SDI Productions/E+ through Getty Images

Introduction

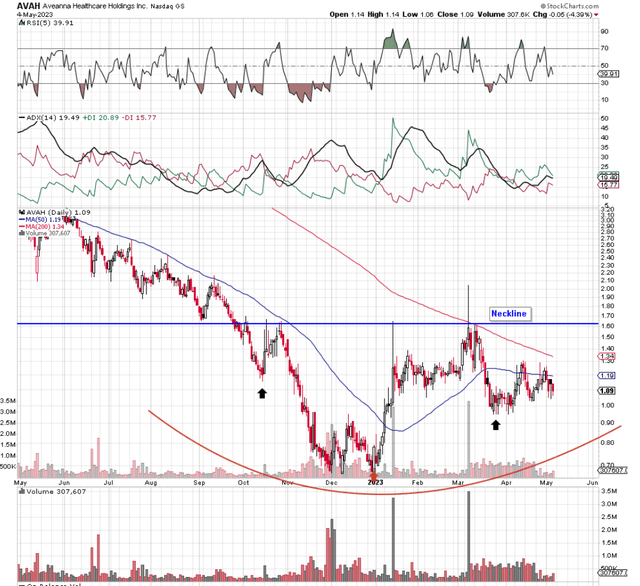

If we bring up a technical chart of Aveanna Health care Holdings Inc. ( NASDAQ: AVAH) (house health care business), we can see that shares lastly appear to be going through a bottoming pattern. Bulls will be hoping that the bullish volume pattern we have actually seen in current weeks will continue to publish the business’s upcoming Q1 profits statement. Volume patterns have actually turned bullish which might indicate that an inverted head & & shoulders pattern is presently playing itself out here. Shares however would require to very first secure the neck line to the benefit (roughly $1.60 a share) to verify the bottoming development where the preliminary objective would be to trade back above the stock’s 200-day moving average ($ 1.34 per share approx) again.

AVAH Technical Chart (Stockcharts.com)

Suffice it to state, even when we take the possible bottoming development into account & & the expert purchasing which occurred in financial 2022 near to $3 a share, we would still avoid getting long the stock till a clear breakout is signed up on the technical chart (Definitive close above the neck line).

The factor being is that dangers stay raised in Aveanna as continual success & & favorable capital generation have actually continued to be hard for Aveanna to understand. In Q4 of 2022 for instance, although top-line sales increased by 9% compared to the very same duration of 12 months prior, operating earnings in fact can be found in unfavorable for the quarter due to raised expenses of items offered in addition to raised SG&A. This is why worth financiers need to beware when measuring the implications of Aveanna’s extremely low-cost sales (tracking sales multiple of a simple 0.11) which are anticipated to keep growing by a mid-single-digit portion each year moving forward. Apart from this, the marketplace requires to see favorable success (or indications of the very same) to come off that top-line development. This would in earnest cause the breakout that bulls are wishing for however raised dangers stay as we see in the following.

Caretaker Earnings Should Increase Considerably

Need for certified community-based care workers continues to stay raised which continues to put upward pressure on the salaries they gather. This paradigm is in fact bullish for Aveanna if certainly it can open markets and get its care employees (properties) in front of as numerous clients as possible. For that reason, by intending to increase the rates Aveanna charges in a few of its biggest states, this would bring more caretakers into the system which gradually ought to have an advantageous outcome to Aveanna’s earnings declaration.

Broadening labor capability is something however management understands it requires to end up being much more selective with regard to choosing where to put this labor to work. In this regard, management intends to improve its variety of favored payers and after that send its labor to these extremely exact same payers where payment will be greater (in regards to rates). If this pattern were to get traction, it would have the combined result of more labor employs in addition to greater rates in general. This is what Aveanna’s earnings declaration requirements which would in turn assist in capital generation to lastly happen at the business.

Balance Sheet Worries

Nevertheless, with running capital being available in unfavorable in financial 2022 (-$ 48.4 million), the clock is ticking for Aveanna particularly when we go through the business’s balance sheet. The business’s low money balance ($ 19.2 million) for instance and high receivables ($ 225.6 million) show that collections stay a problem. Additionally, when taking into consideration Aveanna’s market cap ($ 205.85 million), the business’s financial obligation load of $1.42 billion and goodwill of $1.16 billion stay extremely high, particularly in an environment of unfavorable money circulation generation.

On the financial obligation side, while the business does not have any product maturities till 2028 and continues to hedge the financial obligation versus rate of interest boosts, the financial obligation load is a significant number and should be added quicker instead of later on. On the goodwill side, the longer development expectations dissatisfy, the more pressure will pertain to jot down that goodwill gradually. Although management would reveal adjusted profits numbers to compensate, any possible problems would reduce Aveanna’s book worth (and more than likely share rate) which by the way is currently in unfavorable area. (-$ 4.2 million).

Conclusion

For that reason to summarize, although shares of Aveanna Health care Holdings seem going through a long-awaited bottoming pattern at present, it stays far prematurely to get long this name. The labor circumstance continues to be an issue for Aveanna and capital generation stays awry. Let’s see what Q1 profits numbers bring next week (11th of May). We anticipate continued protection.