The other day TD Bank put out a note detailing a brand-new macro long position in Gold and their reasoning

Authored by Goldfix, ZH Edit

Gold is overbought. There’s no mild method to state it. This was gone over on Sunday with the Creators group (recording readily available to premium customers here). The spike greater and turnaround when Shanghai resumed likewise alerted of it as did TD’s CoT analysis today. These are brief term metrics nevertheless. From a macro viewpoint, there might be a lot more dry powder waiting on a factor to get long than typical.

CTA Cash is Long Gold, However Really Successful So Far …

Several banks had actually been pitching the concept that financiers were underinvested in Gold which if they just actioned in quickly, Gold might rocket greater. While it has genuine threats– such as if Bank purchasing reversed (Hi Russia), or if the Fed treked once again– there is absolutely nothing incorrect with that concept

In reality, TD Bank is putting their cash where their mouth is. They believe the selloff is going to be brief lived; and they believe present longs in the market are a lot more client than typical. They longed Gold at $1994 with a $2150 target and a $1900 stop-loss, basically running the risk of 1 to make 1.5. They purchased gold thinking this selloff is a dip to purchase.

From that report:

We [are] long active gold at $1994/oz, expecting impending selling fatigue in rare-earth elements and increasing discretionary interest to support the yellow metal towards brand-new all-time highs.

( Report at bottom with more GF analysis)

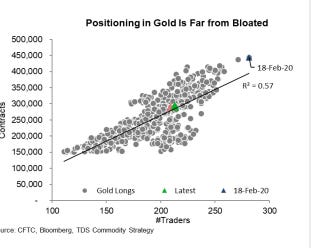

The bank’s placing analytics argue that selling-exhaustion in rare-earth elements might be impending which fresh CTA momentum type liquidation selling does not appear to be close by. They base this off CTA placing revealing algos being long, however likewise substantially in-the-money. For that reason they are not most likely to be afraid or stopped out on smaller sized relocations lower.

The bar for algorithmic liquidations in gold to pressure costs rises, whereas Shanghai trader length is nearing year-to-date lows. Even more, dry-powder analysis highlights that position sizing for gold bulls stays near typical levels, which indicates less discomfort related to the current pullback.

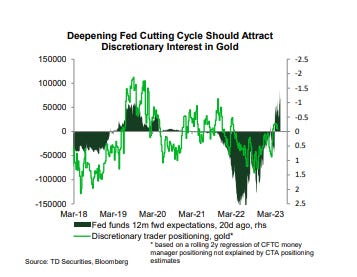

They likewise think, as do numerous other banks of late, that this is an underinvested rally by your regular buy and hold type financiers.

Our gauge of discretionary trader placing continues to recommend that this friend has yet to take part in the rare-earth elements rally.

Macro and Financier Fund placing is substantially lower than historic averages at these costs.

While it holds true the marketplace is handicapping Fed reducing beginning in November of this year, and this will no doubt put a strong tailwind behind gold (simply as it put a killer headwind on metals beginning when the Fed began treking March 2022)– we would keep in mind TD’s technique is most likely to take some discomfort initially.

Gold Supported by Geopolitical and Domestic Dangers regardless of Monetary Headwinds.

The marketplace has actually been quite bad in handicapping Fed habits of late. Moreso, Fed habits can and will provide a push if they relieve, however so far, it has actually been Geopolitical and domestic financial crises underpinning rallies.

If The Fed Begins Cutting, Stars Might Line Up …

They think Gold costs might well be near all-time highs, however the placing set-up stays irregular with a cycle peak.

Factor posts released on Absolutely no Hedge do not always represent the views and viewpoints of Absolutely no Hedge, and are not chosen, modified or evaluated by Absolutely no Hedge editors.

Packing …