Following the 2008 worldwide monetary catastrophe set off mainly by U.S. banks taking extreme threats, authorities enforced brand-new safeguards to attempt to avoid another disaster.

That consisted of completely raising the limitation on federally guaranteed bank client deposits to $250,000.

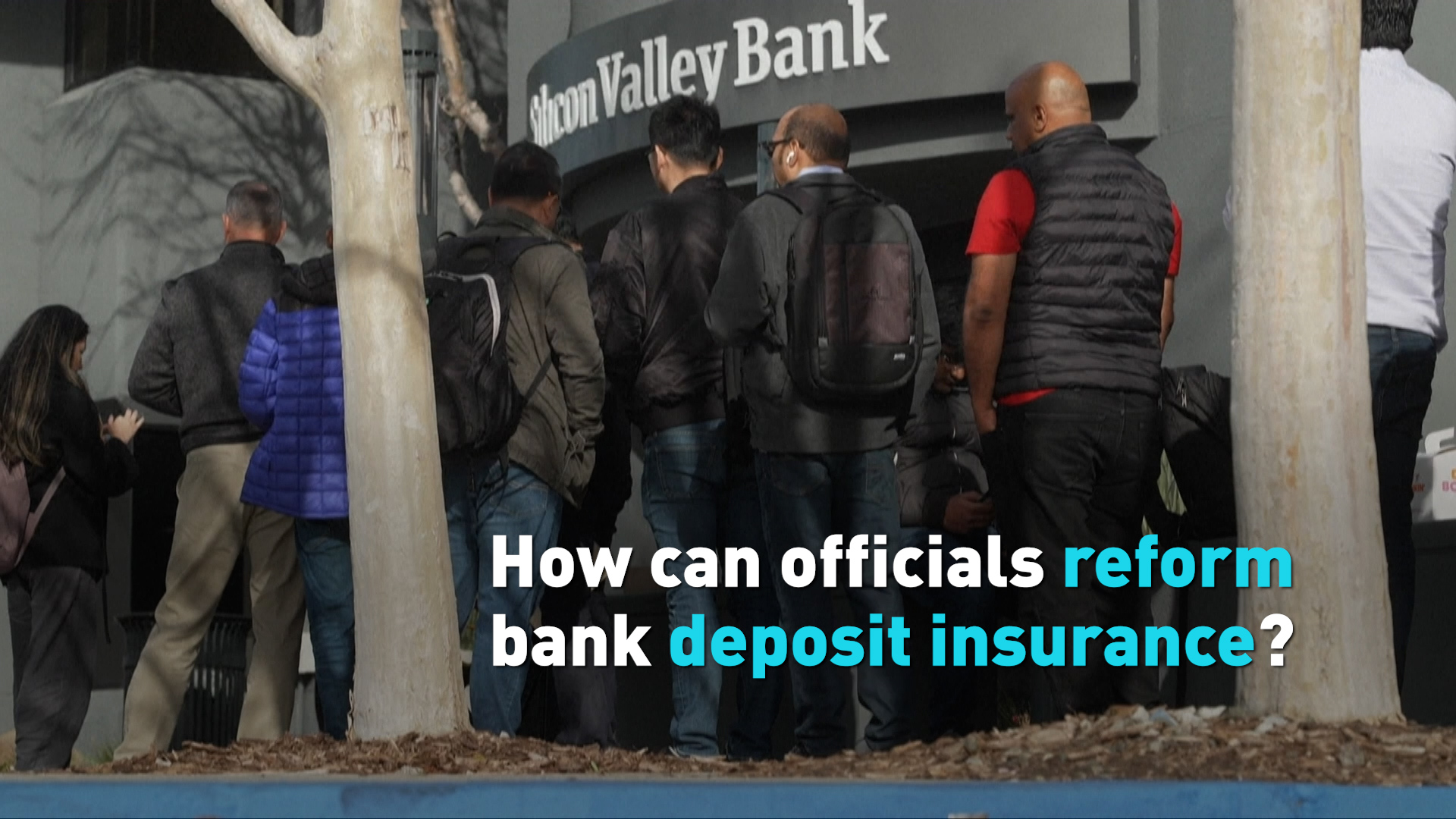

This was partially to stop future bank runs– when consumers panic and pull their deposits.

However 4 U.S. banks have actually collapsed just recently after significant work on deposits.

Now regulators are thinking of how to reform deposit insurance coverage. However they need to wrangle with the issue of ethical danger.

For more, take a look at our unique material on CGTN Now and register for our weekly newsletter, The China Report