viking75/iStock by means of Getty Pictures

Welcome to the Might 2023 cobalt miners information.

The previous month noticed persevered low cobalt costs, however some optimism against the mid to long-term outlook. It used to be additionally reported that Germany plans to devote $2.2 billion to protected provide of essential commodities.

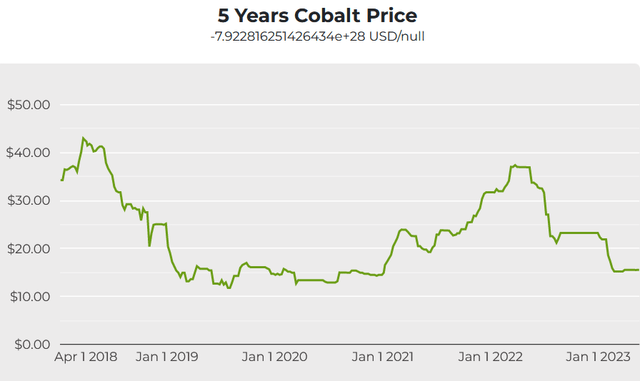

Cobalt value information

As of Might 24, the cobalt spot value used to be at US$15.53/lb, flat from US$15.54/lb ultimate month. The LME cobalt value is US$33,985/tonne. LME Cobalt stock is 96 tonnes, down from the 109 degree from ultimate month. Extra main points on cobalt pricing (particularly the extra related cobalt sulphate), will also be discovered right here at Benchmark Mineral Intelligence or Speedy Markets MB.

Cobalt spot costs – 5-year chart – USD 15.53 (supply)

Cobalt call for vs. provide forecasts

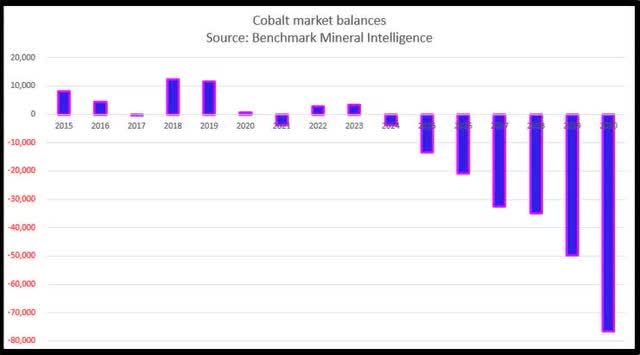

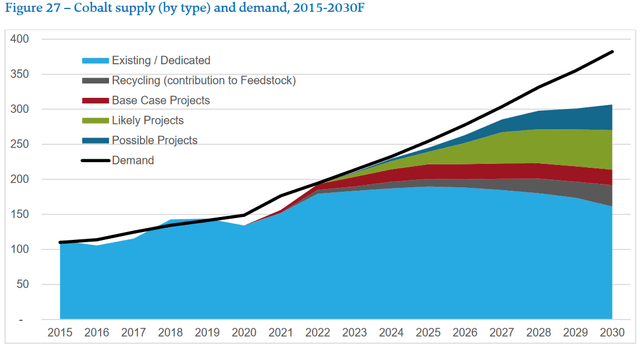

Cobalt provide and insist forecast – Deficits rising from ~2025 (as of April 2022) via Cobalt Blue and Picket Mackenzie (supply)

Cobalt Blue and Picket Mackenzie

BMI 2022 forecast for cobalt – Deficits construction ranging from 2024

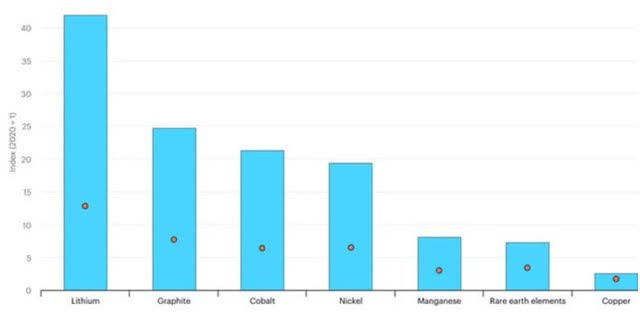

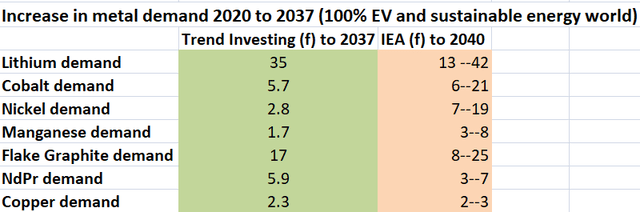

Pattern Making an investment vs. IEA call for forecast for EV metals (Pattern Making an investment) (IEA)

Pattern Making an investment and the IEA

2021 IEA forecast expansion in call for for decided on minerals from blank power applied sciences via state of affairs, 2040 relative to 2020 – Will increase Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Uncommon Earths 3x to 7x, And Copper 2x to 3x

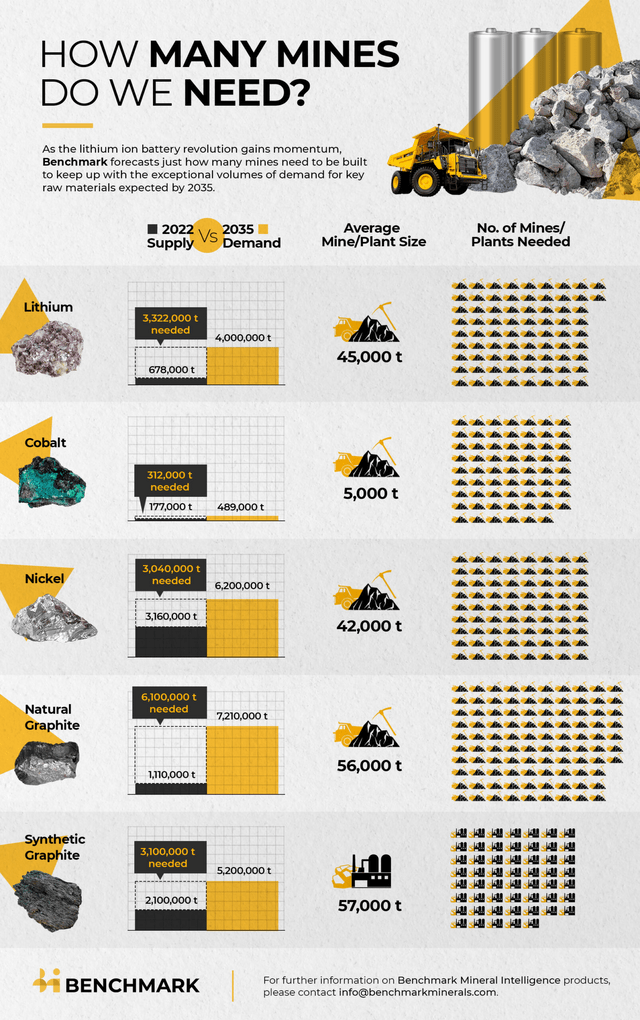

2022 – BMI forecasts we’d like 330+ new EV steel mines from 2022 to 2035 to fulfill surging call for – 62 new 5,000tpa cobalt mines (drops to 38 if come with recycling).

Cobalt marketplace information

On April 26 Kitco reported:

Germany to devote $2.2 billion to protected provide of essential commodities – file… The function is to extend get right of entry to and depend much less on China. The uncooked fabrics Germany could be curious about securing come with copper, cobalt, lithium, silicon, and uncommon earths. Germany is growing “a uncooked fabrics fund to beef up uncooked fabrics initiatives at house and in another country…”

On Might 3 Reuters reported:

US Senator Rubio seeks probe of Ford’s Chinese language partnership on nickel plant. U.S. Senator Marcio Rubio on Wednesday requested the Biden management to research Ford Motor Co’s (F.N) plan to spouse with PT Vale Indonesia (INCO.JK) and China’s Zhejiang Huayou Cobalt in a $4.5 billion nickel processing plant in Indonesia. Rubio…stated the enterprise threatens U.S. nationwide safety and requested the Justice, State, Treasury, Trade, Fatherland Safety departments in addition to the Securities and Trade Fee to research the plan.

On Might 11 Making an investment Information reported:

Cobalt to stay key EV uncooked subject matter regardless of substitution danger. The Cobalt Institute’s 2022 marketplace file presentations that cobalt will proceed to play a key function within the power transition, with call for doubling via 2030… Ultimate 12 months, call for for cobalt noticed a slight build up in comparison to 2021, emerging via 21,000 tonnes to 187,000 tonnes… Cobalt provide reached just about 198,000 tonnes in 2022, up 21 p.c year-on-year… All in all, the outlook for cobalt stays robust, with call for anticipated to double via 2030… “Regardless of the emerging proportion of lithium-iron-phosphate, cobalt-containing cathode chemistries (nickel-cobalt-manganese, nickel-cobalt-aluminum and lithium-cobalt-oxide) will stay as the most popular era selection for battery programs – accounting for 59 p.c of general cathode call for in 2030,” the file states… Provide may be anticipated to extend considerably via 2030, leaping from greater than 200,000 tonnes this 12 months to about 318,000 tonnes.

On Might 22 Fastmarkets reported:

Key takeaways from Cobalt Congress 2023… Oversupply and vulnerable call for around the provide chain has burdened the cobalt steel value during the last twelve months… Fastmarkets’ analysis analysts forecast cobalt will achieve an oversupply of four,000 tonnes in 2023, with the excess expanding to fourteen,000 tonnes in 2024… Nickel cobalt manganese oxide (NCM) seems to be to stay a well-liked battery chemistry outdoor of China amid the rising marketplace proportion of lithium iron phosphate (LFP) batteries, in line with analysts on the convention… Funding wanted in cobalt refining capability… America has but to have an operational cobalt refinery, despite the fact that initiatives have been scheduled to be up and operating within the subsequent couple of years. The EU used to be additional ahead in that regard, with the EU and Turkey accounting for 9% of worldwide refining capability… “In the beginning within the cobalt marketplace, the bottleneck is refining”… Marketplace individuals be expecting funding to be incentivized via grants made to be had from the USA by means of the Inflation Aid Act (IRA).

Cobalt corporate information

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On Might 9 Glencore introduced: “Glencore and Li-Cycle announce joint learn about to broaden a Eu recycling hub, repurposing an present Glencore metallurgical facility to be the most important supply of recycled battery grade lithium in addition to recycled nickel and cobalt in Europe.” Highlights come with:

- “…..”Anticipated new Hub processing capability of fifty,000 to 70,000 tonnes of black mass enter in line with 12 months.

- Definitive Feasibility Learn about to start in mid-2023 and can leverage Li-Cycle’s main era and lengthen first-mover merit to Europe….”

On Might 22 Glencore introduced: “Glencore publishes 2022 Sustainability Record.”

CMOC Workforce Restricted [HKSE:3993] [SHE:603993] (OTCPK:CMCLF) (previously China Molybdenum)

On April 28 Marketplace Screener reported:

CMOC Workforce Restricted experiences income effects for the primary quarter ended March 31, 2023. CMOC Workforce Restricted reported income effects for the primary quarter ended March 31, 2023. For the primary quarter, the corporate reported gross sales used to be CNY 44,283.52 million in comparison to CNY 44,524.84 million a 12 months in the past. Income used to be CNY 44,283.52 million in comparison to CNY 44,524.84 million a 12 months in the past. Internet source of revenue used to be CNY 317.12 million in comparison to CNY 1,792.06 million a 12 months in the past. Elementary income in line with proportion from proceeding operations used to be CNY 0.015 in comparison to CNY 0.084 a 12 months in the past. Diluted income in line with proportion from proceeding operations used to be CNY 0.015 in comparison to CNY 0.083 a 12 months in the past.

On April 28 Marketplace Screener reported: “CMOC Workforce’s January to March benefit falls 82.3%…”

Zheijiang Huayou Cobalt [SHA:603799]

On April 27 Marketplace Screener reported:

Zhejiang Huayou Cobalt Co., Ltd experiences income effects for the primary quarter ended March 31, 2023. Zhejiang Huayou Cobalt Co., Ltd reported income effects for the primary quarter ended March 31, 2023. For the primary quarter, the corporate reported gross sales used to be CNY 19,110.27 million in comparison to CNY 13,211.98 million a 12 months in the past. Income used to be CNY 19,110.27 million in comparison to CNY 13,211.98 million a 12 months in the past. Internet source of revenue used to be CNY 1,024.1 million in comparison to CNY 1,206.31 million a 12 months in the past. Elementary income in line with proportion from proceeding operations used to be CNY 0.64 in comparison to CNY 0.76 a 12 months in the past. Diluted income in line with proportion from proceeding operations used to be CNY 0.64 in comparison to CNY 0.76 a 12 months in the past.

On Might 4 Marketplace Screener reported: “Huayou Cobalt in talks to shape Battery Fabrics Undertaking with South Korea’s POSCO Long term…

Jinchuan Workforce Global Assets [HK:2362]

No information for the month.

Chemaf (subsidiary of Shalina Assets)

No information for the month.

GEM Co Ltd [SHE:002340]

On April 29 GEM Co Ltd introduced: “GEM declares effects for the primary quarter of 2023.” Highlights come with:

- “The Corporate accomplished an running income of RMB 6.129 billion, representing a lower of 12.03% year-on-year. The primary explanation why is that the gross sales quantity of precursors diminished because of the destocking of China’s NEV trade chain and the decline in marketplace call for for 3C digital client merchandise.

- The Corporate accomplished a internet benefit because of shareholder of the indexed corporate of RMB 17.245 million, with a year-on-year lower of 48.01%, principally suffering from the decline in running source of revenue all through the reporting length.

- Energy battery recycling has develop into a brand new expansion level for the Corporate. Within the first quarter of 2023, the corporate recycled 0.66GWh of energy batteries, a year-on-year build up of 65%, accomplished gross sales income of RMB 194 million, a year-on-year build up of 149%, and internet benefit larger via 335% year-on-year. We plan to recycle 35,000 lots of energy batteries in 2023 and succeed in gross sales income of greater than RMB 2 billion.”

Buyers can learn extra about GEM Co within the Pattern Making an investment article: “A Glance At GEM Co Ltd – The International’s Greatest Battery Recycling Corporate.”

Eurasian Assets Workforce (“ERG”) – personal

ERG personal the Metalkol facility within the DRC the place ERG processes cobalt and copper tailings with a capability of as much as 24,000 tonnes of cobalt pa.

No information for the month.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On April 27 Umicore SA introduced:

Umicore replace on buying and selling prerequisites and outlook… Mathias Miedreich, CEO of Umicore commented: “Umicore posted a cast get started of the 12 months regardless of a difficult marketplace surroundings. We stay a pointy focal point at the execution of our 2030 RISE technique and our efforts have already resulted in more evidence issues such because the affirmation of our era management in Car Catalysts and the ongoing ramp-up of top nickel CAM volumes in Rechargeable Battery Fabrics…

Sumitomo Steel Mining Co. (TYO:5713) (OTCPK:STMNF)

On Might 10 Sumitomo Steel Mining Co. introduced:

FY2023 Capital Expenditure and Overall Funding Plans… Sumitomo Steel Mining Co., Ltd. (SMM) plans a complete 198.0 billion yen of capital expenditures on a consolidated foundation all through the fiscal 12 months 2023 (April 1, 2023 – March 31, 2024). The entire funding represents a 41% build up from that of FY2022.

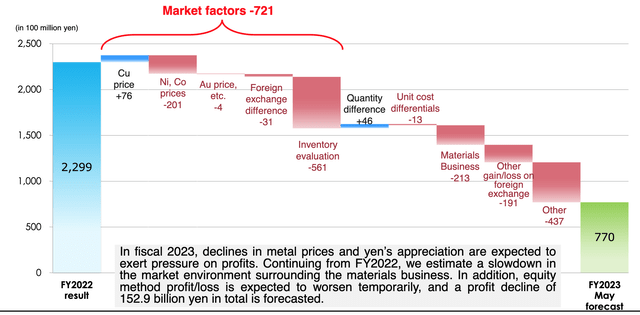

On Might 10 Sumitomo Steel Mining Co. introduced: “Consolidated monetary effects for the 12 months ended March 31, 2023…”

On Might 17 Sumitomo Steel Mining Co. introduced: “FY2022 Development of Industry Technique.”

Benefit earlier than Tax Research: FY2023 Forecast vs. FY2022 Effects (supply)

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTC:NILSY)

No vital information for the month.

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

On April 28 OZ Minerals introduced: “First quarter file 2023 for the 3 months finishing March 2023.”

On Might 2 OZ Minerals introduced:

Implementation of Scheme. OZ Minerals is happy to advise that the scheme of association pursuant to which it used to be proposed that BHP Lonsdale Investments Pty Ltd (“BHP”), an entirely owned subsidiary of BHP Workforce Restricted (ASX:BHP), would achieve 100% of the stocks in OZ Minerals (“Scheme”) has as of late been applied. OZ Minerals Shareholders (“OZ Minerals Shareholders”) will as of late be paid: $1.75 for each and every OZ Minerals proportion they held at the Particular Dividend Document Date (being 7.00pm (Melbourne time) on Friday, 21 April 2023); and $26.50 for each and every OZ Minerals proportion they held at the Scheme Document Date (being 7.00pm (Melbourne time) on Monday, 24 April 2023).

Sherritt Global [TSX:S] (OTCPK:SHERF)

On Might 10 Sherritt Global introduced: “Sherritt experiences Q1 effects and a hit implementation of the cobalt change.” Highlights come with:

Decided on Q1 2023 Trends

- “Internet income from proceeding operations used to be $13.6 million, or $0.03 in line with proportion in Q1 2023, in comparison to internet income from proceeding operation of $16.4 million, or $0.04 in line with proportion, in Q1 2022…

- In response to the Cobalt Switch: The Moa JV disbursed 1,280 tonnes (100% foundation) of the two,082 annual most quantity (61%) of completed cobalt…

- Filed a Nationwide Software 43-101 technical file for the Moa JV which signifies that present reserves estimates are enough to increase the lifetime of mine to 2048 with an after-tax NPV (8%) of US$1.5 billion (100% foundation) within the selection case in accordance with fresh analyst nickel, cobalt and enter commodity value forecasts.

- Sherritt’s proportion of completed nickel and cobalt manufacturing on the Moa Joint Challenge (Moa JV) used to be 3,483 tonnes and 367 tonnes, 10% and 18% decrease, respectively, than the prior 12 months quarter.

- Internet direct coins price (NDCC)(1) used to be US$6.46/lb in Q1 2023 in comparison to US$3.42/lb in Q1 2022 basically because of materially decrease discovered cobalt costs, hanging Sherritt in the second one price quartile for HPAL nickel manufacturers.

- Energy manufacturing larger 15% to 158 GWh in comparison to Q1 2022 on account of further fuel provide…”

Nickel 28 [TSXV:NKL] [GR:3JC] (OTCPK:CONXF)

On Might 3 Nickel 28 introduced: “Nickel 28 releases Ramu Q1 2023 running efficiency and gives replace on Shareholder Engagement.” Highlights come with:

- “Nickel 28 confirms receipt of biggest ever coins distribution from Ramu three way partnership of US$9.7 million.

- Concurrent with coins distribution, Nickel 28’s Ramu development debt diminished via US$18.1 million leaving a stability of roughly US$55.8 million as of January 2, 2023.

- Nickel 28 supplies replace on shareholder engagement efforts.”

On Might 9 Nickel 28 introduced:

Nickel 28 rejects Pelham’s newest 0 top class take-over try. Pelham’s purported “agreement be offering” would depart Nickel 28 with out necessary experience or a reputable plan to force shareholder worth. Nickel 28’s Board and control group has situated the Corporate to develop into a number one coins producing battery metals funding car…

On Might 17 Nickel 28 introduced: “Nickel 28 declares fiscal 2023 monetary effects.” Highlights come with:

The Corporate’s fundamental asset, an 8.56% joint-venture hobby within the Ramu Nickel-Cobalt (“Ramu”) built-in operation in Papua New Guinea, had some other remarkable 12 months in the case of manufacturing, gross sales and coins go with the flow. Highlights from Ramu and the Corporate all through the 12 months come with:

- “Complete 12 months debt reimbursement of US$21.3 million, with a final development debt stability of US$55.8 million as at January thirty first, 2023.

- Manufacturing of 34,302 tonnes of contained nickel and a pair of,987 tonnes of contained cobalt in blended hydroxide precipitate (MHP) hanging Ramu as one of the most most sensible manufacturers of MHP globally.

- Overall Ramu undertaking income of over US$820 million.

- Moderate coins prices for the 12 months, internet of derivative gross sales, of US$3.37/lb. of contained nickel.

- Overall internet and complete source of revenue of US$6.1 million or US$0.07 in line with proportion.”

Buyers can view the corporate displays right here.

Electra Battery Fabrics [TSXV:ELBM] (ELBM)

On Might 2 Electra Battery Fabrics introduced: “Electra and First Country-Owned 3 Fires Workforce signal MOU to recycle lithium-ion battery waste in Ontario…”

On Might 10 Electra Battery Fabrics introduced: “Electra experiences Q1 2023 effects and gives replace on Cobalt Refinery Undertaking and Black Mass Recycling Trial.” Highlights come with:

Electra Q1 2023 Highlights and Trends

- “Internet loss for the length used to be $21.8 million or $0.61 in line with proportion. Integrated within the internet loss used to be the have an effect on of a debt providing transaction finished within the length involving a non-cash agreement of 2026 Notes in trade for 2028 Notes at a lack of $19.9 million. Effects for Q1 2023 examine to internet source of revenue of $2.3 million or $0.08 in line with proportion for Q1 2022, which used to be pushed via a acquire of $4 million at the honest worth of the embedded by-product legal responsibility portion of Electra’s convertible debt.

- Held coins and marketable securities of $12.9 million as at March 31, 2023, up from $8.4 million as at December 31, 2022. Electra’s coins stability on the finish of Q1 2023 does no longer come with the rest $5.1 million of presidency investments anticipated to be won.

- Effectively finished the primary plant-scale recycling of black mass subject matter in North The usa and showed the restoration of essential metals, together with lithium, nickel, cobalt, copper, manganese, and graphite, wanted for the EV battery provide chain the use of Electra’s proprietary hydrometallurgical procedure.

- Disposed of non-core exploration belongings within the Canadian Cobalt Camp to Kuya Silver Company for two.7 million stocks of Kuya valued at $1 million. Electra retained a two p.c royalty on internet smelter returns from all industrial manufacturing derived from the belongings.

- Closed a personal placement providing for the issuance of US$51 million fundamental quantity of 8.99% senior secured convertible notes (“Be aware Providing”) due February 2028…

- Issued its inaugural Sustainability Record and dedicated to net-zero greenhouse emissions via 2050.

- Launched an up to date mineral assets estimate (“MRE”) for the Iron Creek Cobalt-Copper undertaking situated in Idaho…”

On Might 11 Electra Battery Fabrics introduced:

Electra supplies replace on Refinery Undertaking and Black Mass Economics; Launches Strategic Evaluation Procedure… Up to now, Electra has produced high quality nickel-cobalt blended hydroxide, graphite, and lithium carbonate merchandise in its black mass recycling trial. The Corporate expects to start industrial shipments of product to consumers in Q2 2023. Electra finished an desktop scoping learn about to guage the possible economics of growing a standalone black mass procedure plant inside of its refinery advanced able to processing 2,500 tonnes of black mass subject matter in line with annum. The Section 1 facility might be scaled through the years as the marketplace for battery recycling expands. Highlights from Electra’s desktop scoping learn about come with: Capital spend is estimated at roughly US$6 million. The inner price of go back is estimated at 127%. EBITDA is estimated to be within the vary of US$9.6 to US$12.6 million in line with 12 months starting within the first complete 12 months of operations. The payback length is estimated at between 1 and a pair of years.

Upcoming catalysts come with:

- H1 2023 – Goal to have their Ontario cobalt refinery operational with ore feed from Glencore.

Buyers can view the corporate displays right here and a contemporary Pattern Making an investment article on Electra right here.

Conceivable mid-term manufacturers (2024 onwards)

Jervois World Restricted [ASX:JRV] [TSXV: JRV] (OTCQX:JRVMF) [FRA: IHS] (previously Jervois Mining)

On April 24 Jervois World Restricted introduced: “U.S. Export-Import Financial institution confirms ICO’s eligibility for home financing tasks.”

On April 24 Jervois World Restricted introduced: “Jervois submits an ATVM mortgage utility to the U.S. Division of Power… “

On April 27 Jervois World Restricted introduced: Jervois World quarterly actions report back to 31 March 2023.” Highlights come with:

Jervois Finland:

- “Certain coins go with the flow from operations of US$1.3 million as a result of trade stabilization and dealing capital enhancements.

- Q1 2023 cobalt gross sales of one,558 metric tonnes, representing a +15% build up in comparison to prior quarter; income US$58 million.

- Q1 used to be ultimate quarter the place top priced 2022 uncooked subject matter purchases impacted monetary effects; Kokkola refinery growth Bankable Feasibility Learn about pivoted to the U.S.”

Idaho Cobalt Operations (“ICO”), United States (“U.S.”):

- “Ultimate development and commissioning suspended because of cobalt marketplace prerequisites and U.S. inflationary affects; restart to happen with upper cobalt costs.

- In-fill and growth drill holes all intersected RAM’s major mineralized horizon.

- Up to date Mineral Useful resource Estimate for RAM deposit provides alternative to increase ICO mine existence.

- U.S. Executive (Division of Protection) grant for drilling and to evaluate development of a U.S. cobalt refinery.”

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil:

- “Preliminary provide contract secured from Gordes plant in Turkey (advertised via Traxys Europe SA); as much as 25% SMP nickel capability for 3 years.

- Refinery restart tempo moderated pending financing.”

Company:

- “Mercuria larger its shareholding to eight.8%.

- Jervois ends March 2023 quarter with US$50 million in coins, US$66 million bodily cobalt inventories in Jervois Finland, and general drawn debt of US$170 million.”

Upcoming catalysts come with:

- Any bulletins referring to Jervois World’s ATVM mortgage utility to the U.S. Division of Power

- Restart of ultimate development at ICO. Information in regards to the refinancing of the restart of the São Miguel Paulista Refinery.

First light Power Metals Restricted [ASX:SRL](OTCQX:SREMF)(previously Blank TeQ)

First light Power Metals has 132kt contained cobalt at their First light undertaking.

On April 28 First light Power Metals Restricted introduced: “Quarterly actions file.” Highlights come with:

- “The Corporate continues to growth discussions with possible fairness investment and offtake companions for the First light Battery Fabrics Complicated (First light Undertaking). Ongoing paintings streams to advance the absolutely built-in First light Undertaking persevered…

- Box exploration actions persevered to advance all through the quarter with a focal point on increasing our figuring out of the geological possible of our massive tenement package deal within the Macquarie Arc, New South Wales (NSW)…Graduation of making plans for FY24 exploration actions.”

Upcoming catalysts come with:

- 2023 – Conceivable off-take agreements and undertaking investment/partnering.

Buyers too can learn the most recent corporate presentation right here.

Ardea Assets [ASX:ARL] (OTCPK:ARRRF)

In general, Ardea has 5.9mt of contained nickel and 380kt of contained cobalt at their KNP Undertaking close to Kalgoorlie in Western Australia. Ardea may be exploring for gold and nickel sulphide on their >5,100 km2 of 100% managed tenements within the Jap Goldfields area of Western Australia.

On April 27 Ardea Assets introduced:

Quarterly operations file for the quarter ended 31 March 2023. $14.5M cash-at-bank, supportive proportion check in in the hunt for construction of the Kalgoorlie Nickel Undertaking (KNP)…

Upcoming catalysts come with:

- 2023 – Conceivable off-take spouse and investment for the GNCP Undertaking. Additional possible exploration effects together with additionally for lithium, uncommon earths, and nickel sulphide.

Buyers can learn the most recent corporate presentation right here.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

Cobalt Blue has 81.1kt of contained cobalt at their 100% owned Damaged Hill Cobalt Undertaking [BHCP] (previously Thackaringa Cobalt Undertaking) in NSW, Australia. LG Global is an fairness strategic spouse.

On April 27 Cobalt Blue Holdings introduced:

March 2023 quarterly actions file… COB’s actions basically relate to the exploration and analysis of the BHCP. There have been no actions associated with manufacturing or construction. Throughout the quarter, COB incurred1 $6.7m on exploration and analysis actions, basically on the subject of technical products and services, together with drilling techniques, demonstration plant operations and different Definitive Feasibility Learn about works.

Upcoming catalysts come with:

- 2023/24 – Conceivable off-take agreements. Feasibility Learn about & undertaking approvals. Ultimate Funding resolution. Doable undertaking investment.

Buyers can watch a CEO interview right here and a contemporary presentation right here.

Australian Mines [ASX:AUZ] (OTCPK:AMSLF)

On April 27 Australian Mines introduced: “Quarterly actions file for length ended 31 March 2023.” Highlights come with:

- “Sconi Undertaking Research – Following the technical and monetary overview of the trade and the trade in strategic route to advance the Sconi undertaking as a Nickel and Cobalt Sulphate Undertaking, Australian Mines has been advancing this technique alongside a lot of fronts. Australian Mines submitted an Have an effect on Evaluate Observation with the Division of Surroundings and Sciences (DES) as a voluntary EIS with the applying being authorized. Floor sampling exploration works proceed on-site to spot further useful resource growth possible for additional exploration drilling techniques. Environmental seasonal tracking and floor and flooring water tracking has commenced. Discussions with the Division of Assets are advancing in regards to the granting of mining rent for the Greenvale MLA10368, which enhances the granted Mining Rentals at Lucknow (ML 10366) and Kokomo (ML 10342). The Corporate stays dedicated to helping our present offtake spouse LG Power Resolution (“LGES”) to fulfill its long term cobalt and nickel necessities. Discussions are proceeding in regards to the required amendments to the Offtake Settlement. We also are in the hunt for companions to fund the undertaking to Ultimate Funding Determination. The Corporate will replace the marketplace sooner or later with admire to such amendments and collaboration on finalization…

- Advancing Cast State Hydrogen Garage Steel Hydride undertaking – Following sure growth made at the Analysis and Building program focused on onboard Cast-State Hydrogen Garage answers for light-duty automobiles, the Corporate is progressing with a program of highbrow belongings coverage.”

Buyers can learn the most recent corporate presentation right here.

Upcoming catalysts come with:

- Finish of 2025 – FID for the Sconi Undertaking.

Havilah Assets [ASX:HAV] [GR:FWL]

Havilah 100% personal the Mutooroo copper-cobalt undertaking about 60km west of Damaged Hill in South Australia. In addition they have the within reach Kalkaroo copper-gold-cobalt undertaking (optioned to Oz. Minerals), in addition to a probably massive iron ore undertaking at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit accommodates JORC Mineral Assets of one.1 million tonnes of copper, 3.1 million oz. of gold and 23,200 tonnes of cobalt.

On Might 9 Havilah Assets introduced: “Deep Smartly drilling returns encouraging new copper & essential minerals effects.” Highlights come with:

3 opposite circulate (RC) drillholes over an roughly 1 km strike period returned the best possible mixed grades of copper and significant minerals ever discovered at Deep Smartly, as follows:

- “KKRC0631 19 metres of 0.42% copper and 206 ppm cobalt from 163 metres downhole, together with 3 metres of one.64 g/t gold from 170 metres downhole.

- KKRC0639 37 metres of 0.25% copper from 28 metres downhole, together with 22 metres of 0.09% molybdenum from 43 metres downhole.

- KKRC0630 110 metres of 0.12% copper from 62 metres downhole, together with 29 metres of 0.26% copper and 460 ppm cobalt from 130 metres downhole.”

On Might 17 Havilah Assets introduced: “Johnson dam prospect sure drilling effects.” Highlights come with:

- “Considerable copper, essential minerals (cobalt and uncommon earth components) and uranium mineralisation known on the Johnson Dam prospect via Strategic Alliance drilling.

- The gossan* focused via the drilling is the skin expression of an as much as 30-40 metres thick, southeast-dipping pyrite-rich horizon that can be correlated with the Kalkaroo deposit host unit.

- Beneficial sides of the Johnson Dam prospect come with the loss of overburden, proximity to the Kalkaroo deposit, greater than 3 km of unexplored strike and the combination of treasured commodities.”

Upcoming catalysts come with:

- 2023 – Development against the OZ Minerals choice to shop for Kalkaroo. Mutooroo exploration effects.

Buyers can be told extra via studying the Pattern Making an investment article “Havilah Assets Has Massive Doable and/or the replace article. You’ll additionally view a CEO interview right here, and the corporate presentation right here.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% personal their Walford Creek copper-cobalt undertaking in Queensland Australia.

On April 28 Aeon Metals introduced: “Quarterly actions file.” Highlights come with:

- “World Copper Wealthy useful resource now probably Australia’s best possible grade, considerable and number one cobalt deposit (33.6 Mt at 0.15% Co), together with Amy (8.3 Mt at 0.22% Co).

- Roughly 61.4% of up to date World Mineral Useful resource in upper self belief Measured and Indicated classifications.

- Roughly 52 km of potential new goal strike spaces known.

- Making plans for 2023 exploration program neatly complex, drilling focused from early June.

- OCP mortgage facility prohibit build up of A$5 million and reimbursement adulthood prolonged to 17 December 2024.”

On Mar 19 Aeon Metals introduced: “Walford Creek exploration technique.” Highlights come with:

- “Fieldwork commenced at Walford Creek interested by mixed geophysical and geochemical anomalies with paintings together with: LAG sampling supported via onsite moveable XRF research. Detailed geological mapping.

- Drilling contractor retained and drilling anticipated to start all through June…”

Alliance Nickel Restricted [ASX:AXN] (Previously GME Assets)

Alliance Nickel personal the NiWest Nickel-Cobalt Undertaking situated adjoining to Glencore’s Murrin Murrin Nickel operations within the North Jap Goldfields of Western Australia. The NiWest Undertaking which has an estimated 830,000 tonnes of nickel steel and 52,000 tonnes of cobalt.

On April 24 Alliance Nickel Restricted introduced: “Quarterly actions file March 2023.” Highlights come with:

- “Development on agenda of the Definitive Feasibility Learn about (“DFS”) with engineering spouse Ausenco and different key specialists throughout a variety of workstreams.

- Preparation and graduation of aircore and diamond drilling on the Mt Kilkenny deposit focused on an larger Ore Reserve and to beef up DFS paintings techniques together with geotechnical research.

- Signing of a non-binding MOU with VinES relating to long term offtake of battery grade nickel and cobalt sulphate merchandise from NiWest and undertaking financing.

- Development in negotiations with Stellantis against a binding settlement relating to long term offtake of battery grade nickel and cobalt sulphate merchandise from NiWest.”

On Might 1 Alliance Nickel Restricted introduced: “Alliance Nickel executes Binding Offtake Settlement and Cornerstone Fairness Funding with Stellantis N.V.” Highlights come with:

- “Alliance Nickel and Stellantis N.V. execute Binding Offtake Settlement for roughly 40% of long term annual forecast NiWest nickel and cobalt sulphate manufacturing for an preliminary time period of five years.

- Percentage Subscription Settlement for A$15 million giving Stellantis an 11.5% shareholding in Alliance and the proper to appoint one director to the Alliance Board.

- The partnership strengthens Stellantis’ worth chain for electrical car battery manufacturing and strongly helps the NiWest Definitive Feasibility Learn about and the long run undertaking investment and construction pathway.”

On Might 3 Alliance Nickel Restricted introduced: “Alliance Nickel receives $12.7 million from first Tranche of Strategic Placement to Stellantis N.V…”

Buyers can learn an organization investor presentation right here.

World Power Metals Corp. [TSXV:GEMC][GR:5GE1] (OTCQB:GBLEF)

On April 27 World Power Metals Corp. introduced: “World Power Metals Consolidates 100% Possession in Lovelock Mine and Treasure Field Tasks, Two Enlargement-Degree Strategic Battery Steel Tasks in Nevada, USA.” Highlights come with:

- “GEMC to consolidate 100% possession of the Lovelock and Treasure Field initiatives.

- The Transaction will build up the present hobby within the Tasks from the present 85% to 100%.

- GEMC conserving 100% possession of the Undertaking will simplify decision-making and gives the optimum construction to supervise the fast exploration and construction of key U.S. based totally essential minerals initiatives.

- Consolidation of 100% of the Tasks’ possession will de-risk the investment pathway and strengthen GEMC’s talent to supply capital for the improvement of the Tasks from a much wider vary of suppliers when put next with the prevailing three way partnership possession construction.

- Attention might be paid in GEMC stocks, topic to TSX Challenge Trade approval, vesting over twelve months thereby permitting the shareholders of the seller to retain publicity to the Tasks.”

Giga Metals Corp. [TSXV:GIGA][FSE: BRR2] (OTCQX:HNCKF) (Turnagain Nickel Deposit now held by means of Onerous Creek Nickel Company [TSXV:HNC] (OTCQX:HNCKF)

No information for the month.

The Metals Corporate (TMC)

On Might 11 The Metals Corporate introduced: “The Metals Corporate supplies Q1 2023 company replace.” Highlights come with:

- “Internet source of revenue and in line with proportion quantity of $nil for the quarter ended March 31, 2023, after recording a acquire on disposition of asset of roughly $14 million.

- Overall coins of roughly $28.4 million at March 31, 2023.

- The Corporate believes that present coins and liquidity might be enough to fund operations for a minimum of the following three hundred and sixty five days.”

Different juniors and miners with cobalt

Satisfied to listen to any information updates from commentators. Tickers of cobalt juniors we can even be following come with:

twenty first Century Metals (CSE: BULL) (OTCQB:DCNNF), African Battery Metals [AIM:ABM], Alloy Assets [ASX:AYR], Artemis Assets Ltd [ASX:ARV] (OTCQB:ARTTF), Aston Minerals [ASX:ASO] (previously Eu Cobalt), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTCPK:AZRMF), Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF), Battery Mineral Assets [TSXV:BMR], BHP Workforce Restricted (BHP), Blackstone Minerals [ASX:BSX], Brixton Metals Company [TSXV:BBB], (OTCQB:BBBXF), Canada Nickel [TSXV:CNC], Canada Silver Cobalt Works Inc [TSXV:CCW] (OTCQB:CCWOF), Canadian Global Minerals [TSXV:CIN], Capstone Copper Corp. [TSX:CS], Carnaby Assets [ASX:CNB], Castillo Copper [ASX:CCZ], Celsius Assets [ASX:CLA] [GR:FX8], Centaurus Metals [ASX:CTM], CBLT Inc. [TSXV:KBLT] (OTCPK:CBBLF), Cobalt Energy Workforce [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cruz Battery Metals Corp. [CSE:CRUZ][FSE: A2DMG8] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], DLE Assets [TSXV:DLP], Dragon Power [ASX:DLE], Edison Battery Metals [TSXV:EDDY], Electrical Royalties [TSXV:ELEC], First Quantum Minerals Ltd. (OTCPK:FQVLF), Fortune Minerals [TSX:FT] (OTCQB:FTMDF), Fuse Cobalt Inc [CVE:FUSE] (WCTXF), Galileo [ASX:GAL], GME Assets [ASX:GME] (OTC:GMRSF), Golden Arrow Assets [TSXV:GRG] (OTCQB:GARWF), Top-Tech Metals [ASX:HTM], Hinterland Metals Inc. (OTCPK:HNLMF), Hylea Metals [ASX:HCO], Idaho Champion [CSE:ITKO] [FSE:1QB1] (OTCQB:GLDRF), IGO Restricted [ASX:IGO] (OTCPK:IIDDY), King’s Bay Res (OTCPK:KBGCF) [TSXV:KBG], Latin American Assets, M2 Cobalt Corp. (TSXV: MC) (OTCPK:MCCBF), MetalsTech [ASE:MTC], Meteoric Assets [ASX:MEI], Mincor Assets (OTCPK:MCRZF) [ASX:MCR], Namibia Vital Metals [TSXV:NMI] (OTCQB:NMREF), Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (PLM), OreCorp [ASX:ORR], Energy Americas Minerals [TSXV:PAM], Panoramic Assets (OTCPK:PANRF) [ASX:PAN], Pioneer Assets Restricted [ASX:PIO], Platina Assets (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Queensland Pacific Metals [ASX:QPM] (OTCPK:QPMLF), Regal Assets (OTC:RGARF), Solution Minerals Ltd [ASX:RML], Sienna Assets [TSXV:SIE], (OTCPK:SNNAF), Stillwater Vital Minerals Corp. [TSXV:PGE] (OTCQB:PGEZF), and Victory Mines [ASX:VIC].

Conclusion

Might noticed cobalt spot costs flat and LME stock decrease.

Highlights for the month have been:

- Germany to devote $2.2 billion to protected provide of essential commodities – file.

- Cobalt to stay key EV uncooked subject matter regardless of substitution danger.

- Fastmarkets’ analysis analysts forecast cobalt will achieve an oversupply of four,000 tonnes in 2023, with the excess expanding to fourteen,000 tonnes in 2024. NCM seems to be to stay a well-liked battery chemistry outdoor of China.

- Glencore and Li-Cycle announce joint learn about to broaden a Eu recycling hub to supply lithium, nickel and cobalt.

- CMOC Workforce’s January to March, 2023 benefit falls 82.3%. Unfavourable have an effect on because of decrease cobalt costs and DRC issues.

- Huayou Cobalt in talks to shape Battery Fabrics Undertaking with South Korea’s POSCO Long term.

- Gem Co experiences Q1, 2023 internet benefit lower of 48.01% YoY.

- BHP Workforce completes OZ Minerals takeover.

- Nickel 28 confirms receipt of biggest ever coins distribution from Ramu three way partnership of US$9.7 million. Rejects Pelham’s newest 0 top class take-over try.

- Electra effectively finished the primary plant-scale recycling of black mass subject matter in North The usa and showed the restoration of essential metals, together with lithium, nickel, cobalt, copper, manganese, and graphite.

- Jervois submits an ATVM mortgage utility to the U.S. Division of Power. Jervois World Kokkola refinery growth BFS pivoted to the U.S.

- Aeon Metals Walford Creek world copper wealthy useful resource now probably Australia’s best possible grade, considerable and number one cobalt deposit (33.6 Mt at 0.15% Co).

- Alliance Nickel executes Binding Offtake Settlement and cornerstone fairness funding with Stellantis N.V.

- World Power metals Corp. to consolidate 100% possession of the Lovelock and Treasure Field initiatives.

As same old all feedback are welcome.

Editor’s Be aware: This text discusses a number of securities that don’t industry on a big U.S. trade. Please take note of the dangers related to those shares.