasing spree concerns an end– in the meantime.

Although Singapore’s reserve bank didn’t contribute to its gold reserves throughout April, it still has the difference of being the world’s greatest reserve bank gold purchaser in Q1 2023, including 68.7 tonnes. https://t.co/TbXgsjTesz pic.twitter.com/8rXqefz3sW

— BullionStar (@BullionStar) June 2, 2023

In addition to Q1 2023, you might remember that Singapore’s reserve bank likewise purchased considerable quantities of gold in the 2 month duration from Might to June 2021– particularly 26.35 tonnes of gold (16.4 tonnes in Might 2021 and 9.95 tonnes in June 2021). See the BullionStar short article here for information.

Those purchases took Singapore’s gold holdings from 127.42 tonnes to 153.76 tonnes. So if you take all of these gold purchases together from Might 2021 approximately March 2023, Singapore’s reserve bank has in fact included a huge 95 tonnes of gold in less than 2 years, and while doing so increased Singapore’s sovereign gold holdings by a big 75% from 127.42 to 222.4 tonnes.

Keep in mind that the country state of Singapore (though the precursor of its reserve bank) purchased the very first 100 tonnes of its financial gold in one deal in 1968. That gold was bought from the South African federal government and provided in Switzerland.

That gold holding stayed continuous at 100 tonnes till it was at some remote point in the past increased to 127.4 tonnes, most likely due in part to gold redistributions that the IMF made to member nations over the duration 1977-1979. Singapore’s gold circulations from the IMF were most likely provided at the Bank of England, as Singapore was formerly in the Sterling Location currency bloc, and would have had a gold account at the Bank of England.

Which brings us to the possible areas of Singapore’s gold, and the unexpected secrecy and stonewalling which MAS has actually when inquired about the areas of Singapore’s gold reserves.

Places of Singapore’s Gold– MAS Secrecy

Considered that Singapore holds the 24th biggest sovereign gold reserves on the planet with 222.4 tonnes, the reasons that MAS holds gold, and the areas of Singapore’s gold may be of interest to the public, particularly in Singapore.

Nevertheless, for anybody desiring absolutely responses on this, and even any responses at all, you will be sorely dissatisfied.

As far back as September 2015, I asked Singapore’s reserve bank (by e-mail) regarding where Singapore’s gold was saved.

Concern– “ Could you verify if the MAS gold is saved locally, or saved abroad, and if saved abroad, could you clarify where it is saved, for instance at the Bank of England, at the Federal Reserve Bank of New york city, and so on?”

MAS Response– “ We are sorry for that we are not able to show you where we keep the gold as the info is private.” — Business Communications Officer

In February 2018 I asked MAS (by e-mail) why it holds gold as a reserve property. This is a completely sensible concern, and one which numerous reserve banks describe in information on their sites and in discussions. However not MAS.

Concern– “ For the Monetary Authority of Singapore particularly, would you have the ability to clarify the primary reasons that MAS continues to hold gold as a reserve property?“

MAS Response— “As a matter of policy, we do not talk about our reserve structure. Hope you can comprehend” — Business Communications Officer

No I do not comprehend. It’s a completely sensible concern, and not addressing it is entirely untransparent. Contrast this with the reserve banks of Poland and Hungary who composed whole posts discussing why they included gold. See here for Poland, and here for Hungary

Then a couple of weeks back, offered Singapore’s big current gold purchases over Q1 2023, I once again asked MAS a series of concerns (by e-mail) about Singapore’s gold and its areas, believing that perhaps MAS was more transparent compared to 2015 and 2018.

Q 1. The Monetary Authority of Singapore (MAS) bought around 68.7 tonnes of gold over January, February and March 2003. This remains in addition to the 26 tonnes of gold which MAS purchased throughout May and June 2021.

In general, in less than 2 years, MAS has actually purchased 95 tonnes of gold, and increased Singapore’s financial gold holdings by 75% from 127.4 tonnes to 222.4 tonnes.

Why has MAS been purchasing more gold for the Authorities Reserves, particularly the purchases in 2023?

Q 2. Does MAS have prepares to purchase extra financial gold throughout the rest of 2023?

Q 3. Where is Singapore’s 222.4 tonnes of gold saved? Do you have a portion breakdown of just how much is saved in Singapore and just how much is saved abroad? And with which foreign custodians is Singapore’s gold saved, for instance, the Bank of England, the Bank for International Settlements (BIS), Swiss National Bank (SNB), and New York City Federal Reserve (NYFED)?

Q 4. For several years because 1968, Singapore held 100 tonnes of gold. At some time this increased to 127.4 tonnes of gold, however because the early 2000s, MAS has actually held 127.4 tonnes of gold (or 4,096,439 great troy ounces).

In which year (or years) did Singapore’s gold holdings increase from 100 tonnes to 127.4 tonnes? Due to the fact that the info on this is uncertain.

When MAS addressed my e-mail, they didn’t address any of the concerns straight at all, and just responded to Q1 and Q2 with an obtruse brief and basic declaration. MAS didn’t address concern Q3 about place at all, and didn’t address Q4– which keep in mind was simply a concern inquiring about a historic holdings modification and date method back in the past.

MAS Response– ” The modifications in MAS’ gold holdings, in addition to any more strategies, are taken as part of our continuous efforts to improve the strength of the Authorities Foreign Reserves (OFR) portfolio such that it stays well-diversified through financial and market conditions.

The modification in MAS’ gold holdings does not make up a big portion of the general MAS portfolio.”– MAS’ representative

This generic response was the very same design template that was provided to the StraitsTimes and AsianInvestor when they asked MAS about why it had actually purchased gold throughout Q1 2023. See here and here

Western Reserve banks less Deceptive

When I asked even more regarding why MAS had not responded to any of my concerns, the MAS Representative responded:

“ We have no extra info to include“.

Why is info about the reasoning that a reserve bank holds gold private, when almost all other significant reserve banks describe in information why they hold gold– as a shop of worth, inflation hedge, portfolio diversifier, safe house and so on?

Why is info about the place of a country’s gold reserves private, when almost all other Western reserve banks (see listed below) state precisely where there gold reserves are held?

Doing a fast run through the leading 10 nations (and tghe IMF) with the biggest gold reserves, almost all of these nations’ reserve banks reveal where their soverign financial gold is held:

The United States reveals its gold storage areas– In United States Mint vault centers in Fort Knox, West Point and Denver.

Germany reveals its gold storage vault areas– At the Bundesbank in Frankfurt, at the NYFED in New York City, and at the Bank of England in London.

The 4 IMF gold despoitories (where IMF gold is held) are the NY Fed in New York City, the Bank of England in London, the Banque de France in Paris, and the RBI in Nagpur India.

Italy reveals its gold storage vault areas– The Banca d’Italia in Rome, the NY Fed in New York City, the Bank of England in London, and the Swiss National Bank in Berne.

France reveals its gold storage vault areas– 90% of the French gold remains in the Banque de France in Paris; the rest (abroad) is most likely in the Bank of England in London.

Russian Federation reveals its gold storage vault areas– Moscow and St Petersburg.

China does not reveals its gold storage vault areas (however the PBoC state that the areas remain in China)

Switzerland reveals its gold storage vault areas– 70% of the Swiss gold remains in Berne Switzerland, 20% at the Bank of England, 10% at the Bank of Canada in Ottawa

Japan does now reveals its gold storage vault areas

India reveals its gold storage vault areas– The Indian gold is saved at the RBI in Nagpur, and likewise Bank of England and the BIS

Netherlands reveals its gold storage vault areas– in the Netherlands (Zeist), and likewise at the NY Fed in New York City, at the Bank of England in London and at the Bank of Canada in Ottawa.

So within this Leading 10 (plus the IMF), just China and Japan do not reveal where their sovereign gold holding are held. Every other nation (and all Western countries along with Russia and India) exposes where its gold is saved. This highlights the secrecy of Singapore’s reserve bank as being entirely unneccessary and out of touch with the thinking about leading reserve bank gold holders. Possibly in time MAS will reevaluate.

In the meantime, Singapore stays as the leading reserve bank gold purchaser of Q1 2023. Which reserve banks will be the leading gold purchasers throughout the staying quarters of 2023. Just time will inform, however enjoy this area.